Singapore Airlines 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

108

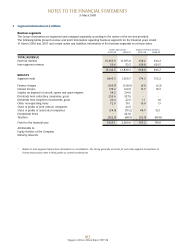

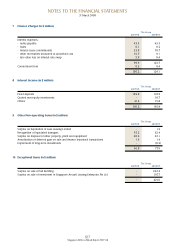

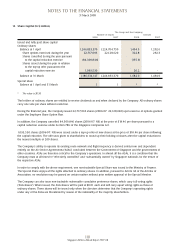

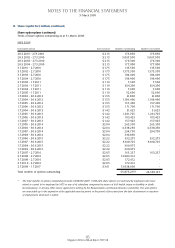

11 Taxation (in $ million)

The Group

2007-08 2006-07

Current taxation

Provision for the year 369.1 185.6

Overprovision in respect of prior years (28.9) (42.1)

Share of joint venture companies’ taxation 0.1 4.9

Share of associated companies’ taxation 3.0 (7.1)

343.3 141.3

Deferred taxation

Movement in temporary differences 81.8 164.8

(Over)/Under provision in respect of prior years (14.8) 22.8

67.0 187.6

410.3 328.9

Adjustment for reduction in Singapore statutory tax rate - (246.7)

410.3 82.2

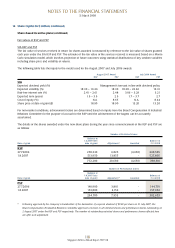

On 15 February 2007, the Government announced a 2% points reduction in statutory tax rate from Year of Assessment

2008. The financial effect of the reduction in tax rate was reflected in the 2006-07 accounts. The aggregate adjustment of

the prior year’s deferred tax liabilities was $246.7 million for the Group.

The Group has tax losses of approximately $22.9 million (2007: $26.9 million) that are available for offset against future

taxable profits of the companies in which no deferred tax assets are recognised due to uncertainty of its recoverability. The

use of the tax losses is subject to the agreement of the tax authorities and compliance with certain provisions of the tax

legislation of the respective countries in which the companies operate.

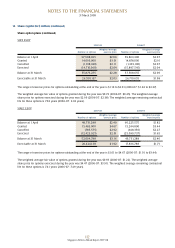

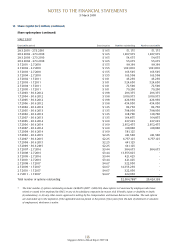

A reconciliation between taxation expense and the product of accounting profit multiplied by the applicable tax rate for the

years ended 31 March is as follows:

The Group

2007-08 2006-07

Profit before taxation 2,547.2 2,284.6

Taxation at statutory tax rate of 18.0% 458.5 411.2

Adjustments

Income not subject to tax (61.5) (114.7)

Expenses not deductible for tax purposes 45.0 57.4

Higher effective tax rates of other countries 10.6 15.4

Overprovision in respect of prior years, net (43.7) (19.3)

Effect of change in statutory tax rate - (246.7)

Income under an incentive scheme - (1.9)

Others 1.4 (19.2)

Taxation 410.3 82.2

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008