Singapore Airlines 2008 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

149

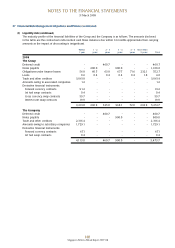

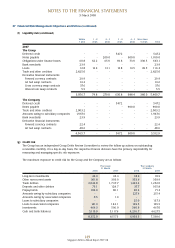

37 Financial Risk Management Objectives and Policies (continued)

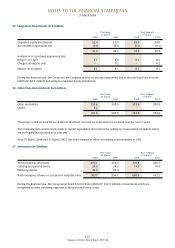

(f) Liquidity risk (continued)

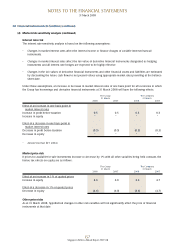

Within 1 - 2 2 - 3 3 - 4 4 - 5 More than

1 year years years years years 5 years Total

2007

The Group

Deferred credit - - - 547.2 - - 547.2

Notes payable - - 200.0 - 900.0 - 1,100.0

Obligations under finance leases 60.8 62.2 65.9 69.8 73.9 330.5 663.1

Bank overdrafts 23.9 - - - - - 23.9

Loans 12.8 12.6 13.1 13.8 14.5 49.5 116.3

Trade and other creditors 2,825.0 - - - - - 2,825.0

Derivative financial instruments:

Forward currency contracts 29.9 - - - - - 29.9

Jet fuel swap contracts 61.2 - - - - - 61.2

Cross currency swap contracts 37.6 - - - - - 37.6

Interest rate swap contracts 5.5 - - - - - 5.5

3,056.7 74.8 279.0 630.8 988.4 380.0 5,409.7

The Company

Deferred credit - - - 547.2 - - 547.2

Notes payable - - - - 900.0 - 900.0

Trade and other creditors 2,003.2 - - - - - 2,003.2

Amounts owing to subsidiary companies 1,967.6 - - - - - 1,967.6

Bank overdrafts 23.9 - - - - - 23.9

Derivative financial instruments:

Forward currency contracts 22.4 - - - - - 22.4

Jet fuel swap contracts 48.6 - - - - - 48.6

4,065.7 - - 547.2 900.0 - 5,512.9

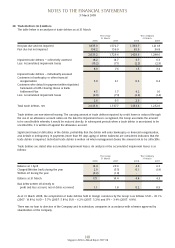

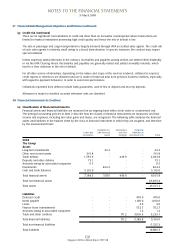

(g) Credit risk

The Group has an independent Group Debts Review Committee to review the follow up actions on outstanding

receivables monthly. On a day-to-day basis, the respective Finance divisions have the primary responsibility for

measuring and managing specific risk exposures.

The maximum exposure to credit risk for the Group and the Company are as follows:

The Group The Company

31 March 31 March

2008 2007 2008 2007

Long-term investments 43.3 43.3 18.9 18.9

Other non-current assets 361.8 303.9 353.6 303.9

Trade debtors 2,043.8 1,737.7 1,433.4 1,252.0

Deposits and other debtors 73.1 128.7 37.7 105.8

Prepayments 104.9 86.1 90.2 71.3

Amounts owing by subsidiary companies - - 227.4 215.4

Amounts owing by associated companies 0.5 1.9 - -

Loans to subsidiary companies - - 25.0 137.3

Loans to associated companies 141.3 142.1 139.5 139.5

Investments 464.3 596.0 360.9 467.0

Cash and bank balances 5,119.0 5,117.6 4,216.7 4,627.5

8,352.0 8,157.3 6,903.3 7,338.6

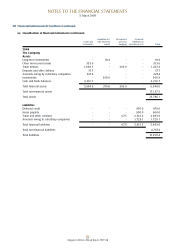

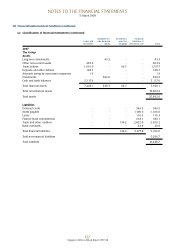

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008