Singapore Airlines 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

113

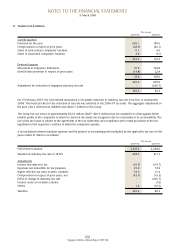

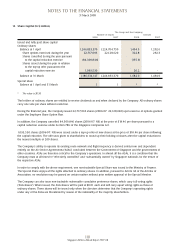

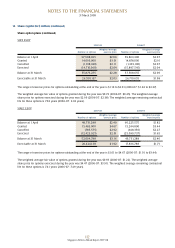

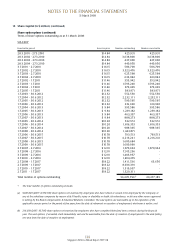

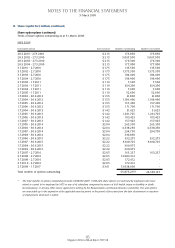

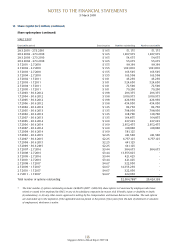

14 Share Capital (in $ million) (continued)

Share option plans (continued)

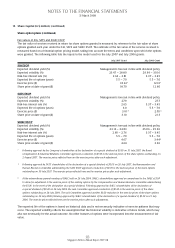

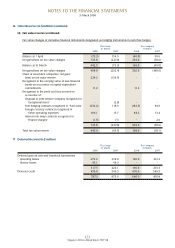

Fair values of SIA, SATS and SIAEC ESOP

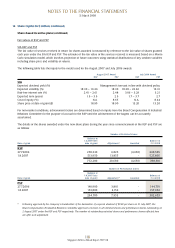

The fair value of services received in return for share options granted is measured by reference to the fair value of share

options granted each year under the SIA, SATS and SIAEC ESOP. The estimate of the fair value of the services received is

measured based on a binomial option pricing model, taking into account the terms and conditions upon which the options

were granted. The following table lists the inputs to the model used for the July 2007 and July 2006 grants:

July 2007 Grant July 2006 Grant

SIA ESOP

Expected dividend yield (%) Management’s forecast in line with dividend policy

Expected volatility (%) 23.47 – 28.80 29.99 – 30.16

Risk-free interest rate (%) 2.64 – 2.81 3.37 – 3.45

Expected life of options (years) 5.5 – 7.0 5.5 – 7.0

Exercise price ($) 18.22* 12.10*

Share price at date of grant ($) 18.70 12.60

SATS ESOP

Expected dividend yield (%) Management’s forecast in line with dividend policy

Expected volatility (%) 27.9 27.7

Risk-free interest rate (%) 2.65 3.37 – 3.45

Expected life of options (years) 6.0 5.5 – 7.0

Exercise price ($) 3.01^ 2.05^

Share price at date of grant ($) 3.10 2.13

SIAEC ESOP

Expected dividend yield (%) Management’s forecast in line with dividend policy

Expected volatility (%) 23.13 – 24.83 25.06 – 25.36

Risk-free interest rate (%) 2.60 – 2.76 3.37 – 3.45

Expected life of options (years) 5.5 – 7.0 5.5 – 7.0

Exercise price ($) 4.67 3.44#

Share price at date of grant ($) 4.64 3.96

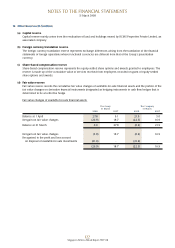

* Following approval by the Company’s shareholders of the declaration of a special dividend of $0.50 on 31 July 2007, the Board

Compensation & Industrial Relations Committee approved a reduction of $0.50 in the exercise prices of the share options outstanding on

2 August 2007. The exercise prices reflected here are the exercise prices after such adjustment.

^ Following approval by SATS’ shareholders of the declaration of a special dividend of $0.05 on 26 July 2007, the Remuneration and

Human Resource Committee administering the SATS ESOP approved a reduction of $0.05 in the exercise prices of the share options

outstanding on 30 July 2007. The exercise prices reflected here are the exercise prices after such adjustment.

# At the extraordinary general meeting of SIAEC held on 26 July 2004, SIAEC’s shareholders approved an amendment to the SIAEC’s ESOP

to allow for adjustment to the exercise prices of the existing options by the Compensation and Human Resource Committee administering

the ESOP, in the event of the declaration of a special dividend. Following approval by SIAEC’s shareholders of the declaration of

a special dividend of $0.20 on 26 July 2004, the said Committee approved a reduction of $0.20 in the exercise prices of the share

options outstanding on 28 July 2004. The said Committee approved another $0.20 reduction in the exercise prices of the share options

outstanding on 25 July 2006 following approval by SIAEC’s shareholders of the declaration of a special dividend of $0.20 on 21 July

2006. The exercise prices reflected here are the exercise prices after such adjustments.

The expected life of the options is based on historical data and is not necessarily indicative of exercise patterns that may

occur. The expected volatility reflects the assumption that the historical volatility is indicative of future trends, which may

also not necessarily be the actual outcome. No other features of options were incorporated into the measurement of fair

value.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008