Singapore Airlines 2008 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

155

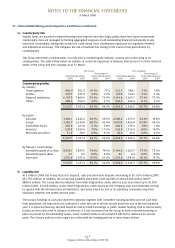

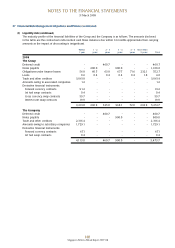

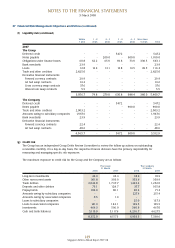

38 Financial Instruments (in $ million) (continued)

(c) Derivative financial instruments and hedging activities (continued)

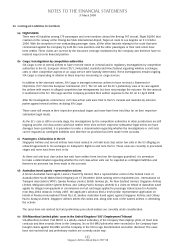

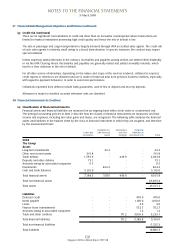

Cash flow hedges

The Group enters into jet fuel swaps and options in order to hedge the financial risk related to the price of jet fuel.

The Group has applied cash flow hedge accounting to these derivatives as they are considered to be highly effective

hedging instruments. A net fair value gain of $741.1 million (2007: $33.7 million), with a related deferred tax charge of

$165.4 million (2007: $18.3 million), is included in the fair value reserve in respect of these contracts.

The cash flows arising from these derivatives are expected to occur and enter into the determination of profit or loss

during the next three financial years as follows: $603.9 million, $98.9 million and $38.3 million (2007: $17.4 million,

$13.6 million and $2.7 million).

The Group has outstanding financial instruments to hedge expected future purchases in USD:

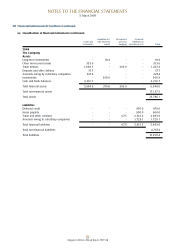

Forward currency contracts and foreign currency options maturing in April 2008 – March 2009 (in $ million)

The Group The Company

Foreign currency USD Effective Foreign currency USD Effective

Currency amount sold purchased rate amount sold purchased Rate

AUD 388.7 327.3 0.84 353.7 297.8 0.84

CHF 35.1 32.1 0.91 27.5 25.2 0.92

CNY 1,352.0 190.9 0.14 587.7 83.0 0.14

EUR 118.5 167.4 1.41 88.6 125.1 1.41

GBP 101.5 199.7 1.97 91.1 179.2 1.97

INR 3,914.0 95.0 0.02 2,213.9 51.5 0.02

JPY 8,881.0 83.4 0.01 5,333.9 50.0 0.01

KRW 38,116.0 40.7 0.001 29,546.3 31.6 0.001

NZD 91.8 66.8 0.73 69.9 50.9 0.73

TWD 951.0 30.6 0.03 472.4 15.2 0.03

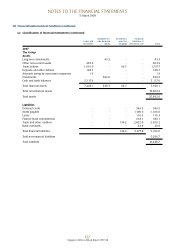

Forward currency contracts maturing in April 2007 – March 2008 (in $ million)

The Group The Company

Foreign currency USD Effective Foreign currency USD Effective

Currency amount sold purchased rate amount sold purchased Rate

AUD 226.5 175.8 0.78 204.5 158.7 0.78

CHF 14.8 12.4 0.84 11.2 9.4 0.84

CNY 885.0 118.0 0.13 346.8 46.2 0.13

EUR 96.3 127.3 1.32 70.3 93.0 1.32

GBP 88.4 170.0 1.92 78.4 150.8 1.92

INR 3,102.0 67.0 0.02 1,842.7 39.8 0.02

JPY 4,710.0 41.7 0.009 2,836.8 25.1 0.009

KRW 27,210.0 29.1 0.001 18,905.7 20.2 0.001

NZD 86.9 56.3 0.65 61.9 40.2 0.65

TWD 513.3 16.2 0.03 242.6 7.7 0.03

The cash flow hedges of the expected future purchases in USD in the next 12 months are assessed to be highly

effective and at 31 March 2008, a net fair value loss of $115.8 million (2007: $117.1 million), with a related deferred

tax credit of $24.3 million (2007: $32.2 million), is included in the fair value reserve in respect of these contracts.

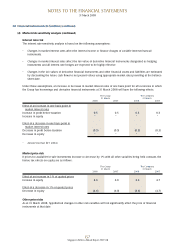

As at 31 March 2008, the Company has also set aside USD331.5 million in deposits to match capital expenditure

requirements expected over the next 10 months.

As at 31 March 2008, the Company has no outstanding interest rate swaps.

The cash flow hedges of some of the Group’s interest rate swaps are assessed to be highly effective and at 31 March

2008, a net fair value loss of $12.1 million (2007: $3.8 million), with a related deferred tax credit of $2.7 million

(2007: $0.8 million), is included in the fair value reserve in respect of these contracts.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008