Singapore Airlines 2008 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

157

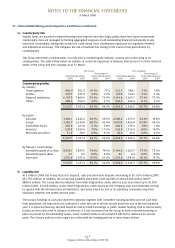

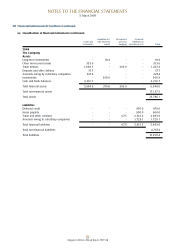

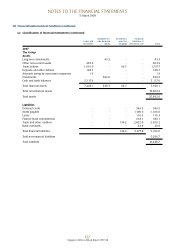

38 Financial Instruments (in $ million) (continued)

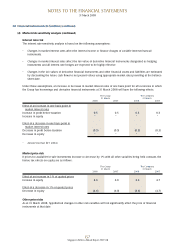

(d) Market risk sensitivity analysis (continued)

Interest rate risk

The interest rate sensitivity analysis is based on the following assumptions:

• Changesinmarketinterestratesaffecttheinterestincomeornancechargesofvariableinterestnancial

instruments.

• Changesinmarketinterestratesaffectthefairvalueofderivativenancialinstrumentsdesignatedashedging

instruments and all interest rate hedges are expected to be highly effective.

• Changesinthefairvaluesofderivativenancialinstrumentsandothernancialassetsandliabilitiesareestimated

by discounting the future cash flows to net present values using appropriate market rates prevailing at the balance

sheet date.

Under these assumptions, an increase or decrease in market interest rates of one basis point for all currencies in which

the Group has borrowings and derivative financial instruments at 31 March 2008 will have the following effects:

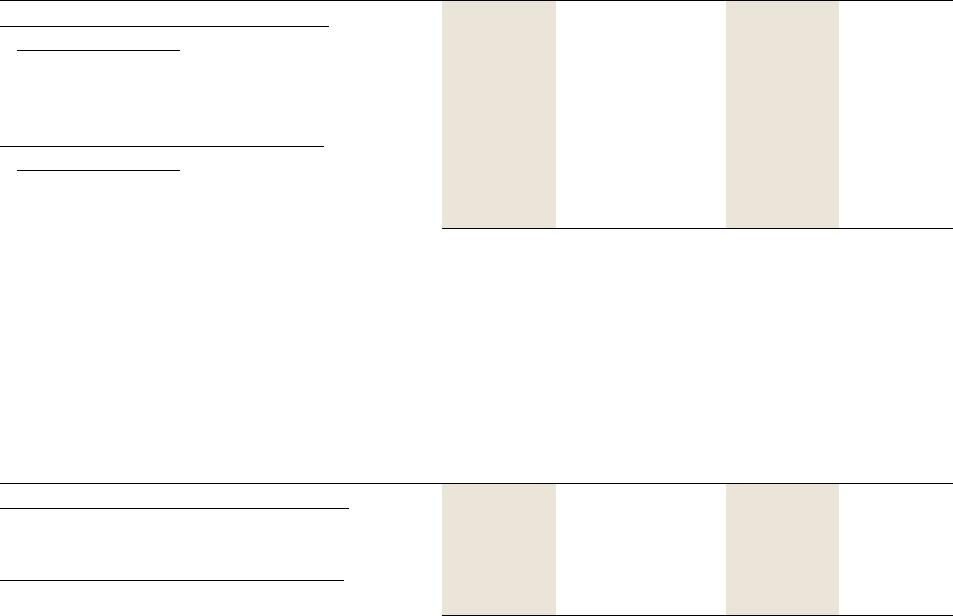

The Group The Company

31 March 31 March

2008 2007 2008 2007

Effect of an increase in one basis point in

market interest rates

Increase in profit before taxation 0.5 0.5 0.3 0.3

Increase in equity * * * *

Effect of a decrease in one basis point in

market interest rates

Decrease in profit before taxation (0.5) (0.5) (0.3) (0.3)

Decrease in equity * * * *

* Amount less than $0.1 million.

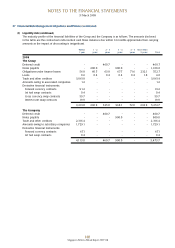

Market price risk

If prices for available-for-sale investments increase or decrease by 1% with all other variables being held constant, the

before tax effects on equity are as follows:

The Group The Company

31 March 31 March

2008 2007 2008 2007

Effect of an increase in 1% of quoted prices

Increase in equity 4.6 6.0 3.6 4.7

Effect of a decrease in 1% of quoted prices

Decrease in equity (4.6) (6.0) (3.6) (4.7)

Other price risks

As at 31 March 2008, hypothetical changes in other risk variables will not significantly affect the price of financial

instruments at that date.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008