Singapore Airlines 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Singapore Airlines Annual Report 2007-08

91

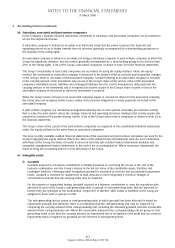

2 Accounting Policies (continued)

(e) Intangible assets (continued)

(i) Goodwill (continued)

Where goodwill forms part of a cash-generating unit (or group of cash-generating units) and part of the operation

within that unit is disposed of, the goodwill associated with the operation disposed of is included in the carrying

amount of the operation when determining the gain or loss on disposal of the operation. Goodwill disposed of in

this circumstance is measured based on the relative fair values of the operation disposed of and the portion of the

cash-generating unit retained.

(ii) Computer software

Computer software acquired separately is measured initially at cost. Following initial acquisition, computer

software is stated at cost less accumulated amortisation and accumulated impairment losses, if any. These costs

are amortised using the straight-line method over their estimated useful lives of 1 to 5 years and assessed for

impairment whenever there is an indication that the computer software may be impaired. The amortisation period

and the amortisation method are reviewed at least at each financial year end.

(iii) Licenses

Licenses acquired in business combinations are capitalised and amortised on a straight-line basis over its estimated

useful life of 2 years.

(f) Foreign currencies

The management has determined the currency of the primary economic environment in which the Company operates

i.e., functional currency, to be SGD. Sales prices and major costs of providing goods and services including major

operating expenses are primarily influenced by fluctuations in SGD.

Foreign currency transactions are converted into SGD at exchange rates which approximate bank rates prevailing

at dates of transactions, after taking into account the effect of forward currency contracts which expired during the

financial year.

All foreign currency monetary assets and liabilities are translated into SGD using year-end exchange rates. Non-

monetary assets and liabilities that are measured in terms of historical cost in a foreign currency are translated using

the exchange rates as at the dates of the initial transactions. Non-monetary assets and liabilities measured at fair value

in a foreign currency are translated using the exchange rates at the date when the fair value was determined.

Gains and losses arising from conversion of monetary assets and liabilities are taken to the profit and loss account.

For the purposes of the Group financial statements, the net assets of the foreign subsidiary, associated and joint

venture companies are translated into SGD at the exchange rates ruling at the balance sheet date. The financial

results of foreign subsidiary, associated and joint venture companies are translated monthly into SGD at the prevailing

exchange rates. The resulting gains or losses on exchange are taken to foreign currency translation reserve.

Goodwill and fair value adjustments arising from the acquisition of foreign operations on or after 1 April 2005 are

treated as assets and liabilities of the foreign operations and are recorded in the functional currency of the foreign

operations, and translated at the closing rate at the balance sheet date.

Goodwill and fair value adjustments which arose on acquisitions of foreign operations before 1 April 2005 are deemed

to be assets and liabilities of the Group and are recorded in SGD at the rates prevailing at the dates of acquisition.

On disposal of a foreign operation, the cumulative amount of exchange differences deferred in equity relating to that

foreign operation is recognised in the profit and loss account as a component of the gain or loss on disposal.

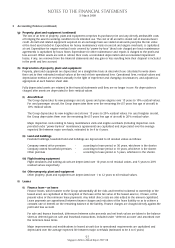

(g) Property, plant and equipment

All items of property, plant and equipment are initially recorded at cost. Subsequent to recognition, property, plant and

equipment are stated at cost less accumulated depreciation and accumulated impairment losses, if any. The cost of

an item of property, plant and equipment is recognised as an asset if, and only if, it is probable that future economic

benefits associated with the item will flow to the Group and the cost of the item can be measured reliably.

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008