Singapore Airlines 2008 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

75

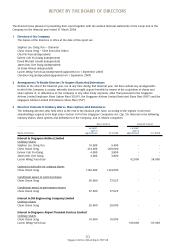

5 Options on Shares in the Company (continued)

(i) Employee Share Option Plan (continued)

(b) SIA Engineering Company Limited (“SIAEC”)

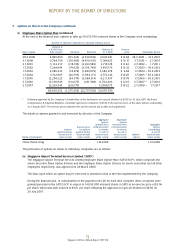

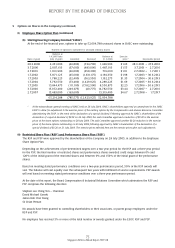

At the end of the financial year, options to take up 52,004,788 unissued shares in SIAEC were outstanding:

Number of options to subscribe for unissued ordinary shares

Balance at

1.4.2007/later Balance at Exercise

Date of grant date of grant Cancelled Exercised 31.3.2008 price * Exercisable period

28.3.2000 2,251,000 (46,800) (734,700) 1,469,500 $1.65 28.3.2001 – 27.3.2010

3.7.2000 2,007,613 (37,600) (483,000) 1,487,013 $1.55 3.7.2001 – 2.7.2010

2.7.2001 1,103,900 (26,000) (358,300) 719,600 $1.01 2.7.2002 – 1.7.2011

1.7.2002 5,871,125 (45,600) (1,631,175) 4,194,350 $1.98 1.7.2003 – 30.6.2012

1.7.2003 1,788,225 (32,400) (563,550) 1,192,275 $1.35 1.7.2004 – 30.6.2013

1.7.2004 5,792,550 (73,400) (1,429,925) 4,289,225 $1.69 1.7.2005 – 30.6.2014

1.7.2005 15,844,475 (111,100) (7,182,500) 8,550,875 $2.25 1.7.2006 – 30.6.2015

3.7.2006 15,072,400 (249,075) (40,775) 14,782,550 $3.44 3.7.2007 – 2.7.2016

2.7.2007 15,483,000 (163,600) - 15,319,400 $4.67 2.7.2008 – 1.7.2017

65,214,288 (785,575) (12,423,925) 52,004,788

* At the extraordinary general meeting of SIAEC held on 26 July 2004, SIAEC’s shareholders approved an amendment to the SIAEC

ESOP to allow for adjustment to the exercise prices of the existing options by the Compensation and Human Resource Committee

administering the ESOP, in the event of the declaration of a special dividend. Following approval by SIAEC’s shareholders of the

declaration of a special dividend of $0.20 on 26 July 2004, the said Committee approved a reduction of $0.20 in the exercise

prices of the share options outstanding on 28 July 2004. The said Committee approved another $0.20 reduction in the exercise

prices of the share options outstanding on 25 July 2006 following approval by SIAEC’s shareholders of the declaration of a

special dividend of $0.20 on 21 July 2006. The exercise prices reflected here are the exercise prices after such adjustments.

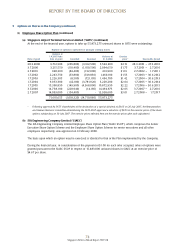

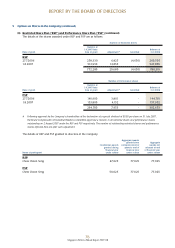

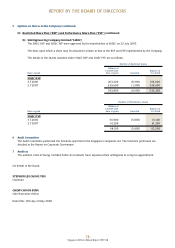

(ii) Restricted Share Plan (“RSP”) and Performance Share Plan (“PSP”)

The RSP and PSP were approved by the shareholders of the Company on 28 July 2005, in addition to the Employee

Share Option Plan.

Depending on the achievement of pre-determined targets over a two-year period for the RSP and a three-year period

for the PSP, the final number of restricted shares and performance shares awarded could range between 0% and

120% of the initial grant of the restricted shares and between 0% and 150% of the initial grant of the performance

shares.

Based on meeting stated performance conditions over a two-year performance period, 50% of the RSP awards will

vest. The balance will vest equally over the subsequent two years with fulfilment of service requirements. PSP awards

will vest based on meeting stated performance conditions over a three-year performance period.

At the date of this report, the Board Compensation & Industrial Relations Committee which administers the RSP and

PSP comprises the following directors:

Stephen Lee Ching Yen – Chairman

David Michael Gonski

James Koh Cher Siang

Sir Brian Pitman

No awards have been granted to controlling shareholders or their associates, or parent group employees under the

RSP and PSP.

No employee has received 5% or more of the total number of awards granted under the ESOP, RSP and PSP.

REPORT BY THE BOARD OF DIRECTORS