Singapore Airlines 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

126

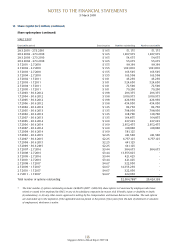

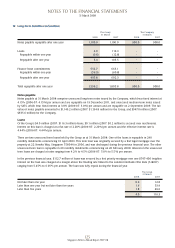

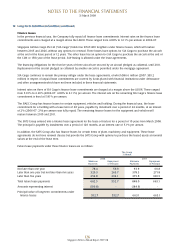

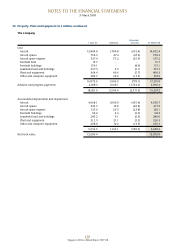

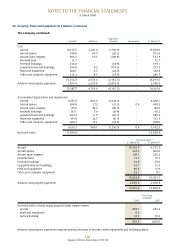

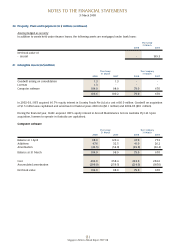

19 Long-Term Liabilities (in $ million) (continued)

Finance leases

In the previous financial year, the Company fully repaid all finance lease commitments. Interest rates on the finance lease

commitments were charged at a margin above the LIBOR. These ranged from 4.80% to 6.11% per annum in 2006-07.

Singapore Airlines Cargo Pte Ltd (“SIA Cargo”) holds four B747-400 freighters under finance leases, which will mature

between 2015 and 2026, without any options for renewal. Three leases have options for SIA Cargo to purchase the aircraft

at the end of the lease period of 12 years. The other lease has an option for SIA Cargo to purchase the aircraft at the end of

the 12th or 15th year of the lease period. Sub-leasing is allowed under the lease agreements.

The financing obligations for the first five years of three aircraft are secured by an aircraft pledged as collateral, until 2011.

Replacement of the aircraft pledged as collateral by another aircraft is permitted under the mortgage agreement.

SIA Cargo continues to remain the primary obligor under the lease agreements, of which $86.6 million (2007: $95.2

million) in respect of unpaid lease commitments are covered by funds placed with financial institutions under defeasance

and other arrangements which have not been included in these financial statements.

Interest rates on three of SIA Cargo’s finance lease commitments are charged at a margin above the LIBOR. These ranged

from 5.01% to 6.20% (2006-07: 4.80% to 6.11%) per annum. The interest rate on the remaining SIA Cargo’s finance lease

commitment is fixed at 5.81% per annum.

The SIAEC Group has finance leases for certain equipment, vehicles and building. During the financial year, the lease

commitment for a building with a lease term of 30 years, payable by instalment over a period of 24 months, at an interest

of 2% (2006-07: 2%) per annum was fully repaid. The remaining finance leases for the equipment and vehicles will

mature between 2010 and 2011.

The SATS Group entered into a finance lease agreement for the lease of tractors for a period of 10 years from March 2008.

The principal is payable by instalments over a period of 120 months, at an interest rate of 5.1% per annum.

In addition, the SATS Group also has finance leases for certain items of plant, machinery and equipment. These lease

agreements do not have renewal clauses but provide the SATS Group with options to purchase the leased assets at nominal

values at the end of the lease term.

Future lease payments under these finance leases are as follows:

The Group

31 March

2008 2007

Minimum Repayment Minimum Repayment

Payments of Principal Payments of Principal

Not later than one year 78.4 56.9 93.9 60.8

Later than one year but not later than five years 329.3 263.7 378.3 271.8

Later than five years 254.8 232.1 375.8 330.5

Total future lease payments 662.5 552.7 848.0 663.1

Amounts representing interest (109.8) - (184.9) -

Principal value of long-term commitments under

finance leases 552.7 552.7 663.1 663.1

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008