Singapore Airlines 2008 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

150

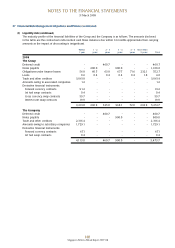

37 Financial Risk Management Objectives and Policies (continued)

(g) Credit risk (continued)

There are no significant concentrations of credit risk other than on derivative counterparties where transactions are

limited to financial institutions possessing high credit quality and hence the risk of default is low.

The sale of passenger and cargo transportation is largely achieved through IATA accredited sales agents. The credit risk

of such sales agents is relatively small owing to a broad diversification. In specific instances, the contract may require

special collateral.

Unless expressly stated otherwise in the contract, receivables and payables among airlines are settled either bilaterally

or via the IATA Clearing House. Receivables and payables are generally netted and settled at weekly intervals, which

lead to a clear reduction in the risk of default.

For all other service relationships, depending on the nature and scope of the services rendered, collateral is required,

credit reports or references are obtained and use is made of historical data from previous business relations, especially

with regard to payment behaviour, in order to avoid non-performance.

Collaterals requested from debtors include bank guarantees, cash-in-lieu of deposit and security deposits.

Allowance is made for doubtful accounts whenever risks are identified.

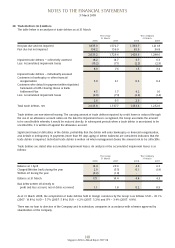

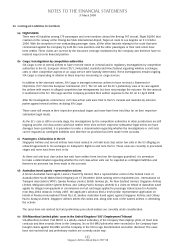

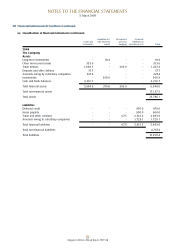

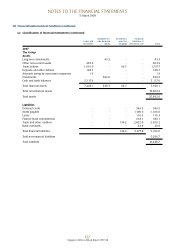

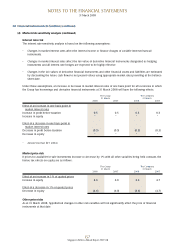

38 Financial Instruments (in $ million)

(a) Classification of financial instruments

Financial assets and financial liabilities are measured on an ongoing basis either at fair value or at amortised cost.

The principal accounting policies in Note 2 describe how the classes of financial instruments are measured, and how

income and expenses, including fair value gains and losses, are recognised. The following table analyses the financial

assets and liabilities in the balance sheet by the class of financial instrument to which they are assigned, and therefore

by the measurement basis:

Available-for- Derivatives Financial

Loans and sale financial used for liabilities at

receivables assets hedging amortised cost Total

2008

The Group

Assets

Long-term investments - 43.3 - - 43.3

Other non-current assets 361.8 - - - 361.8

Trade debtors 1,593.9 - 449.9 - 2,043.8

Deposits and other debtors 73.1 - - - 73.1

Amounts owing by associated companies 0.5 - - - 0.5

Investments - 464.3 - - 464.3

Cash and bank balances 5,119.0 - - - 5,119.0

Total financial assets 7,148.3 507.6 449.9 - 8,105.8

Total non-financial assets 18,409.4

Total assets 26,515.2

Liabilities

Deferred credit - - - 470.0 470.0

Notes payable - - - 1,100.0 1,100.0

Loans - - - 4.0 4.0

Finance lease commitments - - - 552.7 552.7

Amounts owing to associated companies - - - 1.2 1.2

Trade and other creditors - - 171.2 3,061.9 3,233.1

Total financial liabilities - - 171.2 5,189.8 5,361.0

Total non-financial liabilities 5,525.3

Total liabilities 10,886.3

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008