Singapore Airlines 2008 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

132

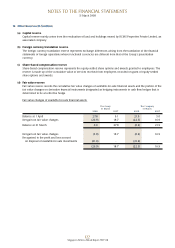

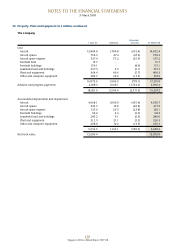

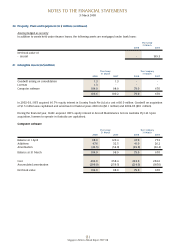

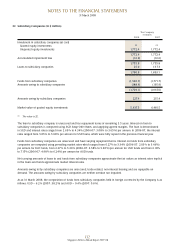

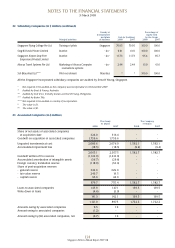

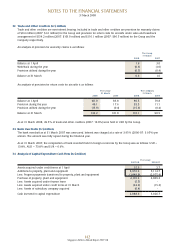

22 Subsidiary Companies (in $ million)

The Company

31 March

2008 2007

Investment in subsidiary companies (at cost)

Quoted equity investments ## ##

Unquoted equity investments 1,772.4 1,772.4

1,772.4 1,772.4

Accumulated impairment loss (16.6) (16.6)

1,755.8 1,755.8

Loans to subsidiary companies 25.0 137.3

1,780.8 1,893.1

Funds from subsidiary companies (1,540.7) (1,771.7)

Amounts owing to subsidiary companies (188.4) (195.9)

(1,729.1) (1,967.6)

Amounts owing by subsidiary companies 227.4 215.4

Market value of quoted equity investments 5,437.5 6,481.5

## The value is $2.

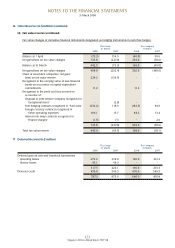

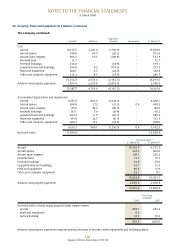

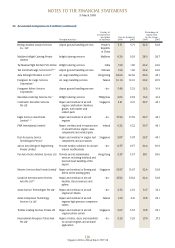

The loan to subsidiary company is unsecured and has repayment terms of remaining 3.5 years. Interest on loan to

subsidiary companies is computed using SGD Swap-Offer Rates, and applying agreed margins. The loan is denominated

in SGD and interest rates ranged from 2.69% to 4.34% (2006-07: 3.08% to 3.65%) per annum. In 2006-07, the interest

rates ranged from 5.05% to 5.98% per annum for USD loans, which were fully repaid in the previous financial year.

Funds from subsidiary companies are unsecured and have varying repayment terms. Interest on funds from subsidiary

companies are computed using prevailing market rates which ranged from 0.27% to 3.34% (2006-07: 2.03% to 3.46%)

per annum for SGD funds, from 2.37% to 5.39% (2006-07: 4.58% to 5.40%) per annum for USD funds and from 6.18%

to 7.15% (2006-07: 4.98% to 6.24%) per annum for AUD funds.

Net carrying amounts of loans to and funds from subsidiary companies approximate the fair values as interest rates implicit

in the loans and funds approximate market interest rates.

Amounts owing to/by subsidiary companies are unsecured, trade-related, non-interest bearing and are repayable on

demand. The amounts owing by subsidiary companies are neither overdue nor impaired.

As at 31 March 2008, the composition of funds from subsidiary companies held in foreign currencies by the Company is as

follows: USD – 6.2% (2007: 38.2%) and AUD – 0.4% (2007: 0.6%).

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008