Singapore Airlines 2008 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Singapore Airlines Annual Report 2007-08

92

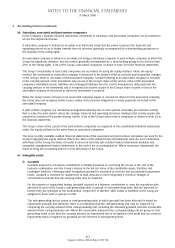

2 Accounting Policies (continued)

(g) Property, plant and equipment (continued)

The cost of an item of property, plant and equipment comprises its purchase price and any directly attributable costs

of bringing the asset to working condition for its intended use. The cost of all aircraft is stated net of manufacturers’

credit. Aircraft and related equipment acquired on an exchange basis are stated at amounts paid plus the fair value

of the fixed asset traded-in. Expenditure for heavy maintenance visits on aircraft and engine overhauls, is capitalised

at cost. Expenditure for engine overhaul costs covered by “power-by-hour” (fixed rate charged per hour) maintenance

agreements is capitalised by hours flown. Expenditure for other maintenance and repairs is charged to the profit and

loss account. When assets are sold or retired, their costs, accumulated depreciation and accumulated impairment

losses, if any, are removed from the financial statements and any gain or loss resulting from their disposal is included

in the profit and loss account.

(h) Depreciation of property, plant and equipment

Property, plant and equipment are depreciated on a straight-line basis at rates which are calculated to write-down

their cost to their estimated residual values at the end of their operational lives. Operational lives, residual values and

depreciation method are reviewed annually in the light of experience and changing circumstances, and adjusted as

appropriate at each balance sheet date.

Fully depreciated assets are retained in the financial statements until they are no longer in use. No depreciation is

charged after assets are depreciated to their residual values.

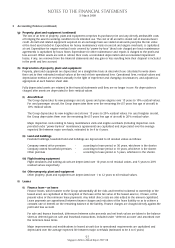

(i) Aircraft fleet

The Group depreciates its new passenger aircraft, spares and spare engines over 15 years to 10% residual values.

For used passenger aircraft, the Group depreciates them over the remaining life (15 years less age of aircraft) to

10% residual values.

The Group depreciates its new freighter aircraft over 15 years to 20% residual values. For used freighter aircraft,

the Group depreciates them over the remaining life (15 years less age of aircraft) to 20% residual value.

Major inspection costs relating to heavy maintenance visits and engine overhauls (including inspection costs

provided under “power-by-hour” maintenance agreements) are capitalised and depreciated over the average

expected life between major overhauls, estimated to be 4 to 6 years.

(ii) Land and buildings

Freehold buildings, leasehold land and buildings are depreciated to nil residual values as follows:

Company owned office premises - according to lease period or 30 years, whichever is the shorter.

Company owned household premises - according to lease period or 10 years, whichever is the shorter.

Other premises - according to lease period or 5 years, whichever is the shorter.

(iii) Flight training equipment

Flight simulators and training aircraft are depreciated over 10 years to nil residual values, and 5 years to 20%

residual values respectively.

(iv) Other property, plant and equipment

Other property, plant and equipment are depreciated over 1 to 12 years to nil residual values.

(i) Leases

(i) Finance lease – as lessee

Finance leases, which transfer to the Group substantially all the risks and benefits incidental to ownership of the

leased asset, are capitalised at the inception of the lease at the fair value of the leased asset or, if lower, at the

present value of the minimum lease payments. Any initial direct costs are also added to the amount capitalised.

Lease payments are apportioned between finance charges and reduction of the lease liability so as to achieve a

constant rate of interest on the remaining balance of the liability. Finance charges are charged directly against the

profit and loss account.

For sale and finance leaseback, differences between sales proceeds and net book values are taken to the balance

sheet as deferred gain on sale and leaseback transactions, included under “deferred account” and amortised over

the minimum lease terms.

Major improvements and modifications to leased aircraft due to operational requirements are capitalised and

depreciated over the average expected life between major overhauls (estimated to be 4 to 6 years).

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008