Singapore Airlines 2008 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2008 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Singapore Airlines Annual Report 2007-08

154

38 Financial Instruments (in $ million) (continued)

(b) Fair values (continued)

The fair value of forward currency contracts is determined by reference to current forward prices for contracts with

similar maturity profiles. The fair value of currency option contracts is determined by reference to valuation reports

provided by counterparties applying the Black-Scholes option valuation model. The parameters used in the model

include terms specified for the option contract, (i.e., currency pair, amount, strike price and expiry date), and prevailing

market values for volatility and spot rates at date of valuation.

The fair value of interest rate contracts is calculated using rates assuming these contracts were liquidated at balance

sheet date.

The fair value of cross currency swaps is determined based on quoted market prices or dealer quotes for similar

instruments used.

Financial instruments whose carrying amounts approximate fair value

The carrying amounts of the following financial assets and liabilities approximate their fair values due to their short-

term nature: cash and bank balances, bank overdrafts, funds from subsidiary companies, amounts owing by/to

subsidiary, associated and joint venture companies, loans, trade debtors, other debtors and creditors.

Financial instruments carried at other than fair value

Long-term investments amounting to $43.3 million (2007: $43.3 million) for the Group and $18.9 million (2007: $18.9

million) for the Company are stated at cost because the fair values cannot be obtained directly from quoted market

price or indirectly using valuation techniques supported by observable market data.

The Group and the Company have no intention to dispose of their interests in the above investments in the foreseeable

future.

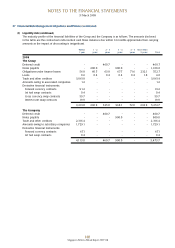

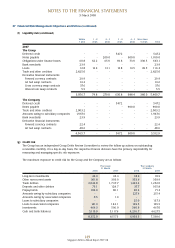

(c) Derivative financial instruments and hedging activities

Derivative financial instruments included in the balance sheets are as follows:

The Group The Company

31 March 31 March

2008 2007 2008 2007

Assets*

Forward currency contracts 7.5 5.5 5.6 3.3

Jet fuel swap and option contracts 442.4 39.4 358.3 31.5

Interest rate swap contracts - 1.8 - -

449.9 46.7 363.9 34.8

Liabilities#

Forward currency contracts 91.2 29.9 67.1 22.4

Jet fuel swap contracts 0.4 61.2 0.4 48.6

Cross currency contracts 59.7 37.6 - -

Interest rate swap contracts 19.9 5.5 - -

171.2 134.2 67.5 71.0

* Included under trade debtors

# Included under trade creditors

NOTES TO THE FINANCIAL STATEMENTS

31 March 2008