HSBC 2011 Annual Report Download - page 390

Download and view the complete annual report

Please find page 390 of the 2011 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Notes on the Financial Statements (continued)

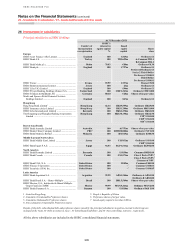

34 – Subordinated liabilities

388

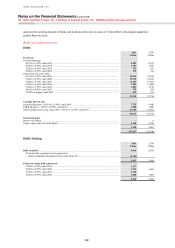

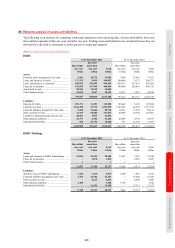

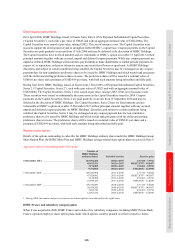

HSBC’s subordinated liabilities (continued)

2011 2010

US$m US$m

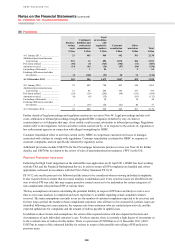

The Hongkong and Shanghai Banking Corporation Ltd and subsidiaries

US$300m Callable subordinated floating rate notes 20179 .......................................................... 300 300

AUD200m Callable subordinated floating rate notes 2020 ........................................................... 203 204

US$400m Primary capital undated floating rate notes ................................................................. 406 407

US$400m Primary capital undated floating rate notes (second series) ........................................ 403 403

US$400m Primary capital undated floating rate notes (third series) ............................................ 400 400

US$450m Callable subordinated floating rate notes 201610 ......................................................... – 450

AUD200m Callable subordinated floating rate notes 201611 ......................................................... – 204

Other subordinated liabilities each less than US$200m .............................................. 362 368

2,074 2,736

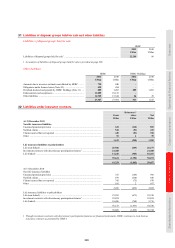

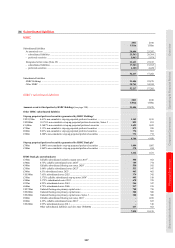

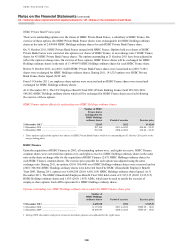

HSBC USA Inc., HSBC Bank USA, N.A. and HSBC Finance Corporation

US$1,000m 4.625% subordinated notes 2014 ................................................................................. 1,009 1,009

US$500m 6.00% subordinated notes 2017.................................................................................... 505 526

US$1,250m 4.875% subordinated notes 2020 ................................................................................. 1,259 1,252

US$750m 5.00% subordinated notes 2020 ................................................................................... 744 747

US$2,939m 6.676% senior subordinated notes 202112 .................................................................... 2,177 2,174

US$200m 7.808% capital securities 2026 .................................................................................... 200 200

US$200m 8.38% capital securities 2027 ...................................................................................... 200 200

US$1,000m 5.875% subordinated notes 2034 ................................................................................. 951 971

US$1,000m 5.911% trust preferred securities 203513 ...................................................................... 994 994

US$750m 5.625% subordinated notes 2035 ................................................................................. 712 728

US$700m 7.00% subordinated notes 2039 ................................................................................... 681 694

US$250m 7.20% subordinated debentures 2097 .......................................................................... 214 213

Other subordinated liabilities each less than US$200m .............................................. 698 780

10,344 10,488

Other HSBC subsidiaries

BRL383m Subordinated certificates of deposit 2015 ................................................................... 206 231

BRL500m Subordinated certificates of deposit 2016 ................................................................... 268 301

US$250m Non-convertible subordinated obligations 2019 ......................................................... 232 248

CAD200m 4.94% subordinated debentures 2021 .......................................................................... 195 200

CAD400m 4.80% subordinated notes 2022 ................................................................................... 417 417

Other subordinated liabilities each less than US$200m .............................................. 1,567 1,533

2,885 2,930

52,217 57,202

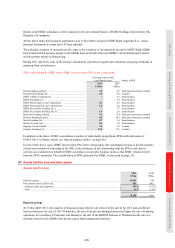

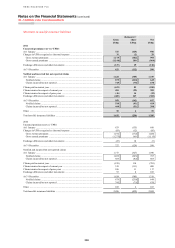

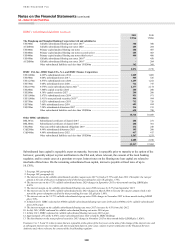

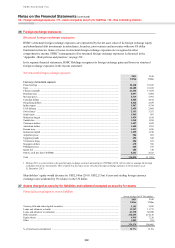

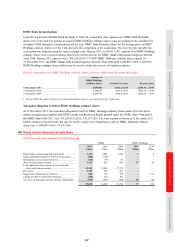

Subordinated loan capital is repayable at par on maturity, but some is repayable prior to maturity at the option of the

borrower, generally subject to prior notification to the FSA and, where relevant, the consent of the local banking

regulator, and in certain cases at a premium over par. Interest rates on the floating rate loan capital are related to

interbank offered rates. On the remaining subordinated loan capital, interest is payable at fixed rates of up to

10.176%.

1 See page 389, paragraph (a).

2 See page 389, paragraph (b).

3 The interest rate on the callable subordinated variable coupon notes 2017 is fixed at 5.75% until June 2012. Thereafter, the rate per

annum is the sum of the gross redemption yield of the then prevailing five-year UK gilt plus 1.70%.

4 The interest rate on the 4.75% callable subordinated notes 2020 changes in September 2015 to three-month sterling LIBOR plus

0.82%.

5 The interest margin on the callable subordinated floating rate notes 2020 increases by 0.5% from September 2015.

6 The interest rate on the 5.00% callable subordinated notes 2023 changes in March 2018 to become the rate per annum which is the

sum of the gross redemption yield of the then prevailing five-year UK gilt plus 1.80%.

7 The interest rate on the 5.375% callable subordinated step-up notes 2030 changes in November 2025 to three-month sterling LIBOR

plus 1.50%.

8 In March 2011, HSBC redeemed its €800m callable subordinated floating rate notes 2016 and its €600m 4.25% callable subordinated

notes 2016 at par.

9 The interest margin on the callable subordinated floating rate notes 2017 increases by 0.5% from July 2012.

10 In July 2011, HSBC redeemed its callable subordinated floating rate notes 2016 at par.

11 In May 2011, HSBC redeemed its callable subordinated floating rate notes 2016 at par.

12 Approximately 25% of the 6.676% senior subordinated notes 2021 is held by HSBC Holdings.

13 The distributions on the trust preferred securities 2035 change in November 2015 to three-month dollar LIBOR plus 1.926%.

Footnotes 3 to 7, 9 and 13 relate to notes that are repayable at the option of the borrower on the date of the change of the interest rate, and

at subsequent interest rate reset dates and interest payment dates in some cases, subject to prior notification to the Financial Services

Authority and, where relevant, the consent of the local banking regulator.