HSBC 2011 Annual Report Download - page 215

Download and view the complete annual report

Please find page 215 of the 2011 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436 -

437

437 -

438

438 -

439

439 -

440

440

|

|

213

Overview Operating & Financial Review Corporate Governance Financial Statements Shareholder Information

Regulation, removing national discretion, with the

exception of countercyclical and capital conservation

buffers which are in the Directive.

The Regulation additionally sets out provisions

to harmonise regulatory and financial reporting in

the EU. In December 2011, the EBA published a

consultative document proposing measures to

specify uniform formats, frequencies and dates

of prudential reporting to the regulator. The new

requirements are due to take effect as of 1 January

2013.

The CRD IV measures are subject to agreement

by the European Parliament, the Council and EU

member states.

In parallel with the Basel III proposals, the

Basel Committee issued a consultative document in

July 2011, Global systemically important banks:

assessment methodology and the additional loss

absorbency requirement. In November 2011, they

published their rules and the Financial Stability

Board (‘FSB’) issued the initial list of global

systematically important banks (‘G-SIBs’). This

list, which includes HSBC alongside twenty-eight

other major banks globally, will be re-assessed

periodically through annual re-scoring of the

individual banks and triennial review of the

methodology.

The rules set out an indicator-based approach to

G-SIBs assessment employing five broad categories:

size, interconnectedness, lack of substitutability,

cross-jurisdictional activity and complexity. The

designated G-SIBs will be required to hold minimum

additional common equity tier 1 capital of between

1% and 2.5%, depending on their relative systemic

importance indicated by their assessed score. A

further 1% charge may be applied to any bank

which fails to make progress, or even regresses, in

performance within the assessment categories. The

requirements, initially for those banks identified

in November 2014 as G-SIBs, will be phased in

from 1 January 2016, becoming fully effective on

1 January 2019. National regulators have discretion

to introduce higher thresholds than these minima.

The above forms part of a broad mandate of the

FSB to reduce the moral hazard of G-SIBs. A further

exercise of this mandate was the FSB’s own direct

consultation of October 2011. This proposed

introducing, over 2012-14, enhanced reporting

by G-SIBs to the Basel Committee centrally.

In September 2011, the ICB recommended

measures on capital requirements for UK banking

groups. For further details on these proposals see

page 101. The requirements as set out above indicate

the required regulatory common equity tier 1 ratio

for a G-SIB may ultimately lie in the range of 8% to

12%.

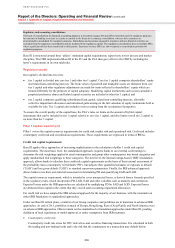

Potential common equity tier 1 requirements from

1 January 2019

(Unaudited)

Minimum common equity tier 1 4.5%

Capital conservation buffer 2.5%

Countercyclical capital buffer 0 – 2.5%

G-SIB buffer 1 – 2.5%

Against the backdrop of eurozone instability, on

a temporary basis, the EBA recommends banks aim

to reach a 9% core tier 1 ratio by the end of June

2012. We will continue to review our target core tier

1 ratio of 9.5% to 10.5% as the applicable regulatory

capital requirements evolve over the period to

1 January 2019.

Impact of Basel III

(Unaudited)

In order to provide some insight into the possible

effects of the Basel III rules on HSBC, we have

estimated the Group’s pro forma common equity

tier 1 ratio on the basis of our interpretation of those

rules applied to our position at 31 December 2011.

The Basel III changes will be progressively

phased in. The increased capital requirements which

come into effect on 1 January 2013 are estimated to

result in a common equity tier 1 ratio which is

100bps lower than the current core tier 1 ratio.

Management actions, primarily the run-off of legacy

positions including the US CML portfolio and the

sale of the US Card and Retail Services portfolio,

coupled with active management of the correlation

trading portfolio, the market risk capital requirement

and the counterparty capital risk requirement, will

mitigate this by 110bps, more than offsetting the

effect of these Basel III changes before taking

account of any future retained earnings.

In addition to the impact on common equity

tier 1 capital, tier 1 capital and tier 2 capital will also

be affected by the derecognition of non-qualifying

capital instruments. These changes will be phased in

over 10 years from 1 January 2013, and will further

reduce the tier 1 ratio by an estimated 10bps, and the

total capital ratio by an estimated 50bps in 2013,

excluding new issues of qualifying capital

instruments.

The changes to capital deductions and regulatory

adjustments including deferred tax assets, material

holdings, excess expected losses and unrealised

losses on available-for-sale portfolios will be phased

in over a five-year period starting on 1 January 2014.