HSBC 2011 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2011 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

HSBC HOLDINGS PLC

Report of the Directors: Operating and Financial Review (continued)

Risk > Footnotes

186

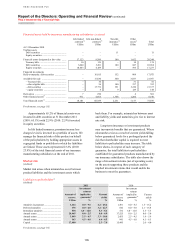

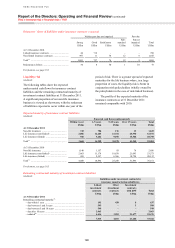

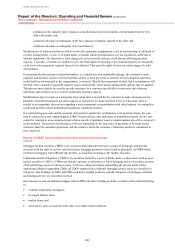

31 Collectively assessed impairment allowances are allocated to geographical segments based on the location of the office booking the

allowances or provisions. Consequently, the collectively assessed impairment allowances booked in Hong Kong may cover assets

booked in branches located outside Hong Kong, principally in Rest of Asia-Pacific, as well as those booked in Hong Kong.

32 The table presents the carrying amount of collateral and other credit enhancements obtained which are held at the reporting date. In previous

years we presented the amount of collateral and other credit enhancements obtained during the year. This resulted from a change to the

disclosure requirements under IFRSs.

33 Carrying amount of the net principal exposure.

34 Total includes holdings of ABSs issued by The Federal Home Loan Mortgage Corporation (‘Freddie Mac’) and The Federal National

Mortgage Association (‘Fannie Mae’).

35 ‘Directly held’ includes assets held by Solitaire where we provide first loss protection and assets held directly by the Group.

36 Impairment charges allocated to capital note holders represent impairments where losses would be borne by external third-party

investors in the structures.

37 The gross principal is the redemption amount on maturity or, in the case of an amortising instrument, the sum of the future redemption

amounts through the residual life of the security.

38 A credit default swap (‘CDS’) gross protection is the gross principal of the underlying instrument that is protected by CDSs.

39 Net principal exposure is the gross principal amount of assets that are not protected by CDSs. It includes assets that benefit from

monoline protection, except where this protection is purchased with a CDS.

40 Net exposure after legal netting and any other relevant credit mitigation prior to deduction of the credit valuation adjustment.

41 Cumulative fair value adjustment recorded against exposures to OTC derivative counterparties to reflect their creditworthiness.

42 Funded exposures represent the loan amount advanced to the customer, less any fair value write-downs, net of fees held on deposit.

Unfunded exposures represent the contractually committed loan facility amount not yet drawn down by the customer, less any fair value

write-downs, net of fees held on deposit.

Liquidity and funding

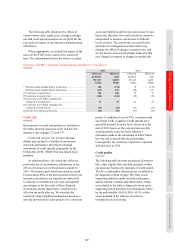

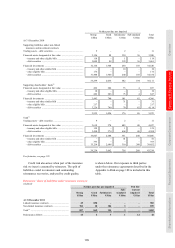

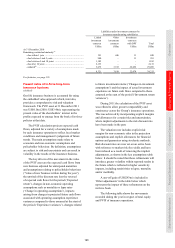

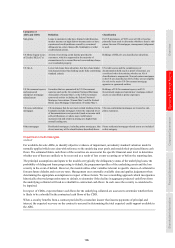

43 As a result of the significant level of disposal groups held for sale at 31 December 2011, the financial liabilities of the disposal groups

held for sale has been separately shown in the table. For further details of the disposal groups held for sale refer to Note 27.

44 The most favourable metrics are a smaller advances to core funding ratio and a larger stressed one month coverage ratio.

45 Figures provided for HSBC Bank plc and The Hongkong and Shanghai Banking Corporation incorporate all overseas branches.

Subsidiaries of these entities are not included unless there is unrestricted transferability of liquidity between them and the parent.

46 Part of the improvement in the advances to core funding ratio and stressed one month coverage ratio for HSBC Bank USA is due to a

change in its inherent liquidity risk categorisation during 2011. The change in categorisation was due to an improvement in the overall

liquidity risk in US banking sector and the strong liquidity profile of HSBC Bank USA. If this change had not been made, the advances

to core funding ratio for 2011 would have been as follows: year end, 96.8%; maximum, 99.7%; minimum, 86.4%; average, 93.5%. The

stressed one month coverage ratio would have been as follows: year end, 105.4%; maximum, 116.3%; minimum, 98.5%; average,

108.2%. For further details of our inherent liquidity risk categorisation refer to the Appendix to Risk on page 188.

47 This comprises our other main banking subsidiaries and, as such, includes businesses spread across a range of locations, in many of

which we may require a higher ratio of net liquid assets to customer liabilities to reflect local market conditions.

48 Unused committed sources of secured funding for which eligible assets were held.

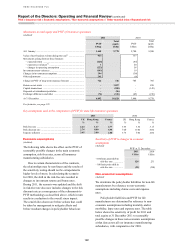

49 Client-originated asset exposures relate to consolidated multi-seller conduits, primarily Regency and Bryant Park. These vehicles

provide funding to our customers by issuing debt secured by a diversified pool of customer-originated assets. The 2010 comparative for

HSBC Bank plc has been restated to include a US$0.6bn committed facility provided to Bryant Park. In 2011 a committed line of

US$3.3bn was provided to Bryant Park by HSBC Bank plc which has been reflected in these figures. The reduction in contingent risk

exposure in HSBC Bank USA in 2011 is primarily due to the transfer of the majority of the committed lines provided for Bryant Park

LLC to HSBC Bank plc.

50 HSBC-managed asset exposures relate to consolidated securities investment conduits, primarily Solitaire and Mazarin (see page 403).

These vehicles issue debt secured by ABSs which are managed by HSBC. HSBC has a total contingent liquidity risk of US$22.1bn

(2010: US$25.6bn) of which Solitaire represents US$9.3bn already funded on-balance sheet as at 31 December 2011 (2010: US$8.1bn)

leaving a net contingent exposure of US$12.8bn (2010: US$17.5bn). As at 31 December 2011, US$6.2bn (2010: US$8.4bn) of the net

contingent liability is on the Commercial Paper issued by Mazarin and entirely held by HSBC.

51 Other conduit exposures relate to third-party sponsored conduits (see page 405).

52 The undrawn balance for the five largest committed liquidity facilities provided to customers other than facilities to conduits.

53 The undrawn balance for the total of all committed liquidity facilities provided to the largest market sector, other than facilities to conduits.

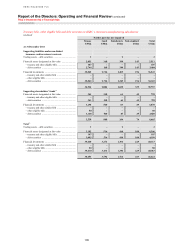

Market risk

54 The structural foreign exchange risk is monitored using sensitivity analysis (see page 166). The reporting of commodity risk is

consolidated with foreign exchange risk and is not applicable to non-trading portfolios.

55 The interest rate risk on the fixed-rate securities issued by HSBC Holdings is not included in the Group VAR. The management of this

risk is described on page 168.

56 Credit spread sensitivity is reported separately for insurance operations (see page 177).

57 2010 VAR comparatives have been adjusted to include credit spread risk to allow for a like for like comparison. In the Annual Report

and Accounts 2010, we reported the following measures for Group VAR for 2010: at 31 December US$267m, average US$200m,

minimum US$140m, and maximum US$286m.

58 The standard deviation measures the variation of daily revenues about the mean value of those revenues.

59 Revenues within the daily distribution graph include all revenues booked in Global Markets (gross of brokerage fees), Balance Sheet

Management, and the trading element of revenues booked in the GPB and RBWM businesses. The effect of any month-end adjustments,

not attributable to a specific daily market move, is spread evenly over the days in the month in question.

60 Trading intent portfolios include positions arising from market-making and position taking.

61 Portfolio diversification is the market risk dispersion effect of holding a portfolio containing different risk types. It represents the

reduction in unsystematic market risk that occurs when combining a number of different risk types, for example, interest rate, equity

and foreign exchange, together in one portfolio. It is measured as the difference between the sum of the VAR by individual risk type and

the combined total VAR. A negative number represents the benefit of portfolio diversification. As the maximum and minimum occur on

different days for different risk types, it is not meaningful to calculate a portfolio diversification benefit for these measures.