HSBC 2007 Annual Report Download - page 240

Download and view the complete annual report

Please find page 240 of the 2007 HSBC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303 -

304

304 -

305

305 -

306

306 -

307

307 -

308

308 -

309

309 -

310

310 -

311

311 -

312

312 -

313

313 -

314

314 -

315

315 -

316

316 -

317

317 -

318

318 -

319

319 -

320

320 -

321

321 -

322

322 -

323

323 -

324

324 -

325

325 -

326

326 -

327

327 -

328

328 -

329

329 -

330

330 -

331

331 -

332

332 -

333

333 -

334

334 -

335

335 -

336

336 -

337

337 -

338

338 -

339

339 -

340

340 -

341

341 -

342

342 -

343

343 -

344

344 -

345

345 -

346

346 -

347

347 -

348

348 -

349

349 -

350

350 -

351

351 -

352

352 -

353

353 -

354

354 -

355

355 -

356

356 -

357

357 -

358

358 -

359

359 -

360

360 -

361

361 -

362

362 -

363

363 -

364

364 -

365

365 -

366

366 -

367

367 -

368

368 -

369

369 -

370

370 -

371

371 -

372

372 -

373

373 -

374

374 -

375

375 -

376

376 -

377

377 -

378

378 -

379

379 -

380

380 -

381

381 -

382

382 -

383

383 -

384

384 -

385

385 -

386

386 -

387

387 -

388

388 -

389

389 -

390

390 -

391

391 -

392

392 -

393

393 -

394

394 -

395

395 -

396

396 -

397

397 -

398

398 -

399

399 -

400

400 -

401

401 -

402

402 -

403

403 -

404

404 -

405

405 -

406

406 -

407

407 -

408

408 -

409

409 -

410

410 -

411

411 -

412

412 -

413

413 -

414

414 -

415

415 -

416

416 -

417

417 -

418

418 -

419

419 -

420

420 -

421

421 -

422

422 -

423

423 -

424

424 -

425

425 -

426

426 -

427

427 -

428

428 -

429

429 -

430

430 -

431

431 -

432

432 -

433

433 -

434

434 -

435

435 -

436

436 -

437

437 -

438

438 -

439

439 -

440

440 -

441

441 -

442

442 -

443

443 -

444

444 -

445

445 -

446

446 -

447

447 -

448

448 -

449

449 -

450

450 -

451

451 -

452

452 -

453

453 -

454

454 -

455

455 -

456

456 -

457

457 -

458

458 -

459

459 -

460

460 -

461

461 -

462

462 -

463

463 -

464

464 -

465

465 -

466

466 -

467

467 -

468

468 -

469

469 -

470

470 -

471

471 -

472

472 -

473

473 -

474

474 -

475

475 -

476

476

|

|

HSBC HOLDINGS PLC

Report of the Directors: The Management of Risk (continued)

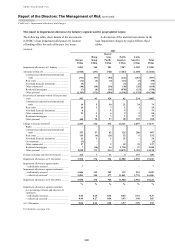

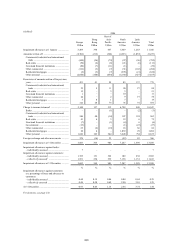

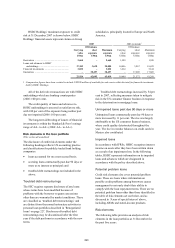

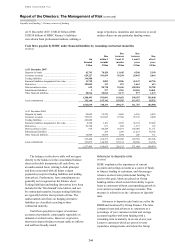

Credit risk > Loan impairment charge > 2007 / 2006

238

regular levels after an upsurge in 2006 due to

regulatory changes which affected collection activity

and minimum payments.

With corporate and commercial loan impairment

charges low in recent years, releases and recoveries

decreased by 6 per cent to US$220 million.

New loan impairment charges in North America

rose by 76 per cent to US$12.2 billion, driven by the

continued deterioration in credit quality in the US

consumer finance loan portfolio.

US credit quality deteriorated as mortgage

delinquencies rose, house prices declined,

refinancing credit became less available in the

market and the macroeconomic outlook worsened.

The reasons behind the deterioration in US credit

quality, the effects on the US personal lending

portfolio and actions taken as a result are discussed

in more detail on page 217.

Other factors affecting the rise in US loan

impairment charges included normal seasoning of

the portfolio, a higher proportion of unsecured

personal lending and a return to historical norms

from the unusually low levels of bankruptcy filings

experienced in 2006, following changes enacted to

US bankruptcy law in 2005.

Delinquency rates rose across all parts of the

HSBC Finance personal lending portfolio, with

mortgage services and consumer lending

experiencing significant rises in delinquency which

flowed through subsequent stages through to

foreclosure. As the housing downturn began to have

more effect on the broader economy, delinquency

rates in credit cards and vehicle finance rose in the

final quarter of 2007. A change in product mix in the

cards portfolio towards higher yielding products also

contributed to higher impairment charges as this

segment of the portfolio seasoned.

Releases and recoveries in North America

decreased to US$116 million. In the US consumer

finance business, collection staff increased in all

lending portfolios as part of the response to the

deteriorating credit environment.

In Latin America, new loan impairment

charges rose by 63 per cent to US$2.0 billion. The

most significant increase was registered in Mexico,

reflecting strong growth in balances, normal

portfolio seasoning and a rise in delinquency rates

in credit cards. Charges for commercial lending in

Mexico fell as increased delinquency rates in the

small and medium-sized business portfolios were

offset by impairment allowance releases. Products

with high credit losses were discontinued or

restructured. Loan impairment charges in Brazil rose

marginally, due to growth in store loans and credit

cards.

Releases and recoveries in Latin America

increased to US$272 million. In Brazil, credit

models were changed during 2007 to align with

credit behaviour in underlying portfolios.

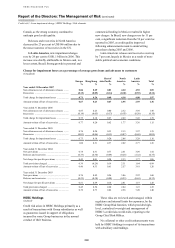

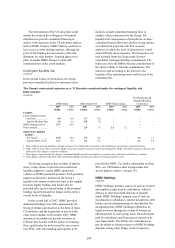

Year ended 31 December 2006 compared

with year ended 31 December 2005

(Unaudited)

Loan impairment charges increased by

US$2.7 billion, or 34 per cent, compared with 2005.

Acquisitions accounted for US$309 million of the

rise, mainly Metris in the US. On an underlying

basis, the increase was 30 per cent. Personal

Financial Services continued to dominate loan

impairments, representing 94 per cent of the Group’s

charge. On a constant currency basis, the key trends

were as follows.

New allowances for loan impairment charges of

US$12.0 billion increased by 27 per cent compared

with 2005. Releases and recoveries of allowances

were broadly in line with 2005.

In Europe, new loan impairment charges rose

by 9 per cent compared with 2005 to US$3.0 billion.

A challenging credit environment in UK unsecured

lending, which began to deteriorate in the middle of

2005, was the primary cause of the increase,

although this was partly mitigated by continued

benign corporate and commercial impairment

experience. Personal bankruptcies and the use of

IVAs have been on a rising trend since the

introduction of legislation in 2004 that eased filing

requirements, and this was further exacerbated by

the recent active marketing of bankruptcy and IVA

relief through the media by debt advisors.

Additionally, a rise in unemployment, which began

in the middle of 2005, and modest rises in interest

rates added to the strain on some personal customers.

In response, HSBC tightened underwriting controls

in the second half of 2005, reduced its market share

of unsecured personal lending and changed the

product mix of new business towards lower-risk

customers. In 2006, there were early signs of

improvement in more recent unsecured lending. New

loan impairment charges also rose in Turkey, by

30 per cent, mainly due to growth in unsecured

credit card and personal lending as overall credit

quality remained stable. In France, new charges fell,

reflecting a stable credit environment and the

reduction in charges following the sale of a

consumer finance business in the second half of

2005.