Xerox 2014 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

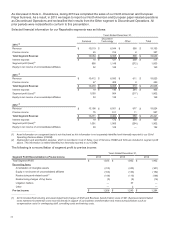

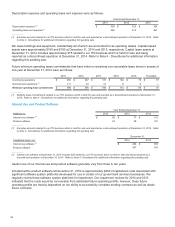

Year Ended December 31,

2014 2013 2012

Net carrying value (NCV) sold $ —$676 $682

Allowance included in NCV —17 18

Cash proceeds received — 635 630

Beneficial interests received —86 101

Pre-tax gain on sales —40 44

Net fees and expenses —55

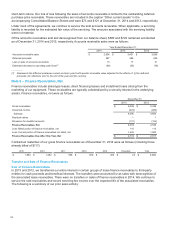

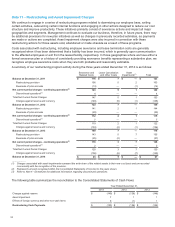

The principal value of the finance receivables derecognized from our balance sheet was $549 and $1,006 at

December 31, 2014 and 2013, respectively (sales value of approximately $596 and $1,098, respectively).

Summary Finance Receivable Sales

The lease portfolios transferred and sold were all from our Document Technology segment and the gains on these

sales were reported in Financing revenues within the Document Technology segment. The ultimate purchaser has

no recourse to our other assets for the failure of customers to pay principal and interest when due beyond our

beneficial interests which were $77 and $150 at December 31, 2014 and 2013, respectively, and are included in

Other current assets and Other long-term assets in the accompanying Consolidated Balance Sheets. Beneficial

interests of $64 and $124 at December 31, 2014 and 2013, respectively, are held by the bankruptcy-remote

subsidiaries and therefore are not available to satisfy any of our creditor obligations. We report collections on the

beneficial interests as operating cash flows in the Consolidated Statements of Cash Flows because such beneficial

interests are the result of an operating activity and the associated interest rate risk is de minimis considering their

weighted average lives of less than 2 years.

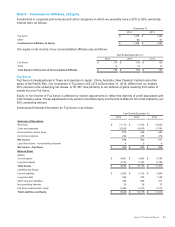

The net impact from the sales of finance receivables on operating cash flows is summarized below:

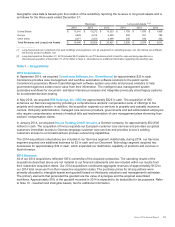

Year Ended December 31,

2014 2013 2012

Net cash received for sales of finance receivables(1) $—$631 $625

Impact from prior sales of finance receivables(2) (527)(392)(45)

Collections on beneficial interests 94 58 —

Estimated (Decrease) Increase to Operating Cash Flows $(433)$ 297 $580

____________

(1) Net of beneficial interest, fees and expenses.

(2) Represents cash that would have been collected if we had not sold finance receivables.

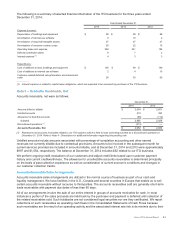

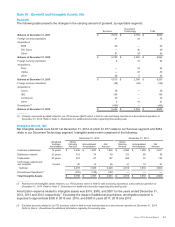

Finance Receivables - Allowance for Credit Losses and Credit Quality

Our finance receivable portfolios are primarily in the U.S., Canada and Europe. We generally establish customer

credit limits and estimate the allowance for credit losses on a country or geographic basis. Customer credit limits

are based upon an initial evaluation of the customer's credit quality and we adjust that limit accordingly based upon

ongoing credit assessments of the customer, including payment history and changes in credit quality.

The allowance for doubtful accounts and provision for credit losses represents an estimate of the losses expected

to be incurred from the Company's finance receivable portfolio. The level of the allowance is determined on a

collective basis by applying projected loss rates to our different portfolios by country, which represent our portfolio

segments. This is the level at which we develop and document our methodology to determine the allowance for

credit losses. This loss rate is primarily based upon historical loss experience adjusted for judgments about the

probable effects of relevant observable data including current economic conditions as well as delinquency trends,

resolution rates, the aging of receivables, credit quality indicators and the financial health of specific customer

classes or groups. The allowance for doubtful finance receivables is inherently more difficult to estimate than the

allowance for trade accounts receivable because the underlying lease portfolio has an average maturity, at any

time, of approximately two to three years and contains past due billed amounts, as well as unbilled amounts. We

consider all available information in our quarterly assessments of the adequacy of the allowance for doubtful

accounts. The identification of account-specific exposure is not a significant factor in establishing the allowance for

doubtful finance receivables. Our policy and methodology used to establish our allowance for doubtful accounts

has been consistently applied over all periods presented.

Xerox 2014 Annual Report 84