Xerox 2014 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Contingent Consideration

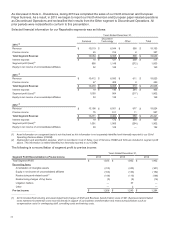

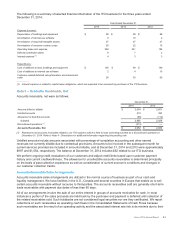

In connection with certain acquisitions, we are obligated to make contingent payments if specified contractual

performance targets are achieved. Contingent consideration obligations are recorded at their respective fair value.

As of December 31, 2014, the maximum aggregate amount of outstanding contingent obligations to former owners

of acquired entities was approximately $33, of which $25 was accrued representing the estimated fair value of this

obligation.

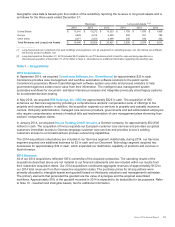

Note 4 – Divestitures

Information Technology Outsourcing (ITO)

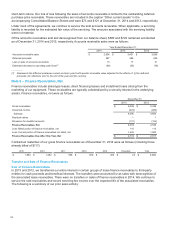

In December 2014, we announced an agreement to sell our ITO business to Atos for $1,050, which includes the

assumption of approximately $100 of capital lease obligations and pension liabilities. The final sales price is subject

to final closing adjustments with additional consideration of $50 contingent on the condition of certain assets at

closing. The transaction is subject to customary closing conditions and regulatory approval and is expected to close

in the first half of 2015. We expect net after-tax proceeds from the transaction of approximately $850.

ITO services include service arrangements where we manage a customer’s IT-related activities, such as application

management and development, data center operations or testing and quality assurance. Our ITO business includes

approximately 9,800 employees in 45 countries. As part of the transaction, Atos will provide IT services for certain of

our existing BPO customers as well as a portion of our internal IT requirements. These continuing cash flows were

determined to not be significant, and we will have no significant continuing involvement in the ITO business post-

closing.

As a result of this pending transaction and having met applicable accounting requirements, in the fourth quarter

2014, we reported the ITO business as held for sale and a Discontinued Operation and reclassified its results from

the Services segment to Discontinued Operations. All prior periods have accordingly been reclassified to conform to

this presentation.

In the fourth quarter 2014, we also recorded a net pre-tax loss of $181 related to the pending sale reflecting the

write-down of the carrying value of the ITO disposal group, inclusive of goodwill, to its estimated fair value less costs

to sell. Goodwill was allocated to the ITO disposal group based on the relative fair value of the business. The

estimated fair value may be adjusted, and we are likely to incur additional charges prior to the closing of the

transaction, which will be recorded in Discontinued Operations. In addition, upon final disposal of the business, we

expect to record additional tax expense of approximately $75 within Discontinued Operations primarily related to the

difference between the book basis and the tax basis of allocated goodwill. All the assets and liabilities of the ITO

business are reported as held for sale at December 31, 2014 and are included in Assets and Liabilities of

discontinued operations, respectively, in the Consolidated Balance Sheet at December 31, 2014.

Since the ITO business comprised a portion of several reporting units, we tested the retained goodwill of those

reporting units for impairment and concluded that the goodwill remaining in those reporting units was not impaired

since the fair values of those reporting units exceeded their carrying values.

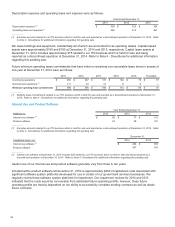

Other Discontinued Operations

During the third quarter 2014, we completed the closure of Xerox Audio Visual Solutions, Inc. (XAV), a small

audio visual business within our Global Imaging Systems subsidiary, and recorded a net pre-tax loss on disposal of

$1. XAV provided audio visual equipment and services to enterprise and government customers. As a result of this

closure, we reported XAV as a Discontinued Operation and reclassified its results from the Other segment to

Discontinued Operations in the third quarter 2014.

In May 2014 we sold our Truckload Management Services, Inc. (TMS) business for $15 and recorded a net pre-

tax loss on disposal of $1. TMS provided document capture and submission solutions as well as campaign

management, media buying and digital marketing services to the long haul trucking and transportation industry. As a

result of this transaction, we reported this business as a Discontinued Operation and reclassified its results from the

Services segment to Discontinued Operations in the second quarter 2014.

Xerox 2014 Annual Report 80