Xerox 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

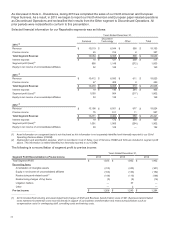

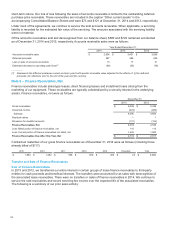

The following is a summary of selected financial information of the ITO business for the three years ended

December 31, 2014:

Year Ended December 31,

2014 2013 2012

Expense (Income):

Depreciation of buildings and equipment $ 98 $ 99 $ 98

Amortization of internal use software 910 2

Amortization of acquired intangible assets 27 27 27

Amortization of customer contract costs 26 22 15

Operating lease rent expense 258 241 185

Defined contribution plans 872

Interest expense (1) 433

Expenditures:

Cost of additions to land, buildings and equipment $ 105 $99$

140

Cost of additions to internal use software 24

15

Customer-related deferred set-up/transition and inducement

costs 26 35 60

_______________

(1) Interest expense is related to capital lease obligations, which are expected to be assumed by purchaser of the ITO business.

Note 5 – Accounts Receivable, Net

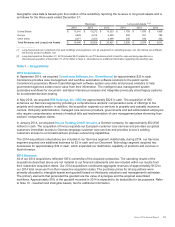

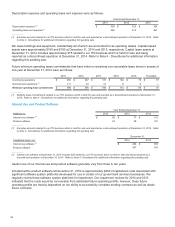

Accounts receivable, net were as follows:

December 31,

2014 2013

Amounts billed or billable $2,634 $2,651

Unbilled amounts 319 390

Allowance for doubtful accounts (88)(112)

Subtotal 2,865 2,929

Discontinued operations (1) (213)—

Accounts Receivable, Net $2,652 $2,929

(1) Represents net accounts receivable related to our ITO business which is held for sale and being reported as a discontinued operation at

December 31, 2014. Refer to Note 4 - Divestitures for additional information regarding this pending sale.

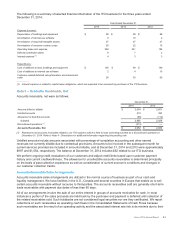

Unbilled amounts include amounts associated with percentage-of-completion accounting and other earned

revenues not currently billable due to contractual provisions. Amounts to be invoiced in the subsequent month for

current services provided are included in amounts billable, and at December 31, 2014 and 2013 were approximately

$997 and $1,054, respectively. The balance at December 31, 2014 includes $52 related to our ITO business.

We perform ongoing credit evaluations of our customers and adjust credit limits based upon customer payment

history and current creditworthiness. The allowance for uncollectible accounts receivables is determined principally

on the basis of past collection experience as well as consideration of current economic conditions and changes in

our customer collection trends.

Accounts Receivable Sales Arrangements

Accounts receivable sales arrangements are utilized in the normal course of business as part of our cash and

liquidity management. We have facilities in the U.S., Canada and several countries in Europe that enable us to sell

certain accounts receivable without recourse to third-parties. The accounts receivables sold are generally short-term

trade receivables with payment due dates of less than 60 days.

All of our arrangements involve the sale of our entire interest in groups of accounts receivable for cash. In most

instances a portion of the sales proceeds are held back by the purchaser and payment is deferred until collection of

the related receivables sold. Such holdbacks are not considered legal securities nor are they certificated. We report

collections on such receivables as operating cash flows in the Consolidated Statements of Cash Flows because

such receivables are the result of an operating activity and the associated interest rate risk is de minimis due to their

Xerox 2014 Annual Report 82