Xerox 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

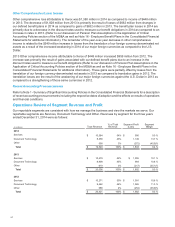

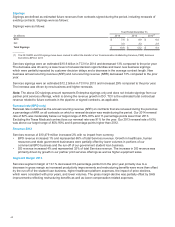

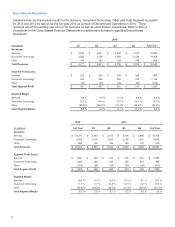

Note: The above table has been revised to reflect the reclassification of the ITO business to Discontinued

Operations. Segment profit associated with the ITO business reclassified from the Services segment to

Discontinued Operations was $107 million, $100 million and $82 million for 2014, 2013 and 2012, respectively.

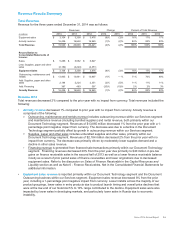

Services Segment

Our Services segment is comprised of two service offerings: Business Process Outsourcing (BPO) and Document

Outsourcing (DO).

Services segment revenues for the three years ended December 31, 2014 were as follows:

Revenue Change

(in millions) 2014 2013 2012 2014 2013

Business processing outsourcing $ 7,304 $7,244 $7,162 1% 1%

Document outsourcing 3,388 3,337 3,210 2% 4%

Less: Intra-segment elimination (108)(102)(101)6%1%

Total Services Revenue $10,584 $10,479 $10,271 1% 2%

__________

Note: The above table has been revised to reflect the reclassification of the ITO business to Discontinued

Operations. Additionally, 2013 and 2012 BPO revenues have been revised to conform to the 2014 presentation of

revenues.

Revenue 2014

Services revenue of $10,584 million increased 1% with no impact from currency.

•BPO revenue increased 1% and represented 68% of total Services revenue. Growth from acquisitions along

with organic growth in commercial healthcare and litigation services as well as growth internationally were

partially offset by declines in portions of customer care. In addition, the anticipated declines in the student loan

business and the Texas Medicaid contract termination had a combined 2.6-percentage point negative impact

on BPO revenue growth and a 1.8-percentage point negative impact on total Services revenue. These

negative year-over-year impacts are expected to end in the second half of 2015.

In 2014, BPO revenue mix across the major business areas was as follows: Commercial - 45%;

Government and Transportation - 25%; Commercial Healthcare - 18%; and Government Healthcare -

12%.

•DO revenue increased 2% and represented 32% of total Services revenue. The increase in DO revenue was

primarily driven by growth in our partner print services offerings offset by declines in Europe and other markets

due to contract run-off and new contract ramp timing.

Segment Margin 2014

Services segment margin of 9.0% decreased 1.1-percentage points from the prior year due primarily to a 1.1-

percentage point decline in gross margin, as margin improvements in DO, commercial healthcare, human

resources and commercial European businesses were more than offset by decreased margin in government

healthcare and government and transportation. Productivity improvements and restructuring benefits were

insufficient to offset higher expenses associated with our government healthcare Medicaid and Health Insurance

Exchange (HIX) platforms, net non-cash impairment charges for the HIX platform, higher compensation expenses,

the anticipated run-off of the student loan business and price declines consistent with prior years. The gross

margin decline was partially offset by improvements in SAG reflecting restructuring benefits.

Metrics

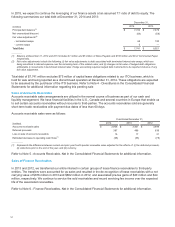

Pipeline

Our total Services sales pipeline at December 31, 2014 declined 5% over the prior year. The pipeline has been

adjusted to remove the ITO business and to reflect the realignment of our Services go-to-market resources into

industry focused business groups. Additionally, the pipeline qualification criteria has been revised. The sales

pipeline includes the Total Contract Value (TCV) of new business opportunities that potentially could be contracted

within the next six months and excludes business opportunities with estimated annual recurring revenue in excess

of $100 million.

Xerox 2014 Annual Report 42