Xerox 2014 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Mid-Range

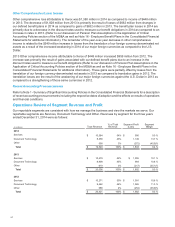

•8% increase in installs of mid-range color devices driven by demand for the ConnectKey® enabled products.

•3% decrease in installs of mid-range black-and-white devices.

High-End

•43% increase in installs of high-end color systems driven by growth in the sale of digital front-ends (DFE's) to

Fuji Xerox, as well as strong customer demand for the Color J75 Press and iGen® as we continue to

strengthen our market leadership in the Production Color segment. High-end color installs increased 7%,

excluding the DFE sales to Fuji Xerox.

•8% decrease in installs of high-end black-and-white systems, reflecting continued declines in the overall

market.

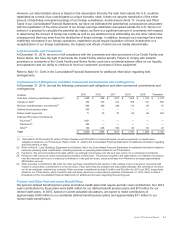

Other Segment

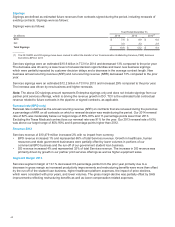

Revenue 2014

Other segment revenue of $598 million decreased 3%, with no impact from currency, due to lower licensing and

patent sale revenues as well as lower wide format systems revenue. Total paper revenue (all within developing

markets) comprised approximately one-third of the Other segment revenue.

Segment Loss 2014

Other segment loss of $272 million, increased $55 million from the prior year, primarily driven by lower gains from

the sale of surplus properties, increased currency losses, higher legal reserves and lower licensing and patent

revenues. Non-financing interest expense as well as all Other expenses, net (excluding deferred compensation

investment gains and losses) are reported within the Other segment.

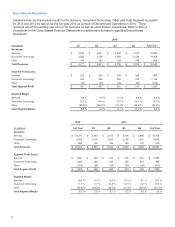

Revenue 2013

Other segment revenue of $619 million decreased 10%, with no impact from currency, due to lower wide format

systems revenue, lower sales of electronic presentation systems, lower developing market paper sales and lower

licensing revenue. Total paper revenue (all within developing markets) comprised approximately one-third of the

Other segment revenue.

Segment Loss 2013

Other segment loss of $217 million, was $37 million lower than the prior year, primarily driven by gains on the sale

of businesses and assets, partially offset by lower revenues. Non-financing interest expense as well as all Other

expenses, net (excluding deferred compensation investment gains) are reported within the Other segment.

Xerox 2014 Annual Report 46