Xerox 2014 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

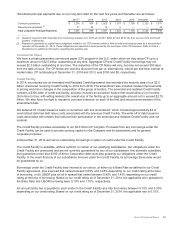

The Credit Facility contains various conditions to borrowing and affirmative, negative and financial maintenance

covenants. Certain of the more significant covenants are summarized below:

(a) Maximum leverage ratio (a quarterly test that is calculated as principal debt divided by consolidated EBITDA, as

defined) of 3.75x.

(b) Minimum interest coverage ratio (a quarterly test that is calculated as consolidated EBITDA divided by

consolidated interest expense) may not be less than 3.00x.

(c) Limitations on (i) liens of Xerox and certain of our subsidiaries securing debt, (ii) certain fundamental changes to

corporate structure, (iii) changes in nature of business and (iv) limitations on debt incurred by certain

subsidiaries.

The Credit Facility also contains various events of default, the occurrence of which could result in termination of the

lenders' commitments to lend and the acceleration of all our obligations under the Credit Facility. These events of

default include, without limitation: (i) payment defaults, (ii) breaches of covenants under the Credit Facility (certain

of which breaches do not have any grace period), (iii) cross-defaults and acceleration to certain of our other

obligations and (iv) a change of control of Xerox.

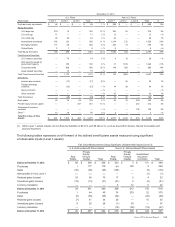

Interest

Interest paid on our short-term and long-term debt amounted to $400, $435 and $464 for the years ended

December 31, 2014, 2013 and 2012, respectively.

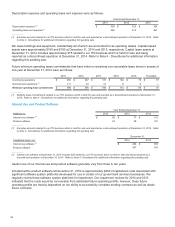

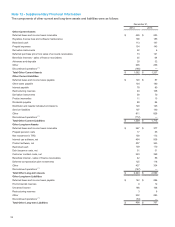

Interest expense and interest income was as follows:

Year Ended December 31,

2014 2013 2012

Interest expense(1) (3) $377 $403 $427

Interest income(2) 397 494 610

___________

(1) Includes Equipment financing interest expense, as well as non-financing interest expense included in Other expenses, net in the

Consolidated Statements of Income.

(2) Includes Finance income, as well as other interest income that is included in Other expenses, net in the Consolidated Statements of

Income.

(3) Excludes interest on capital lease obligations related to our ITO business which is held for sale and being reported as a discontinued

operation at December 31, 2014. These obligations are expected to be assumed by the purchaser of the ITO business. Refer to Note 4 -

Divestitures for additional information regarding this pending sale.

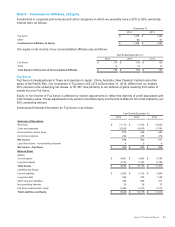

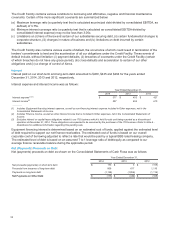

Equipment financing interest is determined based on an estimated cost of funds, applied against the estimated level

of debt required to support our net finance receivables. The estimated cost of funds is based on our overall

corporate cost of borrowing adjusted to reflect a rate that would be paid by a typical BBB rated leasing company.

The estimated level of debt is based on an assumed 7 to 1 leverage ratio of debt/equity as compared to our

average finance receivable balance during the applicable period.

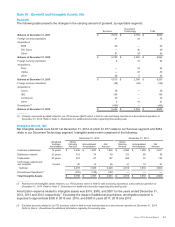

Net (Payments) Proceeds on Debt

Net (payments) proceeds on debt as shown on the Consolidated Statements of Cash Flows was as follows:

Year Ended December 31,

2014 2013 2012

Net proceeds (payments) on short-term debt $ 145 $5$(108)

Proceeds from issuance of long-term debt 808 617 1,116

Payments on long-term debt (1,128) (1,056) (1,116)

Net Payments on Other Debt $(175)$ (434)$ (108)

99