Xerox 2014 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

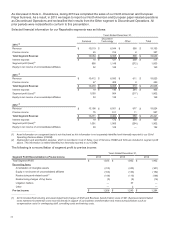

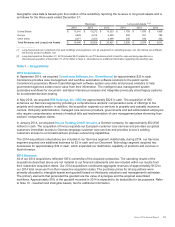

The following table summarizes the purchase price allocations for our 2014 acquisitions as of the acquisition dates:

Weighted-

Average Life

(Years)

Total 2014

Acquisitions

Accounts/finance receivables $33

Intangible assets:

Customer relationships 13 71

Trademarks 11 6

Non-compete agreements 43

Software 725

Goodwill 249

Other assets 26

Total Assets Acquired 413

Liabilities assumed (73)

Total Purchase Price $340

2013 and 2012 Acquisitions

In April 2013, we acquired Florida based Zeno Office Solutions, Inc. (Zeno), a provider of print and IT solutions to

small and mid-sized businesses in the Southeast, for approximately $59 in cash. This acquisition furthers our

coverage in Florida, building on our strategy of expanding our network of locally-based companies focused on

customers' requirements to improve their performance through efficiencies.

In February 2013, we acquired Impika, a leader in the design, manufacture and sale of production inkjet printing

solutions used for industrial, commercial, security, label and package printing for approximately $53 in cash. Impika,

which is based in Aubagne, France, offers a portfolio of aqueous (water-based) inkjet presses based on proprietary

technology. Through the addition of Impika's aqueous technology to our offerings, we go to market with the

industry's broadest range of digital presses, strengthening our leadership in digital color production printing.

In July 2012, we acquired Wireless Data Services, Ltd. (WDS), a provider of technical support, knowledge

management and related consulting to the world's largest wireless telecommunication brands for approximately $95

(£60 million) in cash. Based in the U.K., WDS's expertise in the telecommunications industry strengthens our broad

portfolio of customer care solutions.

In February 2012, we acquired R.K. Dixon, a leading provider of IT services, copiers, printers and managed print

services for approximately $58 in cash. The acquisition furthers our coverage of central Illinois and eastern Iowa,

building on our strategy to create a nationwide network of locally-based companies.

Our Document Technology segment also acquired one additional business in 2013 and three additional business in

2012 for $12 and $62, respectively, in cash. These acquisitions were largely a part of our strategy of increasing our

distribution network for small and mid-size businesses. Our Services segment acquired three additional businesses

in 2013 and four additional business in 2012 for $31 and $61, respectively, in cash primarily related to customer

care and software to support our BPO service offerings.

Summary - 2013 and 2012 Acquisitions

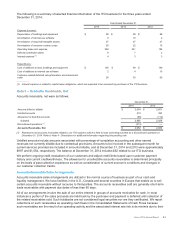

All of our 2013 and 2012 acquisitions reflected 100% ownership of the acquired companies. The operating results of

the 2013 and 2012 acquisitions described above were not material to our financial statements and were included

within our results from the respective acquisition dates. WDS was included within our Services segment while the

acquisitions of Zeno, Impika and R.K. Dixon were included within our Document Technology segment. The

purchase prices for all acquisitions were primarily allocated to intangible assets and goodwill based on third-party

valuations and management's estimates. Refer to Note 10 - Goodwill and Intangible Assets, Net for additional

information. Our 2013 acquisitions contributed aggregate revenues from their respective acquisition dates of

approximately $84 and $56 to our 2014 and 2013 total revenues, respectively. Our 2012 acquisitions contributed

aggregate revenues from their respective acquisition dates of approximately $275, $277 and $162 to our 2014,

2013 and 2012 total revenues, respectively.

79