Xerox 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

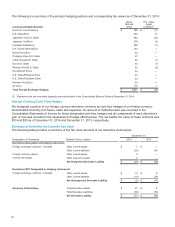

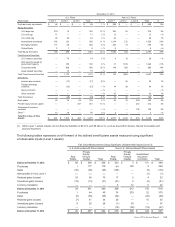

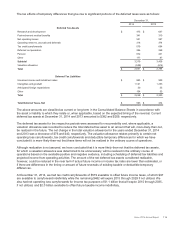

The following tables presents the defined benefit plans assets measured at fair value and the basis for that

measurement:

December 31, 2014

U.S. Plans Non-U.S. Plans

Asset Class Level 1 Level 2 Level 3 Total % Level 1 Level 2 Level 3 Total %

Cash and cash equivalents $ 52 $ — $ — $ 52 2% $ 608 $ — $ — $ 608 10%

Equity Securities:

U.S. large cap 332 15 — 347 11% 253 52 — 305 5%

U.S. mid cap 73 — — 73 2% 10 — — 10 —%

U.S. small cap 52 39 — 91 3% 28 — — 28 —%

International developed 195 92 — 287 9% 1,065 162 — 1,227 20%

Emerging markets 140 113 — 253 8% 276 69 — 345 6%

Global Equity 2 7 — 9 —% 4 6 — 10 —%

Total Equity Securities 794 266 — 1,060 33% 1,636 289 — 1,925 31%

Fixed Income Securities:

U.S. treasury securities — 145 — 145 5% 7 26 — 33 1%

Debt security issued by

government agency — 225 — 225 7% 25 1,536 — 1,561 26%

Corporate bonds — 988 — 988 32% 23 850 — 873 15%

Asset backed securities — 10 — 10 —% — 1 — 1 —%

Total Fixed Income Securities — 1,368 — 1,368 44% 55 2,413 — 2,468 42%

Derivatives:

Interest rate contracts — (1) — (1) —% — 128 — 128 2%

Foreign exchange contracts — 1 — 1 —% — (5) — (5) —%

Equity contracts — — — — —% — — — — —%

Other contracts — — — — —% —14 —14 —%

Total Derivatives — — — — —% — 137 — 137 2%

Real estate 46 39 25 110 4% — 29 279 308 5%

Private equity/venture capital — — 497 497 16% — — 499 499 8%

Guaranteed insurance contracts — — — — —% — — 129 129 2%

Other(1) (1) 40 — 39 1% 6 8 — 14 —%

Total Fair Value of Plan Assets $ 891 $ 1,713 $ 522 $ 3,126 100% $ 2,305 $ 2,876 $ 907 $ 6,088 100%

_____________________________

(1) Other Level 1 assets include net non-financial assets of $(1) U.S. and $6 Non-U.S., such as due to/from broker, interest receivables and

accrued expenses.

107