Xerox 2014 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

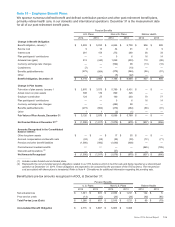

Note 16 – Employee Benefit Plans

We sponsor numerous defined benefit and defined contribution pension and other post-retirement benefit plans,

primarily retiree health care, in our domestic and international operations. December 31 is the measurement date

for all of our post-retirement benefit plans.

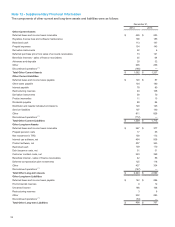

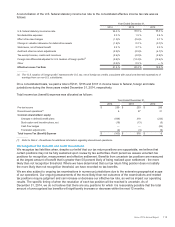

Pension Benefits

U.S. Plans Non-U.S. Plans Retiree Health

2014 2013 2014 2013 2014 2013

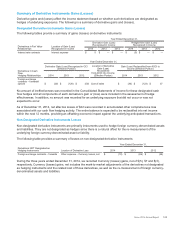

Change in Benefit Obligation:

Benefit obligation, January 1 $ 3,893 $ 5,033 $ 6,664 $6,708 $856 $989

Service cost 9 10 34 91 99

Interest cost 281 154 272 260 36 33

Plan participants' contributions — — 5 6 16 14

Actuarial loss (gain) 813 (440) 1,069 (203)119 (88)

Currency exchange rate changes — — (594)98(13)(10)

Curtailments (7)— —(10)— —

Benefits paid/settlements (273)(864)(279)(264)(86)(91)

Other — — (5) (22)— —

Benefit Obligation, December 31 $4,716 $ 3,893 $ 7,166 $6,664 $937 $856

Change in Plan Assets:

Fair value of plan assets, January 1 $ 2,876 $ 3,573 $ 5,789 $5,431 $—$—

Actual return on plan assets 398 139 899 326 ——

Employer contribution 124 27 160 203 70 77

Plan participants' contributions — — 5 6 16 14

Currency exchange rate changes — — (484)88 — —

Benefits paid/settlements (273)(864)(279)(264)(86)(91)

Other 1 1 (2) (1) — —

Fair Value of Plan Assets, December 31 $3,126 $ 2,876 $ 6,088 $5,789 $—$—

Net Funded Status at December 31(1) $ (1,590) $ (1,017) $ (1,078) $ (875)$ (937)$ (856)

Amounts Recognized in the Consolidated

Balance Sheets:

Other long-term assets $ — $ — $ 17 $ 55 $ — $ —

Accrued compensation and benefit costs (24)(25)(28)(30)(72)(71)

Pension and other benefit liabilities (1,566) (992) (1,040) (900)— —

Post-retirement medical benefits ————

(865)(785)

Discontinued Operations (2) ——

(27)———

Net Amounts Recognized $ (1,590) $ (1,017) $ (1,078) $ (875)$ (937)$ (856)

_______________

(1) Includes under-funded and un-funded plans.

(2) Represents the net un-funded pension obligations related to our ITO business which is held for sale and being reported as a discontinued

operation at December 31, 2014. These obligations are expected to be assumed by the purchaser of the ITO business. The net pension

cost associated with these plans is immaterial. Refer to Note 4 - Divestitures for additional information regarding this pending sale.

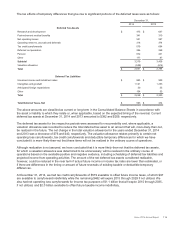

Benefit plans pre-tax amounts recognized in AOCL at December 31:

Pension Benefits

U.S. Plans Non-U.S. Plans Retiree Health

2014 2013 2014 2013 2014 2013

Net actuarial loss $ 1,301 $672 $2,036 $1,741 $122 $6

Prior service credit (13) (15)(20)(20)(42)(85)

Total Pre-tax Loss (Gain) $1,288 $657 $2,016 $1,721 $80$

(79)

Accumulated Benefit Obligation $4,716 $3,887 $6,883 $6,368

Xerox 2014 Annual Report 104