Xerox 2014 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

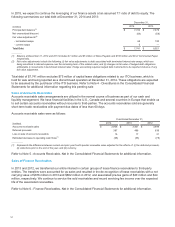

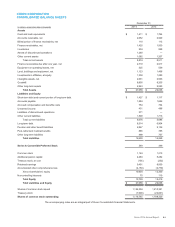

Effective Tax reconciliation:

Year Ended December 31, 2014 Year Ended December 31, 2013 Year Ended December 31, 2012

(in millions)

Pre-Tax

Income

Income Tax

Expense

Effective

Tax Rate

Pre-Tax

Income

Income Tax

Expense

Effective

Tax Rat e

Pre-Tax

Income

Income Tax

Expense

Effective

Tax Rate

As Reported(1) $ 1,206 $ 259 21.5% $ 1,243 $ 253 20.4% $ 1,284 $ 256 19.9%

Adjustments:

Amortization of intangible assets 315 119 305 116 301 115

Adjusted $ 1,521 $ 378 24.9% $ 1,548 $ 369 23.8% $ 1,585 $ 371 23.4%

__________

(1) Pre-tax income and income tax expense from continuing operations attributable to Xerox.

Operating Income / Margin reconciliation:

Year Ended December 31, 2014 Year Ended December 31, 2013 Year Ended December 31, 2012

(in millions) Profit Revenue Margin Profit Revenue Margin Profit Revenue Margin

Reported Pre-tax Income(1) $ 1,206 $ 19,540 6.2% $ 1,243 $ 20,006 6.2% $ 1,284 $ 20,421 6.3%

Adjustments:

Amortization of intangible assets 315 305 301

Xerox restructuring charge 128 115 149

Other expenses, net 232 146 257

Adjusted Operating Income /

Margin 1,881 19,540 9.6% 1,809 20,006 9.0% 1,991 20,421 9.7%

Equity in net income of unconsolidated

affiliates 160 169 152

Business transformation costs(2) 21 — —

Fuji Xerox restructuring charge 3 9 16

Litigation matters — (37) —

Other expense, net* (232) (148) (257)

Segment Profit / Margin $ 1,833 $ 19,540 9.4% $ 1,802 $ 20,006 9.0% $ 1,902 $ 20,421 9.3%

____________

* Includes rounding adjustments.

(1) Profit and revenue from continuing operations attributable to Xerox.

(2) Business transformation costs represent incremental costs incurred directly in support of our business transformation and restructuring initiatives such as

compensation costs for overlapping staff, consulting costs and training costs.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Financial Risk Management

We are exposed to market risk from foreign currency exchange rates and interest rates, which could affect

operating results, financial position and cash flows. We manage our exposure to these market risks through our

regular operating and financing activities and, when appropriate, through the use of derivative financial instruments.

We utilized derivative financial instruments to hedge economic exposures, as well as reduce earnings and cash flow

volatility resulting from shifts in market rates.

Recent market events have not caused us to materially modify or change our financial risk management strategies

with respect to our exposures to interest rate and foreign currency risk. Refer to Note 14 - Financial Instruments in

the Consolidated Financial Statements for additional discussion on our financial risk management.

Xerox 2014 Annual Report 58