Xerox 2014 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

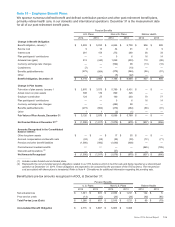

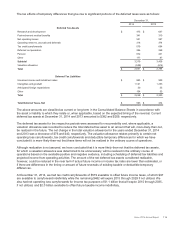

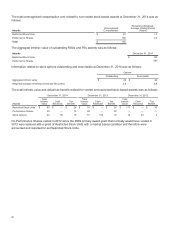

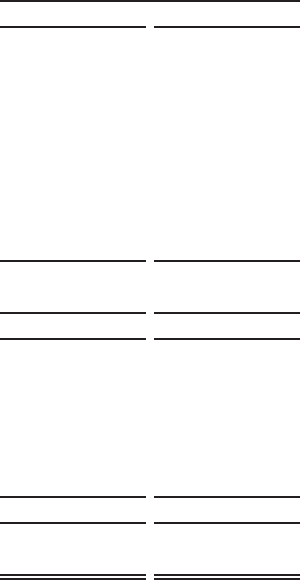

The tax effects of temporary differences that give rise to significant portions of the deferred taxes were as follows:

December 31,

2014 2013

Deferred Tax Assets

Research and development $475 $647

Post-retirement medical benefits 341 310

Net operating losses 531 597

Operating reserves, accruals and deferrals 318 374

Tax credit carryforwards 579 694

Deferred compensation 286 268

Pension 672 431

Other 177 87

Subtotal 3,379 3,408

Valuation allowance (538)(614)

Total $2,841 $2,794

Deferred Tax Liabilities

Unearned income and installment sales $ 883 $959

Intangibles and goodwill 1,161 1,253

Anticipated foreign repatriations 50 55

Other 154 53

Total $2,248 $2,320

Total Deferred Taxes, Net $593 $474

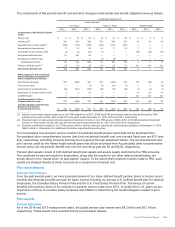

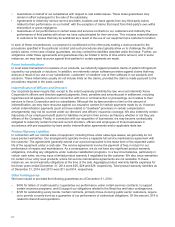

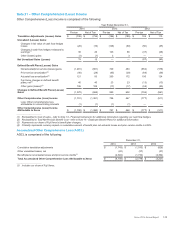

The above amounts are classified as current or long-term in the Consolidated Balance Sheets in accordance with

the asset or liability to which they relate or, when applicable, based on the expected timing of the reversal. Current

deferred tax assets at December 31, 2014 and 2013 amounted to $382 and $209, respectively.

The deferred tax assets for the respective periods were assessed for recoverability and, where applicable, a

valuation allowance was recorded to reduce the total deferred tax asset to an amount that will, more-likely-than-not,

be realized in the future. The net change in the total valuation allowance for the years ended December 31, 2014

and 2013 was a decrease of $76 and $40, respectively. The valuation allowance relates primarily to certain net

operating loss carryforwards, tax credit carryforwards and deductible temporary differences for which we have

concluded it is more-likely-than-not that these items will not be realized in the ordinary course of operations.

Although realization is not assured, we have concluded that it is more-likely-than-not that the deferred tax assets,

for which a valuation allowance was determined to be unnecessary, will be realized in the ordinary course of

operations based on the available positive and negative evidence, including scheduling of deferred tax liabilities and

projected income from operating activities. The amount of the net deferred tax assets considered realizable,

however, could be reduced in the near term if actual future income or income tax rates are lower than estimated, or

if there are differences in the timing or amount of future reversals of existing taxable or deductible temporary

differences.

At December 31, 2014, we had tax credit carryforwards of $579 available to offset future income taxes, of which $97

are available to carryforward indefinitely while the remaining $482 will expire 2015 through 2029 if not utilized. We

also had net operating loss carryforwards for income tax purposes of $1.1 billion that will expire 2015 through 2035,

if not utilized, and $2.0 billion available to offset future taxable income indefinitely.

Xerox 2014 Annual Report 114