Xerox 2014 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

and/or 20(a) of the Securities Exchange Act of 1934, as amended (1934 Act), and SEC Rule 10b-5 thereunder,

each of the defendants was liable as a participant in a fraudulent scheme and course of business that operated as a

fraud or deceit on purchasers of the Company’s common stock during the Class Period by disseminating materially

false and misleading statements and/or concealing material facts relating to the defendants’ alleged failure to

disclose the material negative impact that the April 1998 restructuring had on the Company’s operations and

revenues. The complaint further alleged that the alleged scheme: (i) deceived the investing public regarding the

economic capabilities, sales proficiencies, growth, operations and the intrinsic value of the Company’s common

stock; (ii) allowed several corporate insiders, such as the named individual defendants, to sell shares of privately

held common stock of the Company while in possession of materially adverse, non-public information; and

(iii) caused the individual plaintiffs and the other members of the purported class to purchase common stock of the

Company at inflated prices. The complaint sought unspecified compensatory damages in favor of the plaintiffs and

the other members of the purported class against all defendants, jointly and severally, for all damages sustained as

a result of defendants’ alleged wrongdoing, including interest thereon, together with reasonable costs and expenses

incurred in the action, including counsel fees and expert fees. In 2001, the Court denied the defendants’ motion for

dismissal of the complaint. The plaintiffs’ motion for class certification was denied by the Court in 2006, without

prejudice to refiling. In February 2007, the Court granted the motion of the International Brotherhood of Electrical

Workers Welfare Fund of Local Union No. 164, Robert W. Roten, Robert Agius ("Agius") and Georgia Stanley to

appoint them as additional lead plaintiffs. In July 2007, the Court denied plaintiffs’ renewed motion for class

certification, without prejudice to renewal after a pre-filing conference to identify factual disputes the Court would be

required to resolve in ruling on the motion. After that conference and Agius’s withdrawal as lead plaintiff and

proposed class representative, in February 2008 plaintiffs filed a second renewed motion for class certification. In

April 2008, defendants filed their response and motion to disqualify Milberg LLP as a lead counsel. On

September 30, 2008, the Court entered an order certifying the class and denying the appointment of Milberg LLP as

class counsel. Subsequently, on April 9, 2009, the Court denied defendants’ motion to disqualify Milberg LLP. On

November 6, 2008, the defendants filed a motion for summary judgment. On March 29, 2013, the Court granted

defendants' motion for summary judgment in its entirety. On April 26, 2013, plaintiffs filed a notice of appeal to the

United States Court of Appeals for the Second Circuit. On September 8, 2014, the Second Circuit affirmed the

District Court's decision dismissing the action. The deadline for plaintiffs to file a petition for certiorari before the

United States Supreme Court expired on December 8, 2014; no petition was filed. This matter is now closed.

State of Texas v. Xerox Corporation, Xerox State Healthcare, LLC, and ACS State Healthcare, LLC, a Xerox

Corporation: On May 9, 2014, the State of Texas, via the Texas Office of Attorney General (the “State”), filed a

lawsuit in the 53rd Judicial District Court of Travis County, Texas. The lawsuit alleges that Xerox Corporation, Xerox

State Healthcare, LLC, and ACS State Healthcare (collectively “Xerox” or “the Company”) violated the Texas

Medicaid Fraud Prevention Act in the administration of its contract with the Texas Department of Health and Human

Services (“HHSC”). The State alleges that the Company made false representations of material facts regarding the

processes, procedures, implementation, and results regarding the prior authorization of orthodontic claims. The

State seeks recovery of actual damages, two times the amount of any overpayments made as a result of unlawful

acts, civil penalties, pre- and post-judgment interest, and all costs and attorneys’ fees. The State references the

amount in controversy as exceeding hundreds of millions of dollars. Xerox filed its Answer in June, 2014 denying all

allegations. Xerox will continue to vigorously defend itself in this matter. We do not believe it is probable that we will

incur a material loss in excess of the amount accrued for this matter. In the course of litigation, we periodically

engage in discussions with plaintiff’s counsel for possible resolution of the matter. Should developments cause a

change in our determination as to an unfavorable outcome, or result in a final adverse judgment or settlement for a

significant amount, there could be a material adverse effect on our results of operations, cash flows and financial

position in the period in which such change in determination, judgment, or settlement occurs.

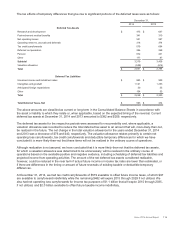

Guarantees, Indemnifications and Warranty Liabilities

Indemnifications Provided as Part of Contracts and Agreements

We are a party to the following types of agreements pursuant to which we may be obligated to indemnify the other

party with respect to certain matters:

• Contracts that we entered into for the sale or purchase of businesses or real estate assets, under which we

customarily agree to hold the other party harmless against losses arising from a breach of representations and

covenants, including obligations to pay rent. Typically, these relate to such matters as adequate title to assets

sold, intellectual property rights, specified environmental matters and certain income taxes arising prior to the

date of acquisition.

Xerox 2014 Annual Report 116