Xerox 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

•$141 million of severance costs related to headcount reductions of approximately 4,800 employees globally.

The actions impacted several functional areas, with approximately 65% of the costs focused on gross margin

improvements, 34% on SAG and 1% on the optimization of RD&E investments.

•$2 million for lease termination costs primarily reflecting continued optimization of our worldwide operating

locations.

• $1 million of asset impairment losses.

The above charges were partially offset by $29 million of net reversals for changes in estimated reserves from prior

period initiatives.

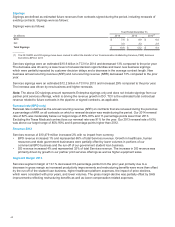

Restructuring Summary

The restructuring reserve balance as of December 31, 2014 for all programs was $97 million, of which

approximately $94 million is expected to be spent over the next twelve months. In the first quarter 2015, we expect

to incur additional restructuring charges of approximately $0.02 per diluted share for actions and initiatives that have

not yet been finalized.

Refer to Note 11 - Restructuring and Asset Impairment Charges in the Consolidated Financial Statements for

additional information regarding our restructuring programs.

Amortization of Intangible Assets

During the year ended December 31, 2014, we recorded $315 million of expense related to the amortization of

intangible assets, which is $10 million higher than the prior year reflecting an increase in acquisitions in 2014.

During the year ended December 31, 2013, we recorded $305 million of expense related to the amortization of

intangible assets, which was $4 million higher than the prior year reflecting the increase in acquisitions in 2012.

Refer to Note 10 - Goodwill and Intangible assets, Net in the Consolidated Financial Statements for additional

information regarding our intangible assets.

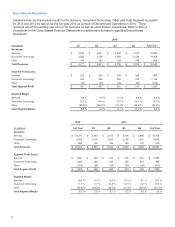

Worldwide Employment

Worldwide employment of approximately 147,500 as of December 31, 2014 increased by approximately 4,400 from

December 31, 2013, due primarily to the impact of acquisitions and seasonal fluctuations in Services, partially offset

by restructuring actions and productivity improvements. Total headcount includes approximately 9,800 employees

who are expected to transfer to Atos upon closure of the sale of our ITO business. Worldwide employment was

approximately 143,100 and 147,600 at December 2013 and 2012, respectively.

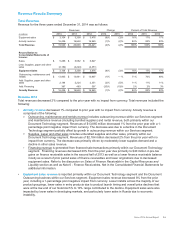

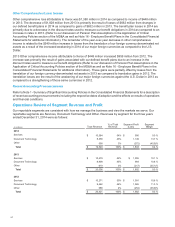

Other Expenses, Net

Year Ended December 31,

(in millions) 2014 2013 2012

Non-financing interest expense $237 $240 $229

Interest income (10)(11)(13)

(Gains) losses on sales of businesses and assets (50)(64)2

Currency losses (gains), net 5(7) 3

Litigation matters 11 (34)(1)

Loss on sales of accounts receivables 15 17 21

Deferred compensation investment gains (7) (15)(10)

All other expenses, net 31 20 26

Total Other Expenses, Net $232 $146 $257

Note: With the exception of Deferred compensation investment gains, all items comprising Other Expense, Net are

reported in the Other segment. Deferred compensation investment gains are reported in the Services segment as

an offset to the associated compensation expense - see below.

Xerox 2014 Annual Report 38