Xerox 2014 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

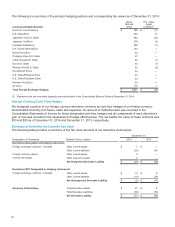

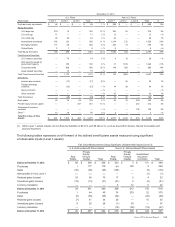

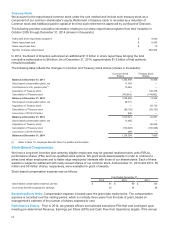

Assumed health care cost trend rates have a significant effect on the amounts reported for the health care plans. A

one-percentage-point change in assumed health care cost trend rates would have the following effects:

1% increase 1% decrease

Effect on total service and interest cost components $ 1$(1)

Effect on post-retirement benefit obligation 46 (39)

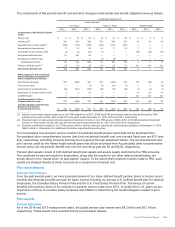

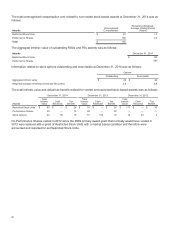

Defined Contribution Plans

We have savings and investment plans in several countries, including the U.S., U.K. and Canada. In many instances,

employees from those defined benefit pension plans that have been amended to freeze future service accruals (see

"Plan Amendments" for additional information) were transitioned to an enhanced defined contribution plan. In these

plans employees are allowed to contribute a portion of their salaries and bonuses to the plans, and we match a portion

of the employee contributions. We recorded charges related to our defined contribution plans of $102 in 2014, $89 in

2013 and $61 in 2012. These charges exclude $8, $7 and $2 for the three years ended December 31, 2014, respectively,

related to our ITO business, which is held for sale and reported as a discontinued operation at December 31, 2014.

Refer to Note 4 - Divestitures for additional information regarding this pending sale.

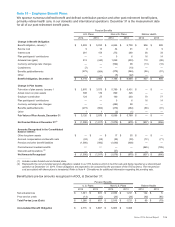

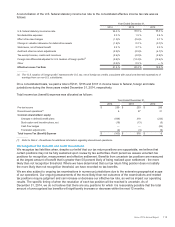

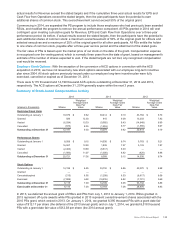

Note 17 - Income and Other Taxes

Income before income taxes (pre-tax income) was as follows:

Year Ended December 31,

2014 2013 2012

Domestic income $ 675 $905 $850

Foreign income 531 338 434

Income Before Income Taxes $1,206 $1,243 $1,284

Provisions (benefits) for income taxes were as follows:

Year Ended December 31,

2014 2013 2012

Federal Income Taxes

Current $(3)$17$ 5

Deferred 79 66 93

Foreign Income Taxes

Current 115 82 114

Deferred 28 36 (1)

State Income Taxes

Current 34 37 32

Deferred 61513

Total Provision $259 $253 $256

111