Xerox 2014 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

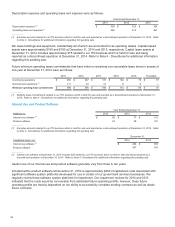

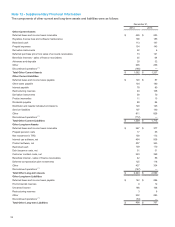

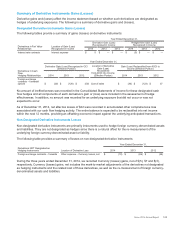

Scheduled principal payments due on our long-term debt for the next five years and thereafter are as follows:

2015(1) 2016 2017 2018 2019 Thereafter Total

Continuing operations $ 1,276 $974 $1,023 $1,017 $1,158 $2,123 $7,571

Discontinued operations (2) 31 24 14 6 — — 75

Total Long-term Principal Payments $1,307 $998 $1,037 $1,023 $1,158 $2,123 $7,646

_____________

(1) Quarterly long-term debt maturities from continuing operations for 2015 are $1,007, $256, $7 and $6 for the first, second, third and fourth

quarters, respectively.

(2) Represents payments on capital lease obligations related to our ITO business which is held for sale and being reported as a discontinued

operation at December 31, 2014. These obligations are expected to be assumed by the purchaser of the ITO business. Refer to Note 4 -

Divestitures for additional information regarding this pending sale.

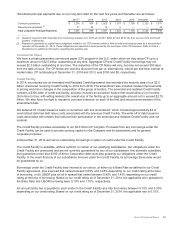

Commercial Paper

We have a private placement commercial paper (CP) program in the U.S. under which we may issue CP up to a

maximum amount of $2.0 billion outstanding at any time. Aggregate CP and Credit Facility borrowings may not

exceed $2.0 billion outstanding at any time. The maturities of the CP Notes will vary, but may not exceed 390 days

from the date of issue. The CP Notes are sold at a discount from par or, alternatively, sold at par and bear interest at

market rates. CP outstanding at December 31, 2014 and 2013, was $150 and $0, respectively.

Credit Facility

In 2014, we entered into an Amended and Restated Credit Agreement that extended the maturity date of our $2.0

billion unsecured revolving Credit Facility to 2019 from 2016. The amendment also included modest improvements

in pricing and minor changes in the composition of the group of lenders. The amended and restated Credit Facility

contains a $300 letter of credit sub-facility, and also includes an accordion feature that would allow us to increase

(from time to time, with willing lenders) the overall size of the facility up to an aggregate amount not to exceed $2.75

billion. We also have the right to request a one year extension on each of the first and second anniversaries of the

amendment date.

We deferred $7 of debt issuance costs in connection with this amendment, which included approximately $4 of

unamortized deferred debt issue costs associated with the previous Credit Facility. The write-off of debt issuance

costs associated with lenders that reduced their participation in the amended and restated Credit Facility was not

material.

The Credit Facility provides a backstop to our $2.0 billion CP program. Proceeds from any borrowings under the

Credit Facility can be used to provide working capital for the Company and its subsidiaries and for general

corporate purposes.

At December 31, 2014 we had no outstanding borrowings or letters of credit under the Credit Facility.

The Credit Facility is available, without sublimit, to certain of our qualifying subsidiaries. Our obligations under the

Credit Facility are unsecured and are not currently guaranteed by any of our subsidiaries. Any domestic subsidiary

that guarantees more than $100 of Xerox Corporation debt must also guaranty our obligations under the Credit

Facility. In the event that any of our subsidiaries borrows under the Credit Facility, its borrowings thereunder would

be guaranteed by us.

Borrowings under the Credit Facility bear interest at our choice, at either (a) a Base Rate as defined in our Credit

Facility agreement, plus a spread that varies between 0.00% and 0.45% depending on our credit rating at the time

of borrowing, or (b) LIBOR plus an all-in spread that varies between 0.90% and 1.45% depending on our credit

rating at the time of borrowing. Based on our credit rating as of December 31, 2014, the applicable all-in spreads for

the Base Rate and LIBOR borrowing were 0.10% and 1.10%, respectively.

An annual facility fee is payable to each lender in the Credit Facility at a rate that varies between 0.10% and 0.30%

depending on our credit rating. Based on our credit rating as of December 31, 2014, the applicable rate is 0.15%.

Xerox 2014 Annual Report 98