Xerox 2014 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Treasury Stock

We account for the repurchased common stock under the cost method and include such treasury stock as a

component of our common shareholder's equity. Retirement of treasury stock is recorded as a reduction of

Common stock and Additional paid-in capital at the time such retirement is approved by our Board of Directors.

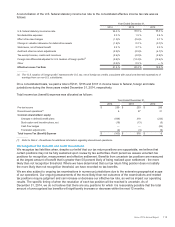

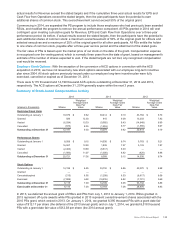

The following provides cumulative information relating to our share repurchase programs from their inception in

October 2005 through December 31, 2014 (shares in thousands):

Authorized share repurchase programs $8,000

Share repurchase cost $6,455

Share repurchase fees $10

Number of shares repurchased 580,029

In 2014, the Board of Directors authorized an additional $1.5 billion in share repurchase bringing the total

cumulative authorization to $8 billion. As of December 31, 2014, approximately $1.5 billion of that authority

remained available.

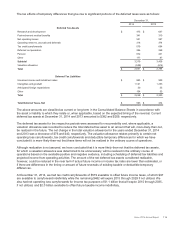

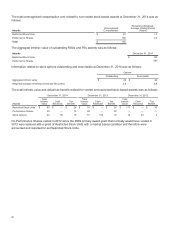

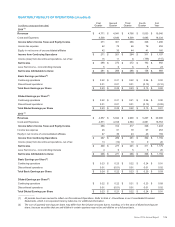

The following table reflects the changes in Common and Treasury stock shares (shares in thousands):

Common Stock

Shares

Treasury Stock

Shares

Balance at December 31, 2011 1,352,849 15,508

Stock based compensation plans, net 17,343 —

Contributions to U.S. pension plan(1) 15,366 —

Acquisition of Treasury stock — 146,278

Cancellation of Treasury stock (146,862) (146,862)

Balance at December 31, 2012 1,238,696 14,924

Stock based compensation plans, net 28,731 —

Acquisition of Treasury stock — 65,179

Cancellation of Treasury stock (58,102) (58,102)

Conversion of 2014 9% Notes 996 —

Balance at December 31, 2013 1,210,321 22,001

Stock based compensation plans, net 13,965 —

Acquisition of Treasury stock — 86,536

Cancellation of Treasury stock (100,928)(100,928)

Conversion of 2014 9% Notes 996 —

Balance at December 31, 2014 1,124,354 7,609

_____________________________

(1) Refer to Note 16 - Employee Benefits Plans for additional information.

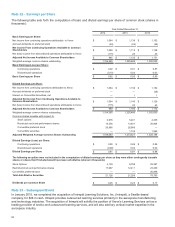

Stock-Based Compensation

We have a long-term incentive plan whereby eligible employees may be granted restricted stock units (RSUs),

performance shares (PSs) and non-qualified stock options. We grant stock-based awards in order to continue to

attract and retain employees and to better align employees' interests with those of our shareholders. Each of these

awards is subject to settlement with newly issued shares of our common stock. At December 31, 2014 and 2013, 50

million and 59 million shares, respectively, were available for grant of awards.

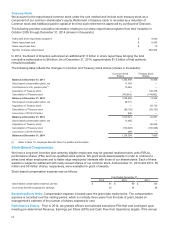

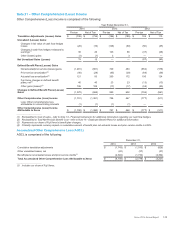

Stock-based compensation expense was as follows:

Year Ended December 31,

2014 2013 2012

Stock-based compensation expense, pre-tax $ 91 $ 90 $ 125

Income tax benefit recognized in earnings 35 34 48

Restricted Stock Units: Compensation expense is based upon the grant date market price. The compensation

expense is recorded over the vesting period, which is normally three years from the date of grant, based on

management's estimate of the number of shares expected to vest.

Performance Shares: Prior to 2014, we granted officers and selected executives PSs that vest contingent upon

meeting pre-determined Revenue, Earnings per Share (EPS) and Cash Flow from Operations targets. If the annual

119