Xerox 2014 Annual Report Download - page 40

Download and view the complete annual report

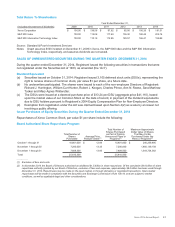

Please find page 40 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS

The following Management’s Discussion and Analysis (MD&A) is intended to help the reader understand the results

of operations and financial condition of Xerox Corporation. MD&A is provided as a supplement to, and should be

read in conjunction with, our Consolidated Financial Statements and the accompanying notes. Throughout the

MD&A, we refer to various notes to our Consolidated Financial Statements which appear in Item 8 of this 2014

Form 10-K, and the information contained in such notes is incorporated by reference into the MD&A in the places

where such references are made.

Throughout this document, references to “we,” “our,” the “Company,” and “Xerox” refer to Xerox Corporation and its

subsidiaries. References to “Xerox Corporation” refer to the stand-alone parent company and do not include its

subsidiaries.

Executive Overview

With revenues of $19.5 billion, we are the world's leading global enterprise for business process and document

management solutions. We provide services, technology and expertise to enable our customers - from small

businesses to large global enterprises - to focus on their core business and operate more effectively.

Headquartered in Norwalk, Connecticut, the 147,500 people of Xerox serve customers in more than 180 countries

providing business services, printing equipment and software for commercial and government organizations. In

2014, 33% of our revenue was generated outside the U.S.

We are a leader across large, diverse and growing markets estimated at over $650 billion. The global business

process outsourcing market is very broad, encompassing multi-industry business processes as well as industry-

specific business processes, and our addressable market is estimated at almost $300 billion. The document

management market is estimated at roughly $100 billion and is comprised of the document systems, software,

solutions and services that our customers have relied upon for years to help run their businesses and reduce their

costs. The remaining market is the global information technology outsourcing market segment, which is

estimated to be roughly $250 billion in aggregate - see the following paragraph.

On December 18, 2014, we announced an agreement to sell our Information Technology Outsourcing (ITO)

business to Atos SE (Atos). The transaction is subject to customary closing conditions and regulatory approval and

is expected to close in the first half of 2015. As a result of this pending transaction and having met applicable

accounting requirements, in 2014 we reported the ITO business as a Discontinued Operation and reclassified its

results from the Services segment to Discontinued Operations. Subsequent to the closing of this transaction, Xerox

will no longer directly market stand-alone IT services. This transaction is part of our on-going effort to evolve our

portfolio in line with our business and financial strategy. It gives us the opportunity to make further investments and

acquisitions in our remaining Services business - strengthening our competitive positioning and supporting our

global expansion goals. Refer to Note 4 - Divestitures in our Consolidated Financial Statements for additional

information regarding Discontinued Operations.

We organize our business around two main reportable segments: Services and Document Technology.

•Our Services segment is comprised of business process outsourcing (BPO) and document outsourcing

(DO) services.

In 2014 we focused on improving our cost infrastructure and evolving our Services portfolio to enable increased

revenue growth and margin expansion. Revenue from Services grew 1% in 2014, reflecting growth in both

service offerings, BPO and DO, and represented 54% of our total revenues. Revenue growth was below the

prior year growth rate of 2% and our longer-term expectations of mid-to-high single digit growth; however, we

did deliver improvements in revenue growth and profit margin through the year. Services signings in 2014

declined by 13% but were up 20% year-over-year in fourth quarter 2014. During 2014, we implemented

initiatives to improve our go-to-market effectiveness, software platform implementation and global service

delivery capabilities. Across our services portfolio, the diversity of our offerings and the differentiated solutions

we provide, enable us to deliver greater value to our customers.

25