Xerox 2014 Annual Report Download - page 47

Download and view the complete annual report

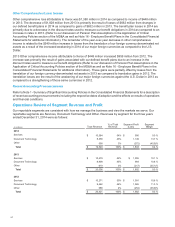

Please find page 47 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.We record the estimated future tax effects of temporary differences between the tax bases of assets and liabilities

and amounts reported in our Consolidated Balance Sheets, as well as operating loss and tax credit carryforwards.

We follow very specific and detailed guidelines in each tax jurisdiction regarding the recoverability of any tax assets

recorded in our Consolidated Balance Sheets and provide valuation allowances as required. We regularly review

our deferred tax assets for recoverability considering historical profitability, projected future taxable income, the

expected timing of the reversals of existing temporary differences and tax planning strategies. Adjustments to our

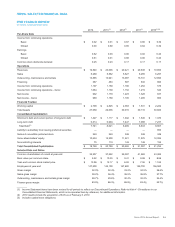

valuation allowance, through (credits) charges to income tax expense, were $(20) million, $2 million and $(9) million

for the years ended December 31, 2014, 2013 and 2012, respectively. There were other decreases to our valuation

allowance, including the effects of currency, of $56 million, $42 million and $14 million for the years ended

December 31, 2014, 2013 and 2012, respectively. These did not affect income tax expense in total as there was a

corresponding adjustment to deferred tax assets or other comprehensive income. Gross deferred tax assets of $3.4

billion and $3.4 billion had valuation allowances of $538 million and $614 million at December 31, 2014 and 2013,

respectively.

We are subject to ongoing tax examinations and assessments in various jurisdictions. Accordingly, we may incur

additional tax expense based upon our assessment of the more-likely-than-not outcomes of such matters. In

addition, when applicable, we adjust the previously recorded tax expense to reflect examination results. Our

ongoing assessments of the more-likely-than-not outcomes of the examinations and related tax positions require

judgment and can materially increase or decrease our effective tax rate, as well as impact our operating results.

Unrecognized tax benefits were $240 million, $267 million and $201 million at December 31, 2014, 2013 and 2012,

respectively.

Refer to Note 17 - Income and Other Taxes in the Consolidated Financial Statements for additional information

regarding deferred income taxes and unrecognized tax benefits.

Business Combinations and Goodwill

The accounting for business combinations requires the use of significant estimates and assumptions in the

determination of the fair value of assets acquired and liabilities assumed in order to properly allocate purchase price

consideration between assets that are depreciated and amortized from goodwill. Our estimates of the fair values of

assets and liabilities acquired are based upon assumptions believed to be reasonable, and when appropriate,

include assistance from independent third-party valuation firms. Refer to Note 3 - Acquisitions in the Consolidated

Financial Statements for additional information regarding the allocation of the purchase price consideration for our

acquisitions.

As a result of our acquisition of Affiliated Computer Services, Inc. (ACS) in 2010, as well as other acquisitions

including GIS, we have a significant amount of goodwill. Goodwill at December 31, 2014 was $8.8 billion. Goodwill

is not amortized but rather is tested for impairment annually or more frequently if an event or circumstance indicates

that an impairment may have been incurred. Events or circumstances that might indicate an interim evaluation is

warranted include, among other things, unexpected adverse business conditions, macro and reporting unit specific

economic factors, supply costs, unanticipated competitive activities and acts by governments and courts.

Application of the annual goodwill impairment test requires judgment, including the identification of reporting units,

assignment of assets and liabilities to reporting units, assignment of goodwill to reporting units and the assessment

- qualitatively or quantitatively - of the fair value of each reporting unit against its carrying value. At December 31,

2014, $6.5 billion and $2.3 billion of goodwill was allocated to reporting units within our Services and Document

Technology segments, respectively. Our Services segment is comprised of five reporting units while our Document

Technology segment is comprised of one reporting unit for a total of six reporting units with goodwill balances.

Our annual impairment test of goodwill was performed in the fourth quarter of 2014. Consistent with 2013, we

elected to utilize a quantitative assessment of the recoverability of our goodwill balances for each of our reporting

units.

In our quantitative test, we estimate the fair value of each reporting unit by weighting the results from the income

approach (discounted cash flow methodology) and market approach. These valuation approaches require

significant judgment and consider a number of factors that include, but are not limited to, expected future cash

flows, growth rates and discount rates, and comparable multiples from publicly traded companies in our industry

and require us to make certain assumptions and estimates regarding the current economic environment, industry

factors and the future profitability of our businesses.

Xerox 2014 Annual Report 32