Xerox 2014 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

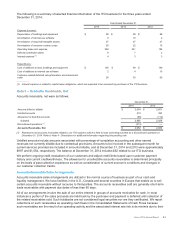

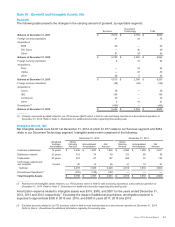

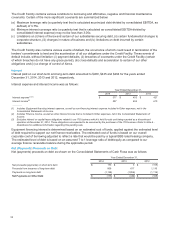

Depreciation expense and operating lease rent expense were as follows:

Year Ended December 31,

2014 2013 2012

Depreciation expense (1) $324 $332 $354

Operating lease rent expense(1) 560 513 461

___________

(1) Excludes amounts related to our ITO business which is held for sale and reported as a discontinued operation at December 31, 2014. Refer

to Note 4 - Divestitures for additional information regarding this pending sale.

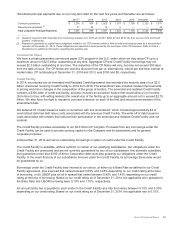

We lease buildings and equipment, substantially all of which are accounted for as operating leases. Capital leased

assets were approximately $180 and $150 at December 31, 2014 and 2013, respectively. Capital lease assets at

December 31, 2014 includes approximately $75 related to our ITO business which is held for sale and being

reported as a discontinued operation at December 31, 2014. Refer to Note 4 - Divestitures for additional information

regarding this pending sale.

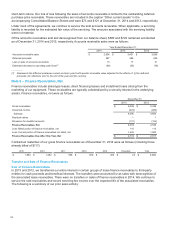

Future minimum operating lease commitments that have initial or remaining non-cancelable lease terms in excess of

one year at December 31, 2014 were as follows:

2015 2016 2017 2018 2019 Thereafter

Continuing operations $ 469 $ 347 $170 $104 $79$ 57

Discontinued operations (1) 117 43 18 8 6—

Minimum operating lease commitments $ 586 $ 390 $188 $112 $85$ 57

___________

(1) Reflects lease commitments related to our ITO business which is held for sale and reported as a discontinued operation at December 31,

2014. Refer to Note 4 - Divestitures for additional information regarding this pending sale.

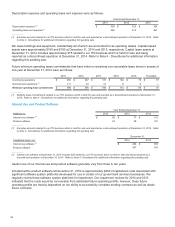

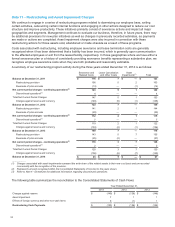

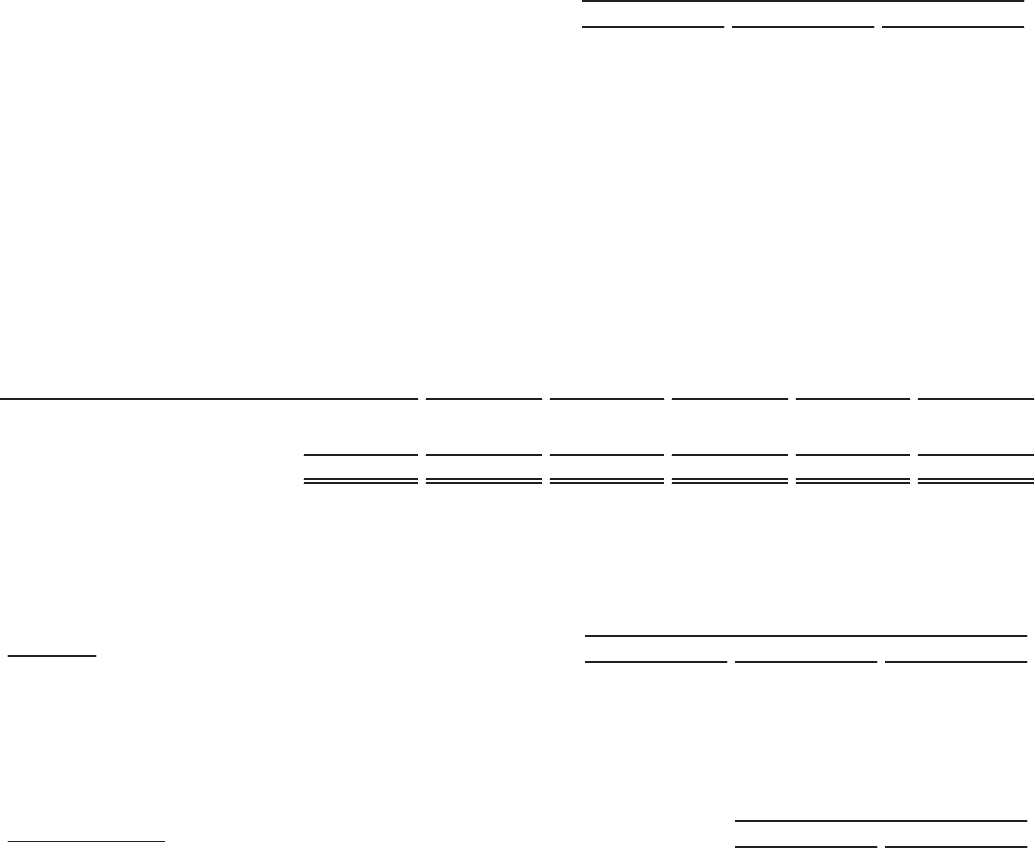

Internal Use and Product Software

Year Ended December 31,

Additions to: 2014 2013 2012

Internal use software (1) $82$77$

110

Product software 23 28 107

___________

(1) Excludes amounts related to our ITO business which is held for sale and reported as a discontinued operation at December 31, 2014. Refer

to Note 4 - Divestitures for additional information regarding this pending sale.

December 31,

Capitalized costs, net: 2014 2013

Internal use software (1) $454 $506

Product software 307 343

___________

(1) Internal use software at December 31, 2014 includes $20 related to our ITO business which is held for sale and being reported as a

discontinued operation at December 31, 2014. Refer to Note 4 - Divestitures for additional information regarding this pending sale.

Useful lives of our internal use and product software generally vary from three to ten years.

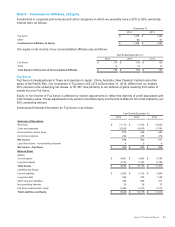

Included within product software at December 31, 2014 is approximately $250 of capitalized costs associated with

significant software system platforms developed for use in certain of our government services businesses. We

regularly review these software system platforms for impairment. Our impairment reviews for 2014 and 2013

indicated that the costs would be recoverable from estimated future operating profits; however, those future

operating profits are heavily dependent on our ability to successfully complete existing contracts as well as obtain

future contracts.

89