Xerox 2014 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

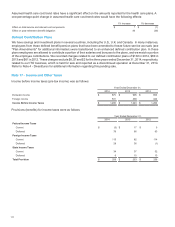

Valuation Method

Our primary Level 3 assets are Real Estate and Private Equity/Venture Capital investments. The fair value of our

real estate investment funds are based on the Net Asset Value (NAV) of our ownership interest in the funds. NAV

information is received from the investment advisers and is primarily derived from third-party real estate appraisals

for the properties owned. The fair value for our private equity/venture capital partnership investments are based on

our share of the estimated fair values of the underlying investments held by these partnerships as reported (or

expected to be reported) in their audited financial statements. The valuation techniques and inputs for our Level 3

assets have been consistently applied for all periods presented.

Investment Strategy

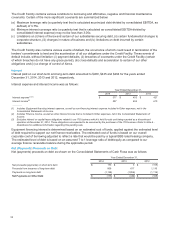

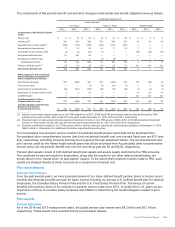

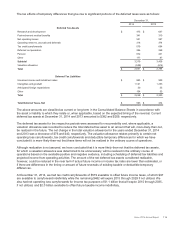

The target asset allocations for our worldwide defined benefit pension plans were:

2014 2013

U.S. Non-U.S. U.S. Non-U.S.

Equity investments 33% 34% 36% 41%

Fixed income investments 43% 47% 44% 47%

Real estate 8% 9% 5% 9%

Private equity 9% 6% 14% —%

Other 7% 4% 1% 3%

Total Investment Strategy 100% 100% 100% 100%

We employ a total return investment approach whereby a mix of equities and fixed income investments are used to

maximize the long-term return of plan assets for a prudent level of risk. The intent of this strategy is to minimize plan

expenses by exceeding the interest growth in long-term plan liabilities. Risk tolerance is established through careful

consideration of plan liabilities, plan funded status and corporate financial condition. This consideration involves the

use of long-term measures that address both return and risk. The investment portfolio contains a diversified blend of

equity and fixed income investments. Furthermore, equity investments are diversified across U.S. and non-U.S.

stocks, as well as growth, value and small and large capitalizations, and may include Company stock. Other assets

such as real estate, private equity, and hedge funds are used to improve portfolio diversification. Derivatives may be

used to hedge market exposure in an efficient and timely manner; however, derivatives may not be used to leverage

the portfolio beyond the market value of the underlying investments. Investment risks and returns are measured and

monitored on an ongoing basis through annual liability measurements and quarterly investment portfolio reviews.

Expected Long-term Rate of Return

We employ a “building block” approach in determining the long-term rate of return for plan assets. Historical

markets are studied and long-term relationships between equities and fixed income are assessed. Current market

factors such as inflation and interest rates are evaluated before long-term capital market assumptions are

determined. The long-term portfolio return is established giving consideration to investment diversification and

rebalancing. Peer data and historical returns are reviewed periodically to assess reasonableness and

appropriateness.

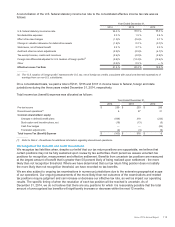

Contributions

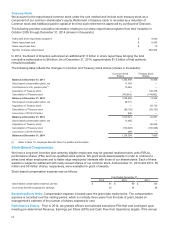

In 2014, we made cash contributions of $284 ($124 U.S. and $160 Non-U.S.) and $70 to our defined benefit

pension plans and retiree health benefit plans, respectively.

In 2015, based on current actuarial calculations, we expect to make contributions of approximately $340 ($180

U.S. and $160 non-U.S.) to our defined benefit pension plans and approximately $71 to our retiree health benefit

plans.

109