Xerox 2014 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

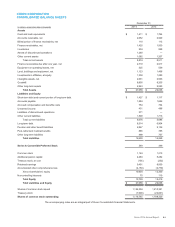

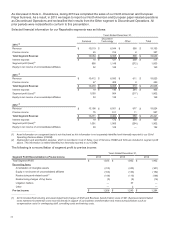

The following table summarizes certain significant costs and expenses that require management estimates for the

three years ended December 31, 2014:

Year Ended December 31,

Expense/(Income) 2014 2013 2012

Provisions for restructuring and asset impairments - continuing operations $ 128 $115 $149

Provisions for restructuring and asset impairments - discontinued operations 2 74

Provision for receivables 53 123 127

Provisions for litigation and regulatory matters 11 (34)(1)

Provisions for obsolete and excess inventory 26 35 30

Provision for product warranty liability 25 28 29

Depreciation and obsolescence of equipment on operating leases 297 283 279

Depreciation of buildings and equipment (1) 324 332 354

Amortization of internal use software (1) 139 137 114

Amortization of product software 62 43 19

Amortization of acquired intangible assets (1) 315 305 301

Amortization of customer contract costs (1) 128 100 92

Defined pension benefits - net periodic benefit cost 82 267 300

Retiree health benefits - net periodic benefit cost 3 111

Income tax expense - continuing operations 259 253 256

Income tax expense - discontinued operations 6 27 21

__________________

(1) Excludes amounts related to our ITO business which is held for sale and reported as a discontinued operation at December 31, 2014. Refer

to Note 4 - Divestitures for additional information regarding this pending sale.

Changes in Estimates

In the ordinary course of accounting for the items discussed above, we make changes in estimates as appropriate

and as we become aware of new or revised circumstances surrounding those estimates. Such changes and

refinements in estimation methodologies are reflected in reported results of operations in the period in which the

changes are made and, if material, their effects are disclosed in the Notes to the Consolidated Financial Statements

and in Management's Discussion and Analysis of Financial Condition and Results of Operations.

New Accounting Standards and Accounting Changes

Except for the Accounting Standard Updates (ASU's) discussed below, the new ASU's issued by the FASB during the

last two years did not have any significant impact on the Company.

Income Statement

In January 2015, the FASB issued ASU 2015-01 Income Statement-Extraordinary and Unusual Items (Subtopic

225-20) - Simplifying Income Statement Presentation by Eliminating the Concept of Extraordinary Items. ASU

2015-01 eliminates from GAAP the concept of extraordinary items. ASU 2015-01 is effective for our fiscal year

ending December 31, 2016, with early adoption permitted. The standard primarily involves presentation and

disclosure and, therefore, is not expected to have a material impact on our financial condition, results of operations

or cash flows.

Business Combinations

In November 2014, the FASB issued ASU 2014-17,Business Combinations (Topic 805) - Pushdown Accounting.

The amendments in this Update provide an acquired entity with an option to apply pushdown accounting in its

separate financial statements. ASU 2014-17 was effective on November 18, 2014. The adoption of this standard did

not have a material impact on our financial condition or results of operations.

Derivatives and Hedging

In November 2014, the FASB issued ASU 2014-16,Derivatives and Hedging (Topic 815) - Determining Whether the

Host Contract in a Hybrid Financial Instrument Issued in the Form of a Share Is More Akin to Debt or to Equity. ASU

2014-16 does not change the current criteria in GAAP for determining when separation of certain embedded

derivative features in a hybrid financial instrument. The amendments clarify how current GAAP should be interpreted

in evaluating the economic characteristics and risks of a host contract in a hybrid financial instrument that is issued in

the form of a share. ASU 2014-16 is effective for our fiscal year ending December 31, 2016, with early adoption

Xerox 2014 Annual Report 68