Xerox 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

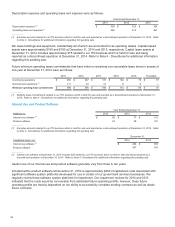

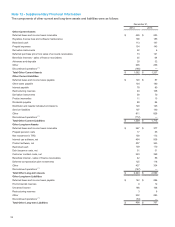

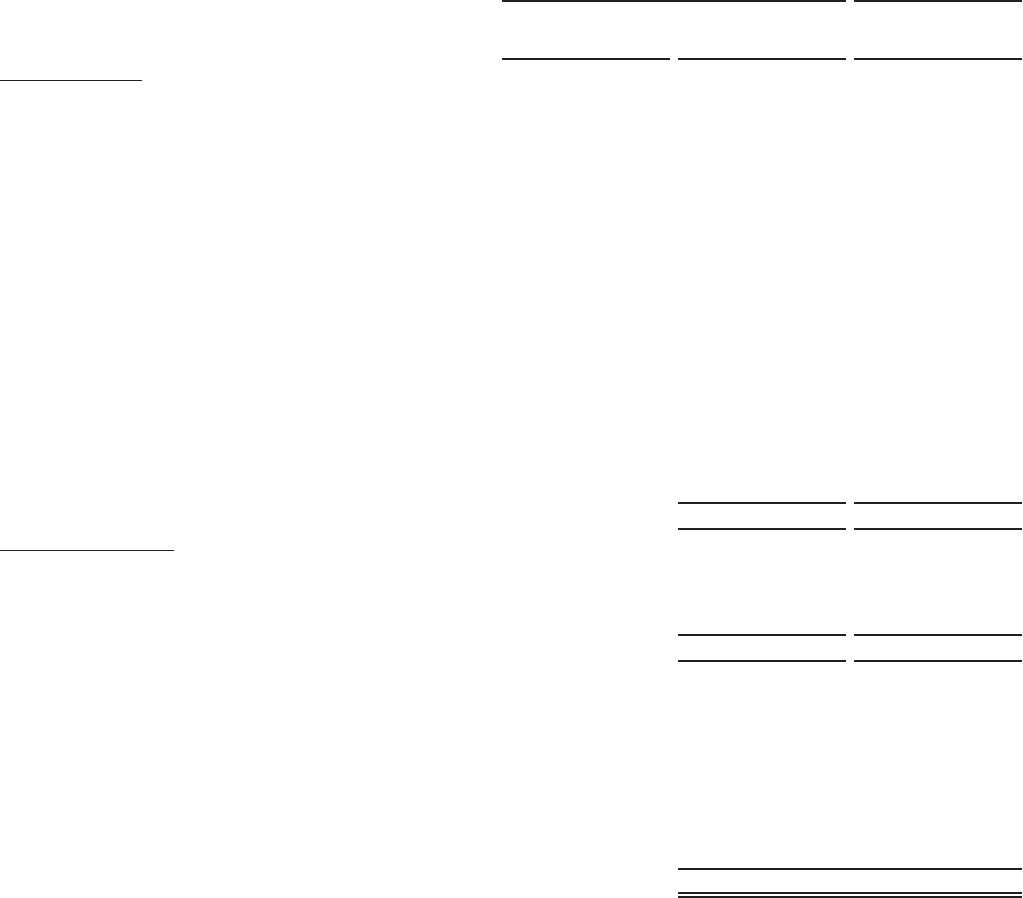

Long-term debt was as follows:

December 31,

Weighted Average

Interest Rates at

December 31, 2014(2) 2014 2013

Xerox Corporation

Convertible Notes due 2014 —% $ —$9

Senior Notes due 2014 —% — 750

Floating Rate Notes due 2014 —% — 300

Senior Notes due 2015 4.29%1,000 1,000

Notes due 2016 7.20%250 250

Senior Notes due 2016 6.48%700 700

Senior Notes due 2017 6.83%500 500

Senior Notes due 2017 2.98%500 500

Notes due 2018 0.57%11

Senior Notes due 2018 6.37%1,000 1,000

Senior Notes due 2019 2.77%500 500

Senior Notes due 2019 5.66%650 650

Senior Notes due 2020 2.81%400 —

Senior Notes due 2021 5.39%1,062 1,062

Senior Notes due 2024 3.84%300 —

Senior Notes due 2039 6.78%350 350

Subtotal - Xerox Corporation $

7,213 $7,572

Subsidiary Companies

Senior Notes due 2015 4.25%250 250

Borrowings secured by other assets 3.85%180 146

Other 1.20%36

Subtotal - Subsidiary Companies $

433 $402

Principal debt balance 7,646 7,974

Unamortized discount (54)(58)

Fair value adjustments(1)

Terminated swaps 68 100

Current swaps 5—

Less: current maturities (1,307) (1,112)

Discontinued Operations (3) (44)—

Total Long-term Debt $6,314 $6,904

____________

(1) Fair value adjustments include the following: (i) fair value adjustments to debt associated with terminated interest rate swaps, which are

being amortized to interest expense over the remaining term of the related notes; and (ii) changes in fair value of hedged debt obligations

attributable to movements in benchmark interest rates. Hedge accounting requires hedged debt instruments to be reported inclusive of any

fair value adjustment.

(2) Represents weighted average effective interest rate which includes the effect of discounts and premiums on issued debt.

(3) Represents long-term capital lease obligations related to our ITO business which is held for sale and being reported as a discontinued

operation at December 31, 2014. These obligations are expected to be assumed by the purchaser of the ITO business. Refer to Note 4 -

Divestitures for additional information regarding this pending sale.

97