Xerox 2014 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

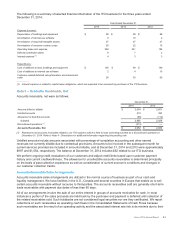

short-term nature. Our risk of loss following the sales of accounts receivable is limited to the outstanding deferred

purchase price receivable. These receivables are included in the caption “Other current assets” in the

accompanying Consolidated Balance Sheets and were $73 and $121 at December 31, 2014 and 2013, respectively.

Under most of the agreements, we continue to service the sold accounts receivable. When applicable, a servicing

liability is recorded for the estimated fair value of the servicing. The amounts associated with the servicing liability

were not material.

Of the accounts receivables sold and derecognized from our balance sheet, $580 and $723 remained uncollected

as of December 31, 2014 and 2013, respectively. Accounts receivable sales were as follows:

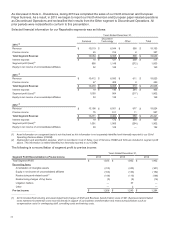

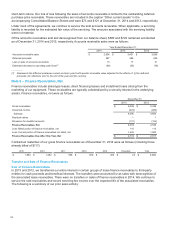

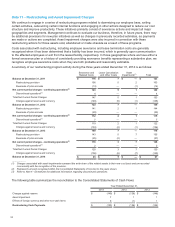

Year Ended December 31,

2014 2013 2012

Accounts receivable sales $2,906 $3,401 $3,699

Deferred proceeds 387 486 639

Loss on sale of accounts receivable 15 17 21

Estimated decrease to operating cash flows(1) (68)(55)(78)

__________

(1) Represents the difference between current and prior year fourth quarter receivable sales adjusted for the effects of: (i) the deferred

proceeds, (ii) collections prior to the end of the year and (iii) currency.

Note 6 – Finance Receivables, Net

Finance receivables include sales-type leases, direct financing leases and installment loans arising from the

marketing of our equipment. These receivables are typically collateralized by a security interest in the underlying

assets. Finance receivables, net were as follows:

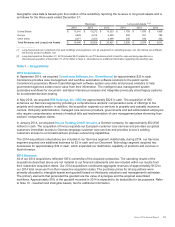

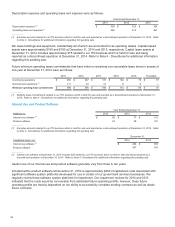

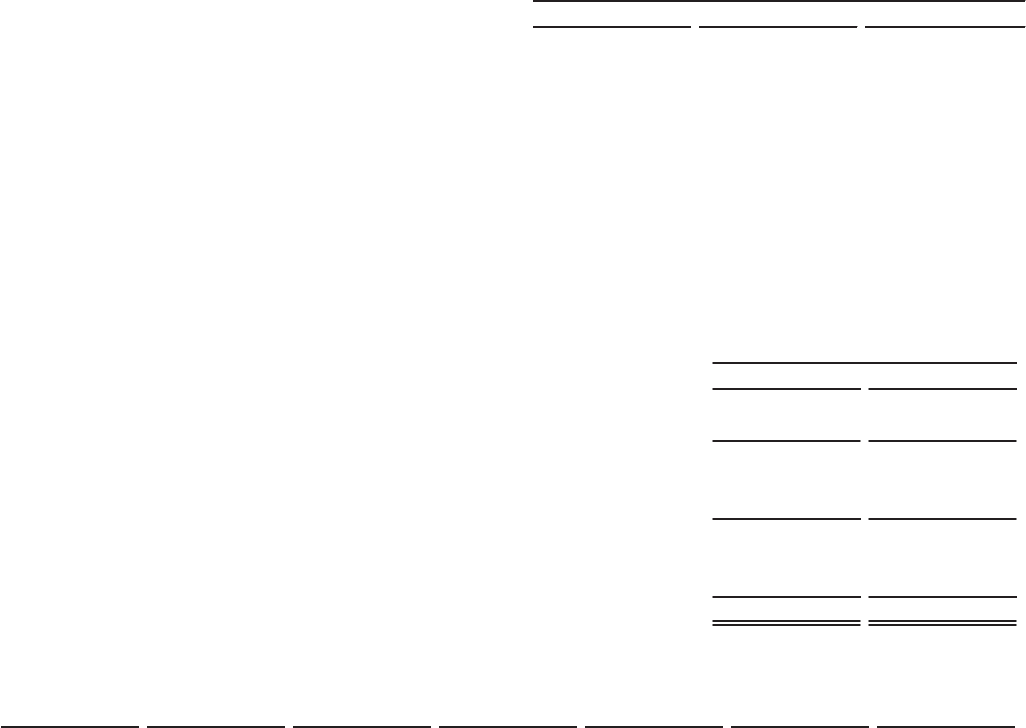

December 31,

2014 2013

Gross receivables $5,009 $5,349

Unearned income (624)(666)

Subtotal 4,385 4,683

Residual values —1

Allowance for doubtful accounts (131)(154)

Finance Receivables, Net 4,254 4,530

Less: Billed portion of finance receivables, net 110 113

Less: Current portion of finance receivables not billed, net 1,425 1,500

Finance Receivables Due After One Year, Net $2,719 $2,917

Contractual maturities of our gross finance receivables as of December 31, 2014 were as follows (including those

already billed of $117):

2015 2016 2017 2018 2019 Thereafter Total

$ 1,883 $ 1,382 $ 958 $ 558 $205 $23$

5,009

Transfer and Sale of Finance Receivables

Sale of Finance Receivables

In 2013 and 2012, we transferred our entire interest in certain groups of lease finance receivables to third-party

entities for cash proceeds and beneficial interests. The transfers were accounted for as sales with derecognition of

the associated lease receivables. There were no transfers or sales of finance receivables in 2014. We continue to

service the sold receivables and record servicing fee income over the expected life of the associated receivables.

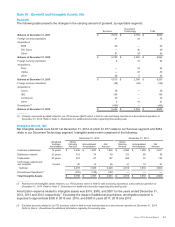

The following is a summary of our prior sales activity:

83