Xerox 2014 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

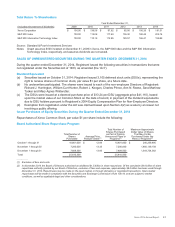

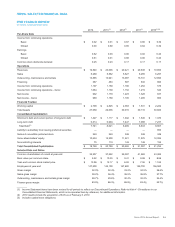

Total Return To Shareholders

Year Ended December 31,

(Includes reinvestment of dividends) 2009 2010 2011 2012 2013 2014

Xerox Corporation $ 100.00 $ 138.56 $97.62 $85.56 $156.26 $181.51

S&P 500 Index 100.00 115.06 117.49 136.30 180.44 205.14

S&P 500 Information Technology Index 100.00 110.19 112.85 129.57 166.41 199.89

Source: Standard & Poor's Investment Services

Notes: Graph assumes $100 invested on December 31, 2009 in Xerox, the S&P 500 Index and the S&P 500 Information

Technology Index, respectively, and assumes dividends are reinvested.

SALES OF UNREGISTERED SECURITIES DURING THE QUARTER ENDED DECEMBER 31, 2014

During the quarter ended December 31, 2014, Registrant issued the following securities in transactions that were

not registered under the Securities Act of 1933, as amended (the “Act”).

Dividend Equivalent

(a) Securities issued on October 31, 2014: Registrant issued 3,105 deferred stock units (DSUs), representing the

right to receive shares of Common stock, par value $1 per share, at a future date.

(b) No underwriters participated. The shares were issued to each of the non-employee Directors of Registrant:

Richard J. Harrington, William Curt Hunter, Robert J. Keegan, Charles Prince, Ann N. Reese, Sara Martinez

Tucker and Mary Agnes Wilderotter.

(c) The DSUs were issued at a deemed purchase price of $13.24 per DSU (aggregate price $41,110), based

upon the market value of our Common Stock on the date of record, in payment of the dividend equivalents

due to DSU holders pursuant to Registrant’s 2004 Equity Compensation Plan for Non-Employee Directors.

(d) Exemption from registration under the Act was claimed based upon Section 4(2) as a sale by an issuer not

involving a public offering.

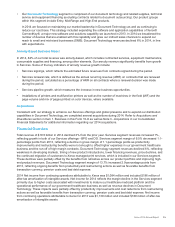

Issuer Purchases of Equity Securities During the Quarter Ended December 31, 2014

Repurchases of Xerox Common Stock, par value $1 per share include the following:

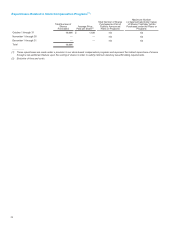

Board Authorized Share Repurchase Program:

Total Number of

Shares

Purchased

Average Price

Paid per Share(1)

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans or

Programs(2)

Maximum Approximate

Dollar Value of Shares

That May Yet Be

Purchased Under the

Plans or Programs(2)

October 1 through 31 10,801,000 $12.84 10,801,000 $246,259,695

November 1 through 30 7,200,000 13.35 7,200,000 1,650,139,158

December 1 through 31 7,609,500 13.85 7,609,500 1,544,724,362

Total 25,610,500 25,610,500

_____________

(1) Exclusive of fees and costs.

(2) In November 2014, the Board of Directors authorized an additional $1.5 billion in share repurchase. Of the cumulative $8.0 billion of share

repurchase authority granted by our Board of Directors, exclusive of fees and expenses, approximately $6.5 billion has been used through

December 31, 2014. Repurchases may be made on the open market, or through derivative or negotiated transactions. Open-market

repurchases will be made in compliance with the Securities and Exchange Commission’s Rule 10b-18, and are subject to market

conditions, as well as applicable legal and other considerations.

Xerox 2014 Annual Report 22