Xerox 2014 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152

|

|

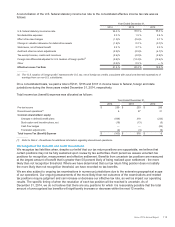

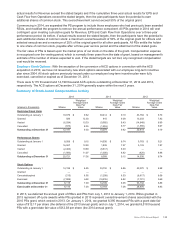

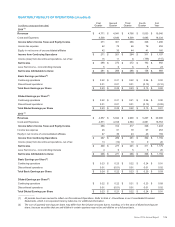

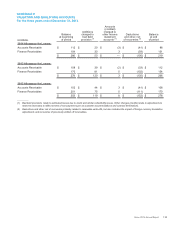

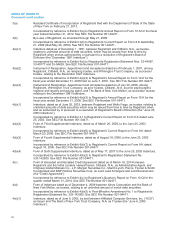

The total unrecognized compensation cost related to non-vested stock-based awards at December 31, 2014 was as

follows:

Awards

Unrecognized

Compensation

Remaining Weighted-

Average Vesting Period

(Years)

Restricted Stock Units $ 23 1.2

Performance Shares 109 2.2

Total $132

The aggregate intrinsic value of outstanding RSUs and PSs awards was as follows:

Awards December 31, 2014

Restricted Stock Units $ 169

Performance Shares 287

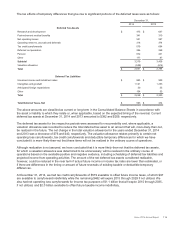

Information related to stock options outstanding and exercisable at December 31, 2014 was as follows:

Options

Outstanding Exercisable

Aggregate intrinsic value $ 42 $ 42

Weighted-average remaining contractual life (years) 2.8 2.8

The total intrinsic value and actual tax benefit realized for vested and exercised stock-based awards was as follows:

December 31, 2014 December 31, 2013 December 31, 2012

Awards

Total

Intrinsic

Value

Cash

Received

Tax

Benefit

Total

Intrinsic

Value

Cash

Received

Tax

Benefit

Total

Intrinsic

Value

Cash

Received

Tax

Benefit

Restricted Stock Units $ 85 $ — $ 26 $91$—$30$

117 $—$33

Performance Shares 30 — 10 62—22———

Stock Options 42 55 15 51 124 19 12 44 4

No Performance Shares vested in 2012 since the 2009 primary award grant that normally would have vested in

2012 was replaced with a grant of Restricted Stock Units with a market based condition and therefore were

accounted and reported for as Restricted Stock Units.

121