Xerox 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Our Document Technology segment is comprised of our document technology and related supplies, technical

service and equipment financing (excluding contracts related to document outsourcing). Our product groups

within this segment include Entry, Mid-Range and High-End products.

In 2014 we focused on maintaining our market leadership in Document Technology as well as continuing to

reduce our cost base. This strategy included expanding the software and application capabilities of Xerox®

ConnectKey®, a major new software and solutions capability we launched in 2013. In 2014 we broadened the

number of devices that are enabled with this capability and grew our indirect sales channels to expand our

reach to small and mid-sized businesses (SMB). Document Technology revenues declined 6% in 2014, in line

with expectations.

Annuity-Based Business Model

In 2014, 84% of our total revenue was annuity-based, which includes contracted services, equipment maintenance,

consumable supplies and financing, among other elements. Our annuity revenue significantly benefits from growth

in Services. Some of the key indicators of annuity revenue growth include:

• Services signings, which reflects the estimated future revenues from contracts signed during the period.

• Services renewal rate, which is defined as the annual recurring revenue (ARR) on contracts that are renewed

during the period, calculated as a percentage of ARR on all contracts where a renewal decision was made

during the period.

• Services pipeline growth, which measures the increase in new business opportunities.

• Installations of printers and multifunction printers as well as the number of machines in the field (MIF) and the

page volume and mix of pages printed on color devices, where available.

Acquisitions

Consistent with our strategy to enhance our Services offerings and global presence and to expand our distribution

capabilities in Document Technology, we completed several acquisitions during 2014. Refer to Acquisitions and

Divestitures section in Item 1. Business in this Form 10-K as well as Note 3 - Acquisitions in our Consolidated

Financial Statements for additional information regarding our 2014 acquisitions.

Financial Overview

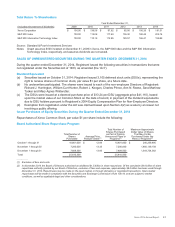

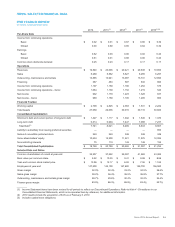

Total revenue of $19.5 billion in 2014 declined 2% from the prior year. Services segment revenues increased 1%,

reflecting growth in both of our Services offerings - BPO and DO. Services segment margin of 9.0% decreased 1.1-

percentage points from 2013, reflecting a decline in gross margin of 1.1-percentage points as productivity

improvements and restructuring benefits were not enough to offset higher expenses in our government healthcare

business and the run-off of high margin contracts. Document Technology segment revenues declined 6%, reflecting

weakness in developing markets, timing of new product introductions, lower financing revenues, price declines, and

the continued migration of customers to Xerox managed print services, which is included in our Services segment.

These declines were partially offset by the benefits from refreshes across our product portfolio and improving high-

end product revenues. Document Technology segment margin of 13.7% increased 2.9-percentage points from

2013, reflecting ongoing benefits from productivity and restructuring actions as well as favorable benefits from

transaction currency, pension costs and bad debt expense.

2014 Net income from continuing operations attributable to Xerox was $1,084 million and included $196 million of

after-tax amortization of intangible assets. Net income for 2014 reflects the margin decline in the Services segment

primarily due to higher costs associated with investments to mature our healthcare medicaid platform and the

operational performance of our government healthcare business as well as revenue declines in Document

Technology. These impacts were partially offset by productivity improvements and cost reductions from restructuring

actions as well as favorable benefits from transaction currency, pension costs and bad debt expense. Net income

from continuing operations attributable to Xerox for 2013 was $1,139 million and included $189 million of after-tax

amortization of intangible assets.

Xerox 2014 Annual Report 26