Xerox 2014 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

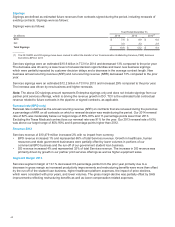

The net impact on operating cash flows from the sales of finance receivables is summarized below

Year Ended December 31,

(in millions) 2014 2013 2012

Net cash received for sales of finance receivables(1) $—$631 $625

Impact from prior sales of finance receivables(2) (527)(392)(45)

Collections on beneficial interest 94 58 —

Estimated (Decrease) Increase to Operating Cash Flows $(433)$ 297 $580

__________

(1) Net of beneficial interest, fees and expenses.

(2) Represents cash that would have been collected if we had not sold finance receivables.

Capital Market Activity

Credit Facility

On March 18, 2014, we entered into an Amended and Restated Credit Agreement that extended the maturity date of

our $2.0 billion unsecured revolving Credit Facility to March 18, 2019 from December 2016. The amendment also

included modest improvements in pricing and minor changes in the composition of the group of lenders. The

amended and restated Credit Facility contains a $300 million letter of credit sub-facility and the accordion feature that

would allow us to increase (from time to time, with willing lenders) the overall size of the facility up to an aggregate

amount not to exceed $2.75 billion. We also have the right to request a one year extension on each of the first and

second anniversary of the amendment date.

At December 31, 2014 we had no outstanding borrowings or letters of credit under our Credit Facility.

Refer to Note 13 - Debt in the Condensed Consolidated Financial Statements for additional information.

Senior Notes

In May 2014, we issued $400 million of 2.8% Senior Notes due 2020 (the "2020 Senior Notes") at 99.956% of par

and $300 million of 3.8% Senior Notes due 2024 (the "2024 Senior Notes") at 99.669% of par, resulting in aggregate

net proceeds of approximately $700 million. Interest on the Senior Notes are payable semi-annually. The proceeds

were used for general corporate purposes which included repayment of a portion of our outstanding borrowings.

Refer to Note 13 - Debt in the Consolidated Financial Statements for additional information regarding our debt.

Financial Instruments

Refer to Note 14 - Financial Instruments in the Consolidated Financial Statements for additional information

regarding our derivative financial instruments.

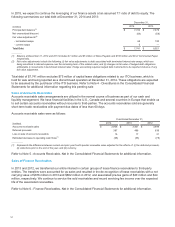

Share Repurchase Programs - Treasury Stock

During 2014, we repurchased 86.5 million shares of our common stock for an aggregate cost of $1.1 billion, including

fees. In November 2014, the Board of Directors authorized an additional $1.5 billion in share repurchases bringing

the total cumulative authorization to $8.0 billion.

Through February 19, 2015, we repurchased an additional 9.2 million shares at an aggregate cost of $125.8 million,

including fees, for total program repurchases of 589.3 million shares at a cost of $6.6 billion, including fees.

We expect total share repurchases of approximately $1 billion in 2015.

Refer to Note 20 - Shareholders’ Equity – Treasury Stock in the Consolidated Financial Statements for additional

information regarding our share repurchase programs.

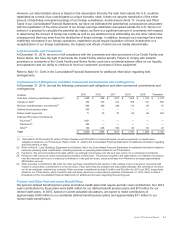

Dividends

The Board of Directors declared aggregate dividends of $293 million, $287 million and $226 million on common

stock in 2014, 2013 and 2012, respectively. The increase in 2014 as compared to prior years is primarily due to the

increase in the quarterly dividend to 6.25 cents per share in 2014 partially offset by a lower level of outstanding

shares as a result of the repurchase of shares under our share repurchase programs.

Xerox 2014 Annual Report 52