Xerox 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

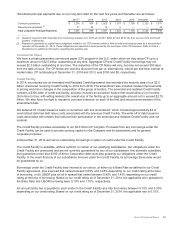

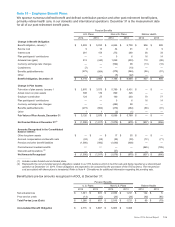

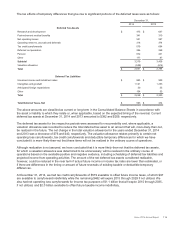

The components of Net periodic benefit cost and other changes in plan assets and benefit obligations were as follows:

Year Ended December 31,

Pension Benefits

U.S. Plans Non-U.S. Plans Retiree Health

2014 2013 2012 2014 2013 2012 2014 2013 2012

Components of Net Periodic Benefit

Costs:

Service cost $ 9 $ 10 $ 112 $ 34 $ 91 $ 83 $ 9 $ 9 $ 9

Interest cost(1) 281 154 282 272 260 270 36 33 42

Expected return on plan assets(2) (290) (179) (306) (342) (317) (307) — — —

Recognized net actuarial loss 17 19 53 54 77 53 1 2 1

Amortization of prior service credit (2) (2) (23) (1) — — (43) (43) (41)

Recognized settlement loss 51 162 82 — — 1 — — —

Recognized curtailment gain — — — (1) (8) ————

Defined Benefit Plans 66 164 200 16 103 100 3 1 11

Defined contribution plans (3) 58 64 28 44 25 33 n/a n/a n/a

Net Periodic Benefit Cost 124 228 228 60 128 133 3 1 11

Other changes in plan assets and

benefit obligations recognized in

Other Comprehensive Income:

Net actuarial loss (gain) 697 (403) 427 481 (224) 416 119 (88) 18

Prior service credit — — (2) (6) (14) (1) — — (6)

Amortization of net actuarial loss (68) (181) (135) (54) (77) (54) (1) (2) (1)

Amortization of net prior service credit 2 2 23 1 — — 43 43 41

Curtailment gain — — — 2 — — n/a n/a n/a

Total Recognized in Other

Comprehensive Income 631 (582) 313 424 (315) 361 161 (47) 52

Total Recognized in Net Periodic

Benefit Cost and Other

Comprehensive Income $ 755 $ (354) $ 541 $ 484 $ (187) $ 494 $ 164 $ (46) $ 63

_______________

(1) Interest cost includes interest expense on non-TRA obligations of $371, $349 and $382 and interest expense directly allocated to TRA

participant accounts of $182, $65 and $170 for the years ended December 31, 2014, 2013 and 2012, respectively.

(2) Expected return on plan assets includes expected investment income on non-TRA assets of $450, $431 and $443 and actual investment

income on TRA assets of $182, $65 and $170 for the years ended December 31, 2014, 2013 and 2012, respectively.

(3) Excludes contributions related to our ITO business, which is held for sale and reported as a discontinued operation at December 31, 2014.

Refer to Note 4 - Divestitures for additional information regarding this pending sale.

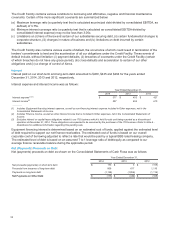

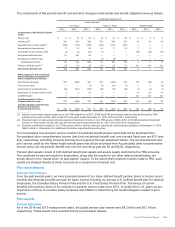

The net actuarial loss and prior service credit for the defined benefit pension plans that will be amortized from

Accumulated other comprehensive income (loss) into net periodic benefit cost over the next fiscal year are $111 and

$(4), respectively, excluding amounts that may be recognized through settlement losses. The net actuarial loss and

prior service credit for the retiree health benefit plans that will be amortized from Accumulated other comprehensive

income (loss) into net periodic benefit cost over the next fiscal year are $5 and $(30), respectively.

Pension plan assets consist of both defined benefit plan assets and assets legally restricted to the TRA accounts.

The combined investment results for these plans, along with the results for our other defined benefit plans, are

shown above in the “actual return on plan assets” caption. To the extent that investment results relate to TRA, such

results are charged directly to these accounts as a component of interest cost.

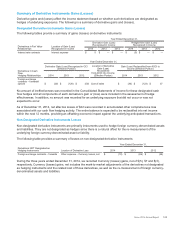

Plan Amendments

Pension Plan Freezes

Over the past several years, we have amended several of our major defined benefit pension plans to freeze current

benefits and eliminate benefits accruals for future service including our primary U.S. defined benefit plan for salaried

employees, the Canadian Salary Pension Plan and the U.K. Final Salary Pension Plan. The freeze of current

benefits is the primary driver of the reduction in pension service costs since 2012. In certain Non-U.S. plans we are

required to continue to consider salary increases and inflation in determining the benefit obligation related to prior

service.

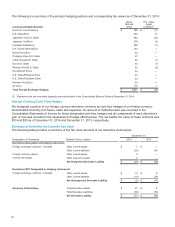

Plan Assets

Current Allocation

As of the 2014 and 2013 measurement dates, the global pension plan assets were $9.2 billion and $8.7 billion,

respectively. These assets were invested among several asset classes.

Xerox 2014 Annual Report 106