Xerox 2014 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2014 Xerox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have elected to apply settlement accounting to these plans and, therefore, we recognize the losses associated

with these settlements immediately upon the settlement of the vested benefits. Settlement accounting requires us to

recognize a pro rata portion of the aggregate unamortized net actuarial losses upon settlement. As noted above,

cumulative unamortized net actuarial losses were $3.3 billion at December 31, 2014, of which the U.S. primary

domestic plans represented approximately $1,149 million. The pro rata factor is computed as the percentage

reduction in the projected benefit obligation due to the settlement of a participant's vested benefit. Settlement

accounting is only applied when the event of settlement occurs - i.e. the lump-sum payment is made. Since

settlement is dependent on an employee's decision and election, the level of settlements and the associated losses

can fluctuate significantly period to period. In 2014, settlement losses associated with our primary domestic pension

plans amounted to $51 million. Currently, on average, approximately $100 million of plan settlements will result in

settlement losses of approximately $25 million. During the three years ended December 31, 2014, U.S. plan

settlements were $250 million, $838 million and $481 million, respectively.

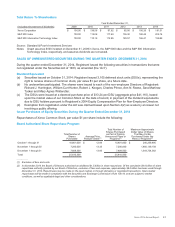

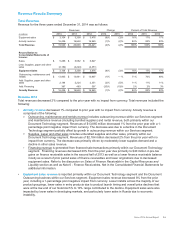

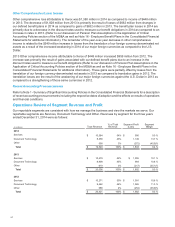

The following is a summary of our benefit plan costs and funding for the three years ended December 31, 2014 as

well as estimated amounts for 2015:

Estimated Actual

(in millions) 2015 2014 2013 2012

Defined benefit pension plans(1) $62$31$

105 $218

U.S. settlement losses 164 51 162 82

Defined contribution plans (2) 101 102 89 61

Retiree health benefit plans 16 3 111

Total Benefit Plan Expense $343 $187 $357 $372

___________

(1) Excludes U.S. settlement losses.

(2) Excludes an estimated $7 million for 2015; and $8 million, $7 million and $2 million for the three years ended December 31, 2014,

respectively, related to our ITO business, which is held for sale and reported as a discontinued operation at December 31, 2014. Refer to

Note 4 - Divestitures for additional information regarding this pending sale.

Our estimated 2015 defined benefit pension plan cost is expected to be approximately $144 million higher than

2014, primarily driven by higher projected U.S. settlement losses of $113 million and higher amortization of actuarial

losses. These increases are primarily the result of lower discount rates and lump-sum settlement rates. Benefit plan

costs are included in several income statement components based on the related underlying employee costs.

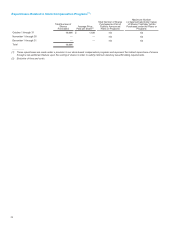

Estimated Actual

(in millions) 2015 2014 2013 2012

Defined benefit pension plans:

Cash $ 340 $284 $230 $364

Stock ———

130

Total 340 284 230 494

Defined contribution plans (1) 101 102 89 61

Retiree health benefit plans 71 70 77 84

Total Benefit Plan Funding $512 $456 $396 $639

___________

(1) Excludes an estimated $7 million for 2015; and $8 million, $7 million and $2 million for the three years ended December 31, 2014,

respectively, related to our ITO business, which is held for sale and reported as a discontinued operation at December 31, 2014. Refer to

Note 4 - Divestitures for additional information regarding this pending sale.

The increase in contributions to our worldwide defined benefit pension plans in 2015, largely in the U.S., is to

gradually address the underfunded liability in the U.S. Refer to Note 16 - Employee Benefit Plans in the

Consolidated Financial Statements for additional information regarding defined benefit pension plan assumptions,

expense and funding.

Income Taxes

We are subject to income taxes in the U.S. and numerous foreign jurisdictions. Significant judgments are required in

determining the consolidated provision for income taxes. Our provision is based on nonrecurring events as well as

recurring factors, including the taxation of foreign income. In addition, our provision will change based on discrete or

other nonrecurring events such as audit settlements, tax law changes, changes in valuation allowances, etc., that

may not be predictable.

31