Xcel Energy 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.73

Registration Statements — Xcel Energy Inc.’s Articles of Incorporation authorize the issuance of one billion shares of $2.50 par value

common stock. As of Dec. 31, 2014 and 2013, Xcel Energy Inc. had approximately 506 million shares and 498 million shares of

common stock outstanding, respectively. In addition, Xcel Energy Inc.’s Articles of Incorporation authorize the issuance of seven

million shares of $100 par value preferred stock. Xcel Energy Inc. had no shares of preferred stock outstanding on Dec. 31, 2014 and

2013.

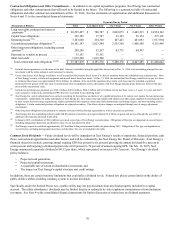

Xcel Energy Inc. and its subsidiaries have the following registration statements on file with the SEC, pursuant to which they may sell,

from time to time, securities:

• Xcel Energy Inc. has an effective automatic shelf registration statement filed in August 2012, which does not contain a limit

on issuance capacity. However, Xcel Energy Inc.’s ability to issue securities is limited by authority granted by the Board of

Directors, which currently authorizes the issuance of up to an additional $900 million of debt and common equity securities.

• NSP-Minnesota has an automatic shelf registration statement filed in December 2013, which does not contain a limit on

issuance capacity. However, NSP-Minnesota’s ability to issue securities is limited by authority granted by its Board of

Directors, which currently authorizes the issuance of up to an additional $750 million of debt securities.

• NSP-Wisconsin has $100 million of debt securities remaining under its currently effective shelf registration statement, which

was filed in December 2013.

• PSCo has an automatic shelf registration statement filed in October 2013, which does not contain a limit on issuance capacity.

However, PSCo’s ability to issue securities is limited by authority granted by its Board of Directors, which currently

authorizes the issuance of up to an additional $700 million of debt securities.

• SPS has $150 million of debt securities remaining under its currently effective shelf registration statement, which was filed in

April 2013. SPS intends to register additional debt securities in 2015.

Long-Term Borrowings and Other Financing Instruments — See the consolidated statements of capitalization and a discussion of

the long-term borrowings in Note 4 to the consolidated financial statements.

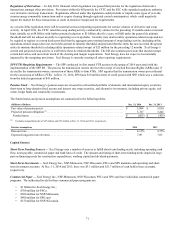

During 2014, Xcel Energy Inc. and its utility subsidiaries completed the following bond issuances:

• In March, PSCo issued $300 million of 4.30 percent first mortgage bonds due March 15, 2044;

• In May, NSP-Minnesota issued $300 million of 4.125 percent first mortgage bonds due May 15, 2044;

• In June, SPS issued $150 million of 3.30 percent first mortgage bonds due June 15, 2024; and

• In June, NSP-Wisconsin issued $100 million of 3.30 percent first mortgage bonds due June 15, 2024.

Xcel Energy Inc. issued approximately 5.7 million shares of common stock through an ATM program for approximately $175 million

during the first six months of 2014. As a result, Xcel Energy completed its ATM program as of June 30, 2014. Xcel Energy does not

anticipate issuing any additional equity, beyond its DRIP and benefit programs, over the next five years based on its current capital

expenditure plan.

Financing Plans — Xcel Energy issues debt and equity securities to refinance retiring maturities, reduce short-term debt, fund capital

programs, infuse equity in subsidiaries, fund asset acquisitions and for other general corporate purposes.

During 2015, Xcel Energy Inc. and its utility subsidiaries anticipate issuing the following:

• Xcel Energy Inc. plans to issue approximately $500 million of senior unsecured bonds;

• PSCo plans to issue approximately $250 million of first mortgage bonds;

• NSP-Minnesota plans to issue approximately $600 million of first mortgage bonds;

• SPS plans to issue approximately $250 million of first mortgage bonds; and

• NSP-Wisconsin plans to issue approximately $100 million of first mortgage bonds.

Financing plans are subject to change, depending on capital expenditures, internal cash generation, market conditions and other

factors.

Off-Balance-Sheet Arrangements

Xcel Energy does not have any off-balance-sheet arrangements, other than those currently disclosed, that have or are reasonably likely

to have a current or future effect on financial condition, changes in financial condition, revenues or expenses, results of operations,

liquidity, capital expenditures or capital resources that is material to investors.