Xcel Energy 2014 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

117

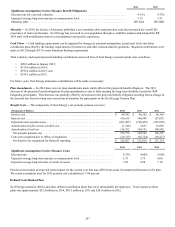

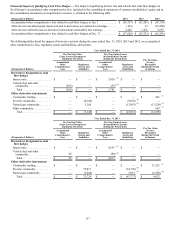

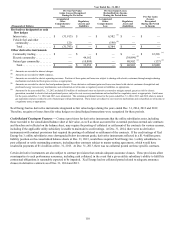

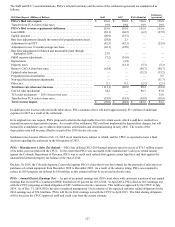

Financial Impact of Qualifying Cash Flow Hedges — The impact of qualifying interest rate and vehicle fuel cash flow hedges on

Xcel Energy’s accumulated other comprehensive loss, included in the consolidated statements of common stockholders’ equity and in

the consolidated statements of comprehensive income, is detailed in the following table:

(Thousands of Dollars) 2014 2013 2012

Accumulated other comprehensive loss related to cash flow hedges at Jan. 1 . . . . . . . . . . . . $ (59,753) $ (61,241) $ (45,738)

After-tax net unrealized gains (losses) related to derivatives accounted for as hedges . . . . . . (163) 12 (19,200)

After-tax net realized losses on derivative transactions reclassified into earnings . . . . . . . . . 2,288 1,476 3,697

Accumulated other comprehensive loss related to cash flow hedges at Dec. 31. . . . . . . . . . . $ (57,628) $ (59,753) $ (61,241)

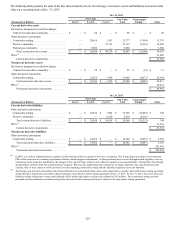

The following tables detail the impact of derivative activity during the years ended Dec. 31, 2014, 2013 and 2012, on accumulated

other comprehensive loss, regulatory assets and liabilities, and income:

Year Ended Dec. 31, 2014

Pre-Tax Fair Value

Gains (Losses) Recognized

During the Period in:

Pre-Tax (Gains) Losses

Reclassified into Income

During the Period from: Pre-Tax Gains

(Losses)

Recognized

During the Period

in Income(Thousands of Dollars)

Accumulated

Other

Comprehensive

Loss

Regulatory

(Assets) and

Liabilities

Accumulated

Other

Comprehensive

Loss

Regulatory

Assets and

(Liabilities)

Derivatives designated as cash

flow hedges

Interest rate . . . . . . . . . . . . . . . . . $ — $ — $ 3,836 (a) $ — $ —

Vehicle fuel and other

commodity. . . . . . . . . . . . . . . . (266) — (55)(b) — —

Total . . . . . . . . . . . . . . . . . . . . $ (266) $ — $ 3,781 $ — $ —

Other derivative instruments

Commodity trading . . . . . . . . . . . $ — $ — $ — $ — $ 881 (c)

Electric commodity. . . . . . . . . . . — (8,306) — (9,036)(d) —

Natural gas commodity. . . . . . . . — 5,166 — (13,997)(e) (13,220) (e)

Other commodity . . . . . . . . . . . . — — — — 643 (c)

Total . . . . . . . . . . . . . . . . . . . . $ — $ (3,140) $ — $ (23,033) $ (11,696)

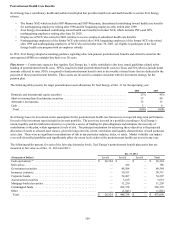

Year Ended Dec. 31, 2013

Pre-Tax Fair Value

Gains (Losses) Recognized

During the Period in:

Pre-Tax (Gains) Losses

Reclassified into Income

During the Period from: Pre-Tax Gains

(Losses)

Recognized

During the Period

in Income(Thousands of Dollars)

Accumulated

Other

Comprehensive

Loss

Regulatory

(Assets) and

Liabilities

Accumulated

Other

Comprehensive

Loss

Regulatory

Assets and

(Liabilities)

Derivatives designated as cash

flow hedges

Interest rate . . . . . . . . . . . . . . . . . $ — $ — $ 4,107 (a) $ — $ —

Vehicle fuel and other

commodity. . . . . . . . . . . . . . . . 29 — (90)(b) — —

Total . . . . . . . . . . . . . . . . . . . . $ 29 $ — $ 4,017 $ — $ —

Other derivative instruments

Commodity trading . . . . . . . . . . . $ — $ — $ — $ — $ 11,221 (c)

Electric commodity. . . . . . . . . . . — 75,817 — (52,796)(d) —

Natural gas commodity. . . . . . . . — (3,088) — 5,019 (e) (6,589) (d)

Total . . . . . . . . . . . . . . . . . . . . $ — $ 72,729 $ — $ (47,777) $ 4,632