Xcel Energy 2014 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

135

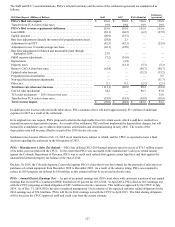

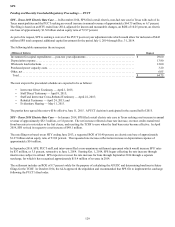

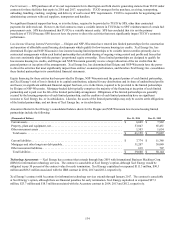

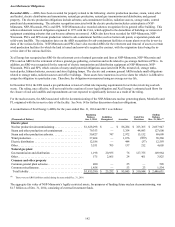

Committed minimum payments under these obligations are as follows:

(Millions of Dollars) IBM

Agreement Accenture

Agreement

2015 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 33.0 $ 9.0

2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31.9 8.9

2017 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 32.0 —

2018 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31.5 —

2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.7 —

Thereafter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — —

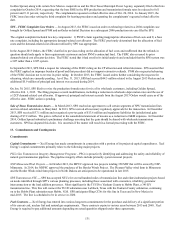

Guarantees and Indemnifications

Xcel Energy Inc. and its subsidiaries provide guarantees and bond indemnities under specified agreements or transactions. The

guarantees and bond indemnities issued by Xcel Energy Inc. guarantee payment or performance by its subsidiaries. As a result, Xcel

Energy Inc.’s exposure under the guarantees and bond indemnities is based upon the net liability of the relevant subsidiary under the

specified agreements or transactions. Most of the guarantees and bond indemnities issued by Xcel Energy Inc. and its subsidiaries

limit the exposure to a maximum amount stated in the guarantees and bond indemnities. As of Dec. 31, 2014 and 2013, Xcel Energy

Inc. and its subsidiaries had no assets held as collateral related to their guarantees, bond indemnities and indemnification agreements.

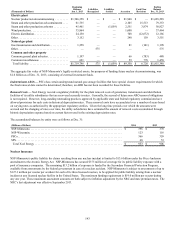

Guarantees and Surety Bonds

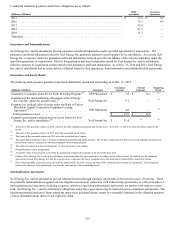

The following table presents guarantees and bond indemnities issued and outstanding as of Dec. 31, 2014:

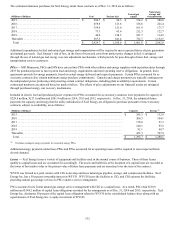

(Millions of Dollars) Guarantor Guarantee

Amount Current

Exposure Triggering

Event

Guarantee of customer loans for the Farm Rewiring Program (a) .NSP-Wisconsin $ 1.0 $ 0.2 (e)

Guarantee of the indemnification obligations of Xcel Energy

Services Inc. under the aircraft leases (b) . . . . . . . . . . . . . . . . . . Xcel Energy Inc. 8.1 — (f)

Guarantee of residual value of assets under the Bank of Tokyo-

Mitsubishi Capital Corporation Equipment Leasing

Agreement (c) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . NSP-Minnesota 4.8 — (g)

Total guarantees issued . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 13.9 $ 0.2

Guarantee performance and payment of surety bonds for Xcel

Energy Inc. and its subsidiaries (d) . . . . . . . . . . . . . . . . . . . . . . . Xcel Energy Inc. $ 31.4 (i) (h)

(a) The term of this guarantee expires in 2018, which is the final scheduled repayment date for the loans. As of Dec. 31, 2014, no claims had been made by the

lender.

(b) The term of this guarantee expires in 2017 when the associated leases expire.

(c) The terms of this guarantee expires in 2019 when the associated lease expires.

(d) The surety bonds primarily relate to workers compensation benefits and utility projects. The workers compensation bonds are renewed annually and the project

based bonds expire in conjunction with the completion of the related projects.

(e) The debtor becomes the subject of bankruptcy or other insolvency proceedings.

(f) Nonperformance and/or nonpayment.

(g) Actual fair value of leased assets is less than the guaranteed residual value amount at the end of the lease term.

(h) Failure of Xcel Energy Inc. or one of its subsidiaries to perform under the agreement that is the subject of the relevant bond. In addition, per the indemnity

agreement between Xcel Energy Inc. and the various surety companies, the surety companies have the discretion to demand that collateral be posted.

(i) Due to the magnitude of projects associated with the surety bonds, the total current exposure of this indemnification cannot be determined. Xcel Energy Inc.

believes the exposure to be significantly less than the total amount of the outstanding bonds.

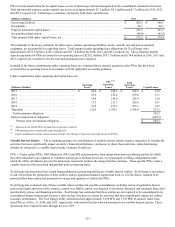

Indemnification Agreements

Xcel Energy Inc. and its subsidiaries provide indemnifications through contracts entered into in the normal course of business. These

are primarily indemnifications against adverse litigation outcomes in connection with underwriting agreements, as well as breaches of

representations and warranties, including corporate existence, transaction authorization and income tax matters with respect to assets

sold. Xcel Energy Inc.’s and its subsidiaries’ obligations under these agreements may be limited in terms of duration and amount. The

maximum potential amount of future payments under these indemnifications cannot be reasonably estimated as the obligated amounts

of these indemnifications often are not explicitly stated.