Xcel Energy 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.88

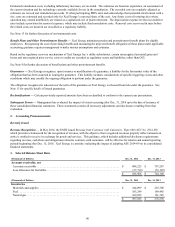

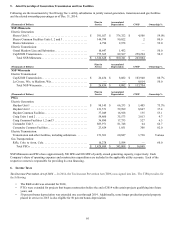

Income Taxes — Xcel Energy accounts for income taxes using the asset and liability method, which requires the recognition of

deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial

statements. Xcel Energy defers income taxes for all temporary differences between pretax financial and taxable income, and between

the book and tax bases of assets and liabilities. Xcel Energy uses the tax rates that are scheduled to be in effect when the temporary

differences are expected to reverse. The effect of a change in tax rates on deferred tax assets and liabilities is recognized in income in

the period that includes the enactment date.

Deferred tax assets are reduced by a valuation allowance if it is more likely than not that some portion or all of the deferred tax asset

will not be realized. In making such a determination, all available evidence is considered, including scheduled reversals of deferred

tax liabilities, projected future taxable income, tax planning strategies and recent financial operations.

Due to the effects of past regulatory practices, when deferred taxes were not required to be recorded due to the use of flow through

accounting for ratemaking purposes, the reversal of some temporary differences are accounted for as current income tax expense.

Investment tax credits are deferred and their benefits amortized over the book depreciable lives of the related property. Utility rate

regulation also has resulted in the recognition of certain regulatory assets and liabilities related to income taxes, which are summarized

in Note 15.

Xcel Energy follows the applicable accounting guidance to measure and disclose uncertain tax positions that it has taken or expects to

take in its income tax returns. Xcel Energy recognizes a tax position in its consolidated financial statements when it is more likely

than not that the position will be sustained upon examination based on the technical merits of the position. Recognition of changes in

uncertain tax positions are reflected as a component of income tax.

Xcel Energy reports interest and penalties related to income taxes within the other income and interest charges sections in the

consolidated statements of income.

Xcel Energy Inc. and its subsidiaries file consolidated federal income tax returns as well as combined or separate state income tax

returns. Federal income taxes paid by Xcel Energy Inc. are allocated to Xcel Energy Inc.’s subsidiaries based on separate company

computations of tax. A similar allocation is made for state income taxes paid by Xcel Energy Inc. in connection with combined state

filings. Xcel Energy Inc. also allocates its own income tax benefits to its direct subsidiaries based on the relative positive tax

liabilities of the subsidiaries.

See Note 6 for further discussion of income taxes.

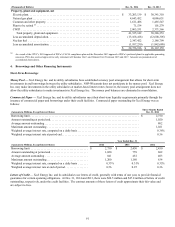

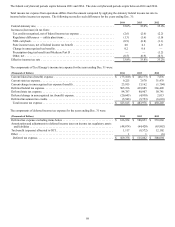

Types of and Accounting for Derivative Instruments — Xcel Energy uses derivative instruments in connection with its interest rate,

utility commodity price, vehicle fuel price, and commodity trading activities, including forward contracts, futures, swaps and options.

All derivative instruments not designated and qualifying for the normal purchases and normal sales exception, as defined by the

accounting guidance for derivatives and hedging, are recorded on the consolidated balance sheets at fair value as derivative

instruments. This includes certain instruments used to mitigate market risk for the utility operations including transmission in

organized markets and all instruments related to the commodity trading operations. The classification of changes in fair value for

those derivative instruments is dependent on the designation of a qualifying hedging relationship. Changes in fair value of derivative

instruments not designated in a qualifying hedging relationship are reflected in current earnings or as a regulatory asset or liability.

The classification as a regulatory asset or liability is based on commission approved regulatory recovery mechanisms.

Gains or losses on commodity trading transactions are recorded as a component of electric operating revenues; hedging transactions

for vehicle fuel costs are recorded as a component of capital projects or O&M costs; and interest rate hedging transactions are

recorded as a component of interest expense. Certain utility subsidiaries are allowed to recover in electric or natural gas rates the costs

of certain financial instruments purchased to reduce commodity cost volatility. For further information on derivatives entered to

mitigate commodity price risk on behalf of electric and natural gas customers, see Note 11.

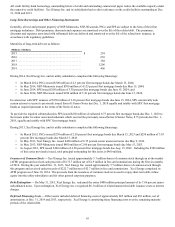

Cash Flow Hedges — Certain qualifying hedging relationships are designated as a hedge of a forecasted transaction, or future cash

flow (cash flow hedge). Changes in the fair value of a derivative designated as a cash flow hedge, to the extent effective, are included

in OCI or deferred as a regulatory asset or liability based on recovery mechanisms until earnings are affected by the hedged

transaction.

Normal Purchases and Normal Sales — Xcel Energy enters into contracts for the purchase and sale of commodities for use in its

business operations. Derivatives and hedging accounting guidance requires a company to evaluate these contracts to determine

whether the contracts are derivatives. Certain contracts that meet the definition of a derivative may be exempted from derivative

accounting if designated as normal purchases or normal sales.