Xcel Energy 2014 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2014 Xcel Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.35

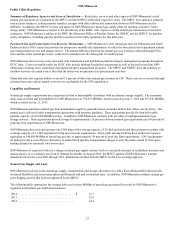

We are also subject to mandates to provide customers with clean energy, renewable energy and energy conservation offerings. Failure

to meet the requirements of these mandates may result in fines or penalties, which could have a material effect on our results of

operations. If our regulators do not allow us to recover all or a part of the cost of capital investment or the O&M costs incurred to

comply with the mandates, it could have a material effect on our results of operations, financial position or cash flows.

In addition, existing environmental laws or regulations may be revised, and new laws or regulations seeking to protect the

environment may be adopted or become applicable to us, including but not limited to, regulation of mercury, NOx, SO2, CO2 and other

GHGs, particulates and cooling water intake systems. We may also incur additional unanticipated obligations or liabilities under

existing environmental laws and regulations.

We are subject to physical and financial risks associated with climate change.

There is a growing consensus that emissions of GHGs are linked to global climate change. Climate change creates physical and

financial risk. Physical risks from climate change include changes in weather conditions, changes in precipitation and extreme

weather events.

Our customers’ energy needs vary with weather conditions, primarily temperature and humidity. For residential customers, heating

and cooling represent their largest energy use. To the extent weather conditions are affected by climate change, customers’ energy use

could increase or decrease. Increased energy use due to weather changes may require us to invest in additional generating assets,

transmission and other infrastructure to serve increased load. Decreased energy use due to weather changes may affect our financial

condition, through decreased revenues. Extreme weather conditions in general require more system backup, adding to costs, and can

contribute to increased system stress, including service interruptions. Weather conditions outside of our service territory could also

have an impact on our revenues. We buy and sell electricity depending upon system needs and market opportunities. Extreme

weather conditions creating high energy demand may raise electricity prices, which would increase the cost of energy we provide to

our customers.

Severe weather impacts our service territories, primarily when thunderstorms, tornadoes and snow or ice storms occur. To the extent

the frequency of extreme weather events increases, this could increase our cost of providing service. Changes in precipitation

resulting in droughts or water shortages could adversely affect our operations, principally our fossil generating units. A negative

impact to water supplies due to long-term drought conditions could adversely impact our ability to provide electricity to customers, as

well as increase the price they pay for energy. We may not recover all costs related to mitigating these physical and financial risks.

To the extent climate change impacts a region’s economic health, it may also impact our revenues. Our financial performance is tied

to the health of the regional economies we serve. The price of energy, as a factor in a region’s cost of living as well as an important

input into the cost of goods and services, has an impact on the economic health of our communities. The cost of additional regulatory

requirements, such as a tax on GHGs, regulation of CO2 emissions under section 111(d) of the CAA, or additional environmental

regulation could impact the availability of goods and prices charged by our suppliers which would normally be borne by consumers

through higher prices for energy and purchased goods. To the extent financial markets view climate change and emissions of GHGs as

a financial risk, this could negatively affect our ability to access capital markets or cause us to receive less than ideal terms and

conditions.

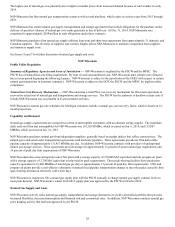

Financial Risks

Our profitability depends in part on the ability of our utility subsidiaries to recover their costs from their customers and there may

be changes in circumstances or in the regulatory environment that impair the ability of our utility subsidiaries to recover costs

from their customers.

We are subject to comprehensive regulation by federal and state utility regulatory agencies. The utility commissions in the states

where we operate regulate many aspects of our utility operations, including siting and construction of facilities, customer service and

the rates that we can charge customers. The FERC has jurisdiction, among other things, over wholesale rates for electric transmission

service, the sale of electric energy in interstate commerce and certain natural gas transactions in interstate commerce.